In the fast-moving and increasingly complex world of cryptocurrency, platforms do not have the time to develop all the components they need to operate from scratch. As the sector becomes more established, specialist companies are developing clear proficiencies in specific areas that platforms can tap into in order to grow faster.

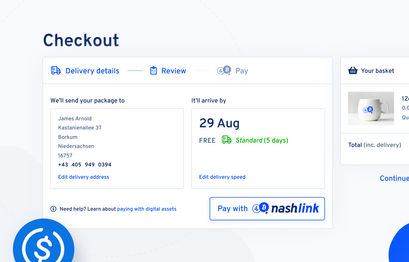

An example of such a partnership is one between Nash and Tuned. Tuned, a cloud-based multi-exchange digital asset trading platform designed for quantitative traders and everyday investors, recently adopted Nash Link, a solution allowing merchants to more easily accept digital assets from customers. Merchants can accept crypto without setting up a wallet or worrying about risk management.