Stellar Lumens (XLM) price continues to consolidate this week as sentiment in the crypto market is waning ahead of the Federal Reserve interest rate decision. The token dropped to a low of $0.26, its lowest level since April 22. This article explores the top three reasons why the XLM price is expected to increase significantly soon.

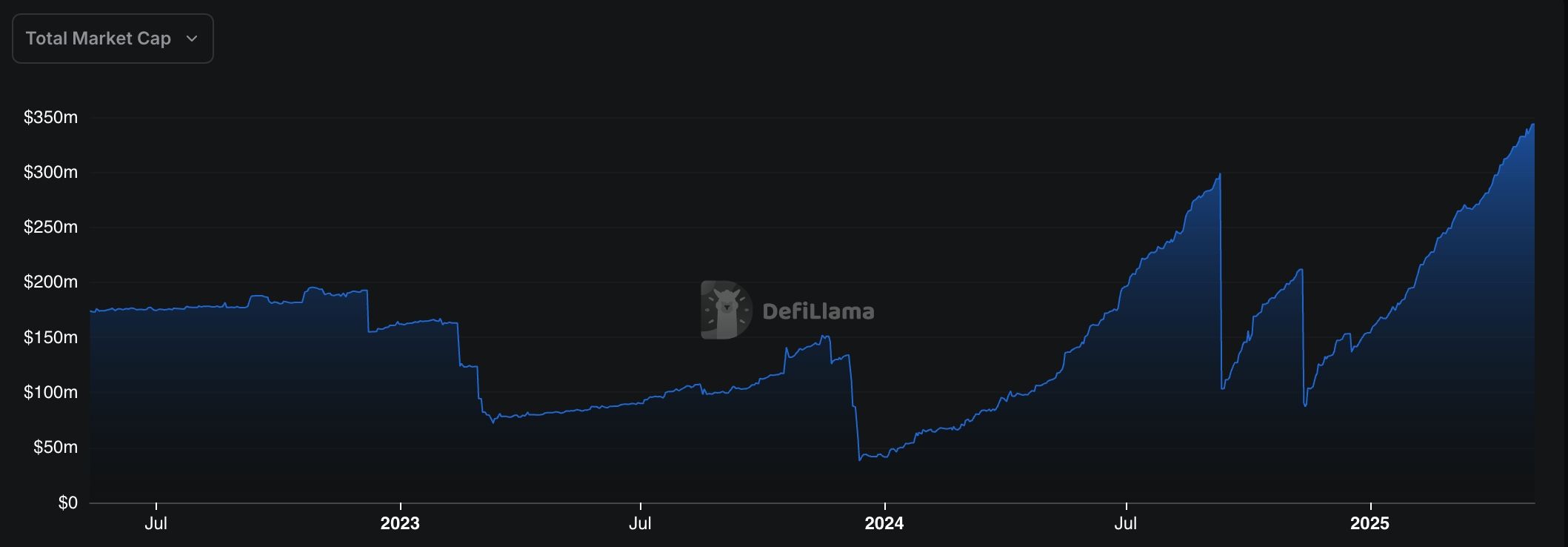

Stablecoins on Stellar are Soaring

The first reason why the XLM price may increase significantly in the coming weeks is that its ecosystem is doing well. DeFi Llama data shows that the amount of stablecoins on the network has jumped to a record high of $350 million, much higher than the year-to-date low of $147 million.

The network’s surge in stablecoins is notable because of its partnership with MoneyGram, one of the biggest players in the money transfer industry. The collaboration means a user can send USDC to a recipient, who will then withdraw the funds at a local MoneyGram agent.

This is an important feature because the volume of funds being transferred in the form of stablecoins continues to grow. Visa expects the amount of cash in stablecoins to hit $1.6 trillion by 2030.

XRP Price to Surge First, then XLM to Follow

The other potential catalyst for the XLM price is its close relationship with Ripple’s XRP. XLM is often perceived as a smaller counterpart to XRP because it was formed by Jed McCaleb, a software engineer who was part of Ripple’s original team.

The two networks are in the same industry but operate using different models. Ripple is a centralized company focusing on institutions like banks and other companies in the money transfer industry.

On the other hand, Stellar uses a non-profit model and is mostly focused on peer-to-peer payments. Still, as its smaller counterpart, the XLM price often soars when XRP is in an uptrend.

Our last XRP price prediction indicated that the coin is likely to surge soon as the SEC approves its ETFs and its goal of disrupting SWIFT remains. Should this occur, the XLM price is anticipated to increase since Canary has also filed for a spot XLM ETF.

READ MORE: XRP Price Can’t Hit $100 by 2030: Here’s a More Realistic Prediction

XLM Price Has Strong Technicals

The XLM price has strong technicals that will boost its price in the long term. A potentially bullish indicator is the formation of the falling wedge pattern on the daily chart. This pattern comprises two descending and converging trendlines, with a breakout happening when they are about to converge.

The Awesome Oscillator and the MACD indicators have been trending upwards and forming a bullish divergence pattern. A bullish breakout often follows this pattern. Therefore, the coin will likely rebound as bulls target the key resistance point at $0.6415. This is the highest swing in November last year, about 150% above the current level.

READ MORE: Best Crypto to Buy as Ethereum Pectra Upgrade Day Arrives