Unichain, the recently-launched layer-2 network by Uniswap, is firing on all cylinders as demand continues rising.

Third-party data shows that the number of active addresses on Unichain has jumped by 368% in the last 30 days to 28.2 million. Its active addresses have soared by 3,096% to more than 5.93 million.

This growth makes it one of the fastest-growing networks in the crypto market. It is even approaching Ethereum, the biggest layer-1 blockchain in the industry. Ethereum’s active addresses rose to 36.6 million, while they stood at 6.4 million.

Unichain’s active addresses have increased in the last seven days. Its addresses jumped by 8.2% to 5.7 million.

More data shows that Unichain has become the third-biggest layer-2 blockchain in decentralized exchange (DEX) volume after Base and Arbitrum. It has also become the seventh-biggest DEX chain after Solana, BSC, Ethereum, Base, Arbitrum, and Sui. It has flipped popular chains like Avalanche, Tron, Polygon, and Cardano.

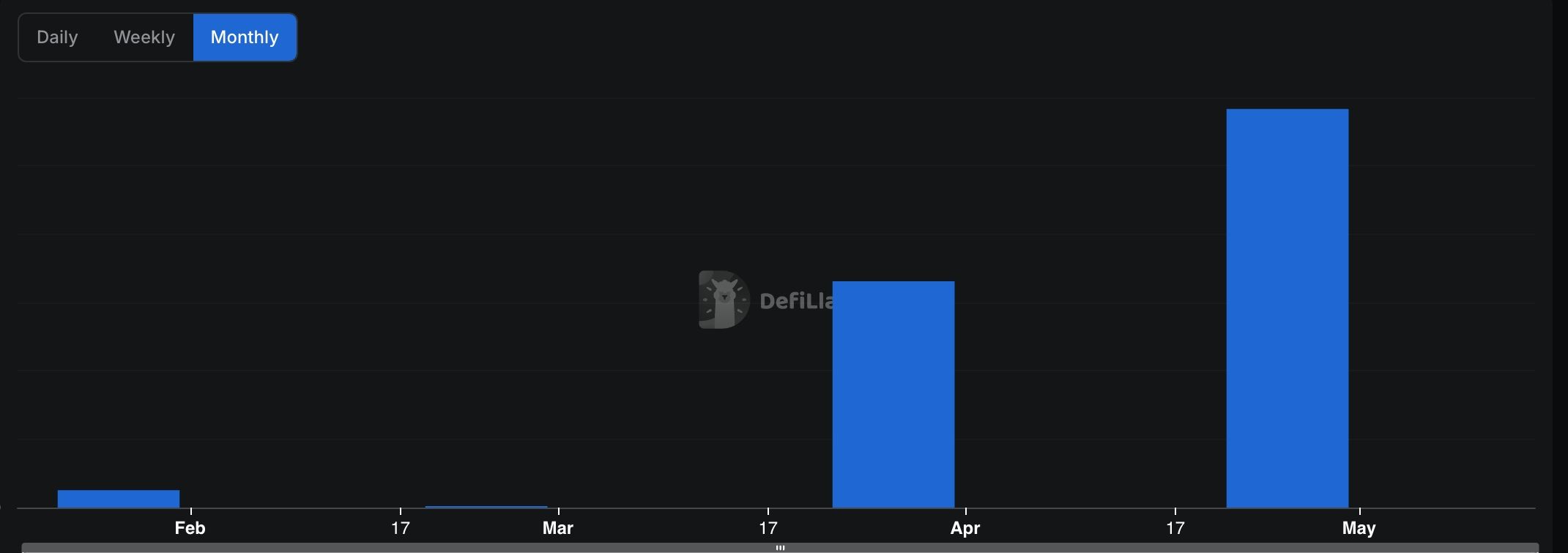

Protocols on Unichain processed transactions worth over $583 million in the last 24 hours, bringing the weekly total to $3.37 billion, a 74% increase. It has now processed transactions worth over $8.45 billion, which will likely cross the $10 billion milestone this week.

Unichain’s network has also grown in other areas. It has attracted 22 developers in the decentralized finance sector, accumulating over $750 million in total value locked. The market cap of stablecoins on Unichain has jumped to over $310 million.

These are strong numbers for a layer-2 chain launched earlier this year. In contrast, Sei has a TVL of $587 million and $235 million in stablecoins. Cardano, one of the biggest cryptocurrencies, has $457 million and $31 million, respectively.

There are two main reasons Unichain is gaining traction among developers and users. First, it was launched by Uniswap, the biggest player in decentralized exchanges. Second, it offers better features than Ethereum, including faster speeds and increased interoperability with most chains.

READ MORE: “Shock” Fed Forecast Crashes BTC, Pepe, Shiba Inu, Cardano as DXY Index Surges