The Jupiter price continued its recovery this week as the mood in the crypto market improved, pushing Solana and tokens in its ecosystem higher. The JUP token jumped to a high of $0.5355 on Saturday—its highest level since March 28 this year. It has soared by more than 78% from its lowest point in April.

Jupiter Price Jumps as DEX Volume Soars

The ongoing crypto rebound has drawn more investors back into the market. CoinMarketCap data shows that the 24-hour volume jumped by over 44% to $200 billion, a move that has benefited centralized and decentralized exchange companies.

Jupiter, the second-biggest player in the perpetual futures industry, has been one of the top beneficiaries, noting a significant increase in its volume. DeFi Llama data shows that its daily volume jumped by 166% to $1.22 billion, making it the second-biggest player after Hyperliquid, which handled $10.7 billion.

Jupiter has processed over $3.3 billion in perpetual futures contracts in the last seven days, a trend that may continue if the crypto market continues.

Its surge has coincided with the strong rebound of Solana meme coins. Per CoinGecko, the market cap of all Solana meme tokens has more than doubled from $6 billion in April to over $12.6 billion today. The 24-hour volume of these tokens was $10.2 billion, with Trump and Bonk (BONK) being the most active.

READ MORE: Solana Price Just Flashed 3 Rare Signals—Is a SOL Surge Coming?

The Jupiter token also surged after developers introduced the Universal Send feature. This feature allows users to send tokens to anyone, including those without a wallet, and aims to make Jupiter a leading player in the crypto peer-to-peer payment industry.

Send money to anyone, anywhere. Even if they don’t have a wallet.

— Jupiter (🐱, 🐐) (@JupiterExchange) May 7, 2025

Introducing Universal Send from @jup_mobile.

Send any token – SOL, USDC, or even memecoins.

With ultra low fees, Jupiter Mobile is the best way to send gifts to family, onboard friends, or even pay for goods. pic.twitter.com/fwwwB0ZWuC

The other reason the JUP price soared is that the developers pledged to channel all jupSOL commissions generated in the network to their decentralized autonomous organization (DAO). This is an important process as the DAO seeks to become independent and decentralized.

JUP Price Technical Analysis

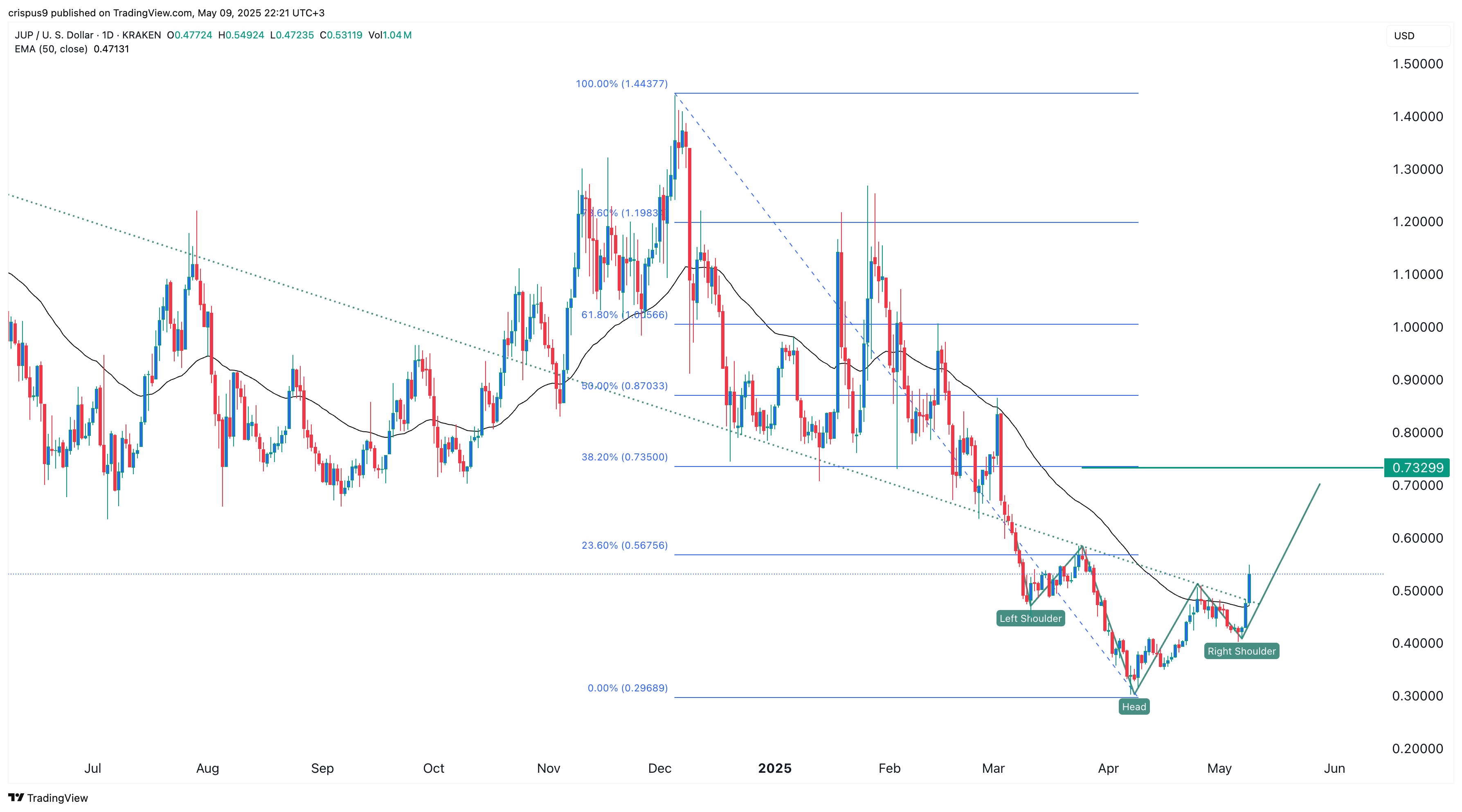

The daily chart shows that the JUP price has rebounded after bottoming at $0.2970 in April. It has moved to $0.5325, its highest level since March 28, and has formed an inverse head-and-shoulders pattern—a highly bullish sign.

The price of Jupiter has moved above the 50-day Exponential Moving Average (EMA) and is nearing the 23.6% Fibonacci Retracement level. The Relative Strength Index has pointed upwards.

Therefore, the JUP token will likely keep rising as bulls target the 38.2% retracement level at $0.7330, up by 38% above the current level. A drop below the right shoulder at $0.40 will invalidate the bullish outlook.

READ MORE: Pepe Coin Price Prediction: Can it Surge by 150% to ATH?