Bitcoin price dropped below the important support level at $70,000 on Wednesday as activity in the futures market faded. BTC token was trading at $68,600 at the time of writing, down sharply from the all-time high of $126,300.

Bitcoin Price Slips as Futures Open Interest Falls

BTC price continued its strong downward trend this week as investors in the spot and futures markets remained on the sidelines.

Data show that the volume of Bitcoin traded in the last 24 hours fell to $40 billion. While this is a big number, it was lower than the historical average.

Additional data indicate that futures open interest has continued to fall over the past few months. It stood at over $44 billion, down from the all-time high of over $95 billion.

The decline in futures open interest indicates that investors are reducing the leverage they use to buy Bitcoin. A lower open interest is usually a sign of weak demand.

Indeed, data show that demand for spot Bitcoin ETFs has continued to decline over the past few months. These funds have experienced over $173 million in outflows this month, following losses of over $1.6 billion in the previous month. The total inflows now stand at $54 billion, down from a record high of over $65 billion.

READ MORE: Robinhood Stock Price Faces a Major Crypto Risk as it Releases its Earnings

One potential reason Bitcoin demand has declined is that American investors have rotated into other assets that are performing well. For example, the stock market is booming, with the Dow Jones and S&P 500 indices trading at their all-time highs. Stock market ETFs have added billions of dollars, with Vanguard’s VOO adding over $70 billion so far this year.

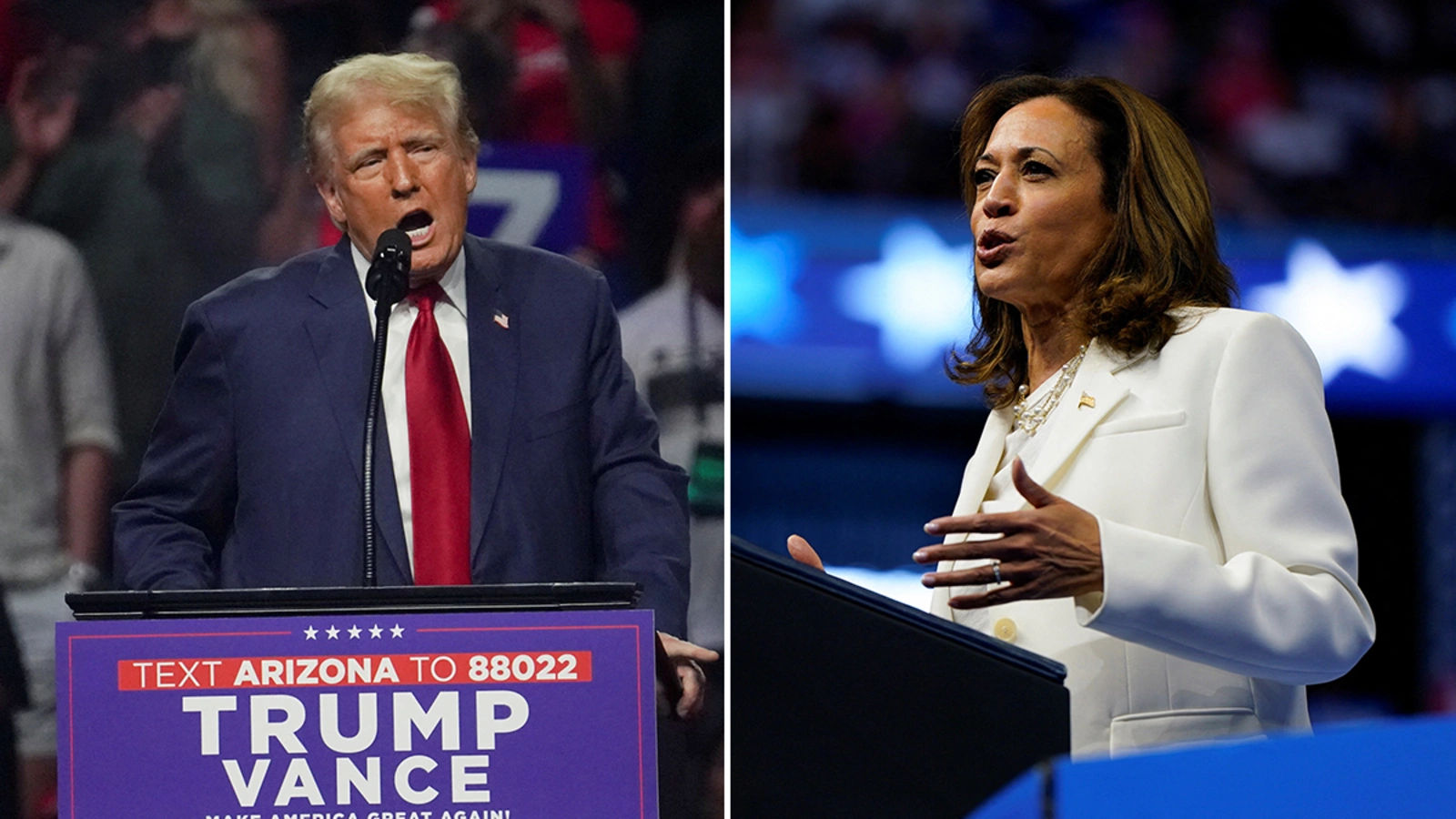

Another reason is that a deal on the CLARITY Act has remained elusive over the past few weeks, and a meeting among banks, crypto executives, and the White House did not resolve it.

BTC Price Prediction: Technical Analysis

The weekly chart indicates that Bitcoin’s price has continued to decline over the past few weeks. It retreated from a record high of $126,300 in October to the current $68,650.

The spread between the 50-week and 100-week Exponential Moving Averages (EMA) has continued to narrow in the past few weeks, meaning that a mini death cross is possible.

Bitcoin has also moved below the Supertrend and the Parabolic SAR indicators. At the same time, the Relative Strength Index (RSI) and the Percentage Price Oscillator (PPO) have continued falling in the past few months.

Therefore, the most likely Bitcoin price prediction is bearish, with the next key target being this month-to-date low of $60,000. A drop below that level will point to more downside.

READ MORE: Coinbase Stock Hangs on a Thread Ahead of its Earnings: Will it Rise or Crash?