Global payments company Emergent Payments has unveiled Jumpstart India, a local solution designed to help global businesses tap into India’s growing eCommerce market.

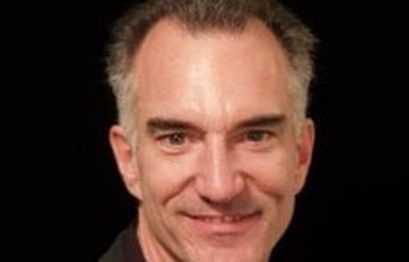

“India is a high growth and underserved market, and there’s clear demand – from our current customers and from the market – for a local solution,” said Mitch Davis, CEO of Emergent Payments.

“That’s why we have set up a local operation to manage all aspects of eCommerce payments in India. We understand the complexities of alternate payment methods for merchants around settlement expectation, refund flows and higher drop offs due to redirect, as well as the compliance landscape originating from card brands, the Reserve Bank of India and local regulations. Further, we have comprehensive risk management and fraud prevention tools.”