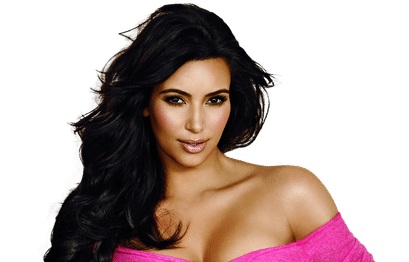

- Kim K. charged with failing to disclose that she received $250k to promote EMAX

- The SEC also went after boxer Floyd Mayweather Jr. for promoting the same crypto

Social media personality and celebrity Kim Kardashian’s fine for promoting EthereumMax (EMAX) was a “gift” to the US Securities and Exchange Commission (SEC) according to Lisa Braganca, an ex-chief of the agency’s enforcement branch.

She told CoinDesk TV that the regulator was always looking for a way to spread its message and it was pure bonanza when somebody with Kim Kardashian’s kind of following made such a mistake.

Kim to pay $1.26m fine, won’t promote crypto for 3 years

Earlier this week, the reality star was ordered to pay a fine of $1.26 million to settle charges. She was charged with failing to disclose that she received $250,000 to promote EMAX. In addition, she faces charges related to the promotion itself, which reached her millions of followers on social media.

While she didn’t admit she had done anything wrong, she agreed she wouldn’t promote crypto assets for three years and to cooperate with the SEC in its pending investigation.

Braganca said:

The chairman [Gary Gensler] is absolutely right to say there is a specific statute that addresses and requires that there be disclosure, not just of a paid promotion, but the amount that someone either has been paid or expects to be paid. That's where [Kardashian] blew it. It was pretty misleading.

No immunity

The case is a reminder that even the rich and famous are not immune to government intervention. What’s more, it’s not the first case of its kind in history. Four years ago, the SEC went after boxer Floyd Mayweather Jr. for promoting the same crypto, EMAX.

‘Low-hanging fruit’

Has anything changed? According to the former SEC chief, the agency is now in search of “bigger penalties.” Asked why the agency isn’t pursuing the actual asset issuers, Braganca said it might only be going after “the low-hanging fruit.”

In her opinion, it is the agency’s strategy to chase influencers to impact token issuers, to whom it will get, eventually.

Image source: https://pngimg.com/image/73827