XRP price was flat on Thursday, mirroring the performance of other cryptocurrencies, as investors responded to the latest U.S. nonfarm payrolls (NFP) data. The Ripple coin was trading at $1.3795 as attention now shifts to the upcoming U.S. consumer inflation report.

XRP Price Pressured After US Jobs Report Despite Aviva Deal

The Ripple price declined following the release of a strong U.S. jobs report. Data compiled by the Bureau of Labor Statistics (BLS) showed that the economy created over 130k jobs in January, higher than the median estimate of 70k.

The unemployment rate fell to 4.3%, while wage growth continued to rise during the year. Looking forward, the next important catalyst for the XRP price and other assets is the upcoming US inflation report on Friday.

Economists polled by Reuters expect the data to show that the headline Consumer Price Index (CPI) data retreated to 2.5%, while the core CPI moved to 2.6%. If this is correct, this report will push the Fed to cut interest rates more times than expected this year, which is beneficial for the crypto market.

READ MORE: Pi Network Coin Price Prediction as Top Whale Restarts Buying

The XRP price also retreated as Ripple emerged as a major player in the Real-World Asset (RWA) tokenization industry. The company reached a deal with Aviva, a top British company with over $349 billion in assets. This deal will see Aviva tokenize some of its assets on the XRP Ledger, a move that will increase utility for XRP and facilitate token burns.

Data compiled by RWA show that the amount of money locked in XRPL’s tokenized assets has continued to soar in the past few months, reaching over $1.7 billion. The Ripple USD (RLUSD) stablecoin recently crossed the $1.5 billion asset mark.

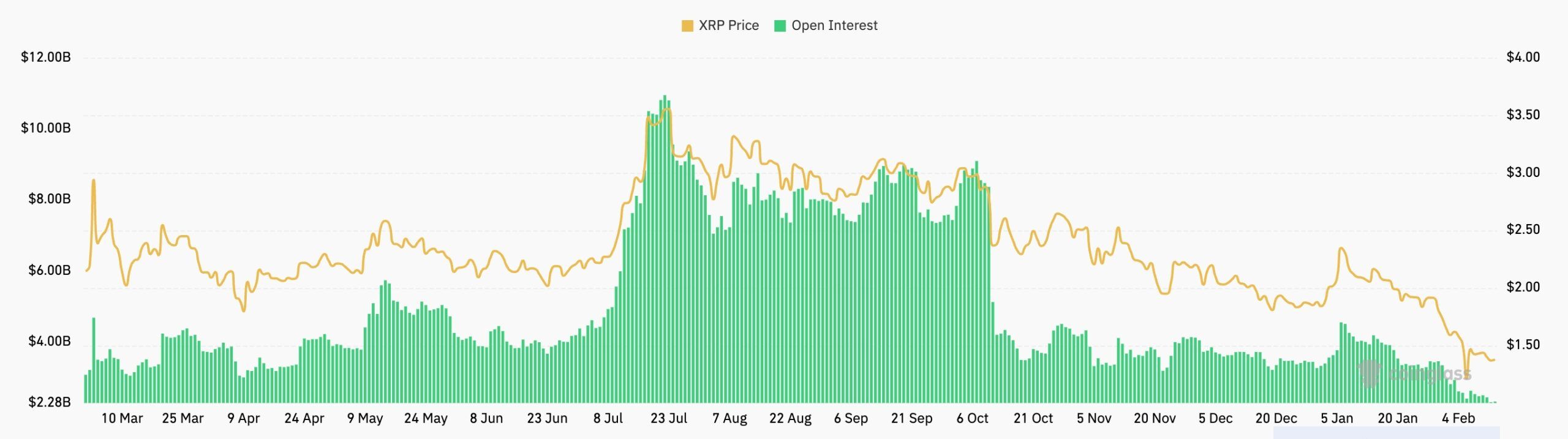

Furthermore, the XRP price has declined amid the ongoing crypto market crash, which has affected Bitcoin and most altcoins. Additionally, demand from the futures market has continued to fall this week. It dropped to $2.2 billion, down sharply from last year’s high of over $10 billion.

Ripple Price Prediction: Technical Analysis

The daily timeframe chart shows that the XRP price remains under pressure this year, continuing a downward trend that began in July last year, when it reached a record high of $3.6650.

It has remained below all moving averages, while the Relative Strength Index (RSI) has continued falling, moving from a high of 73 to the current 33. The Average Directional Index (ADX) has also risen to a high of 54, indicating that the downtrend continues.

Therefore, the token will likely continue to fall in the near term, potentially to the key psychological level of $1, approximately 30% below the current level.

READ MORE: Solana Price Analysis: SOL Crashes Despite Booming Ecosystem Growth