The Bitcoin market cap has experienced remarkable growth over the last 16 years, making it the best-performing asset of all time. In this time, it has grown from nothing into a $2.1 trillion asset, overtaking some of the storied American companies like Berkshire Hathaway, Tesla, Meta Platforms, and Google.

Bitcoin’s rise is notable because retail investors initially powered its surge to a record high. Institutions were always worried about the coin because of its perceived volatility and the regulatory cloud that surrounded it.

Things started to change in 2024 when the Securities and Exchange Commission (SEC) approved spot Bitcoin ETFs. This golden moment encouraged more institutions like Susquehanna, Citadel, and Millennium to invest in Bitcoin through ETFs.

Companies started accumulating Bitcoin in 2020, with MicroStrategy being the first to do so. This move transformed MicroStrategy, now called Strategy, from a struggling technology company into a juggernaut worth almost $120 billion today.

Can Bitcoin Surpass Microsoft, Apple, and NVIDIA?

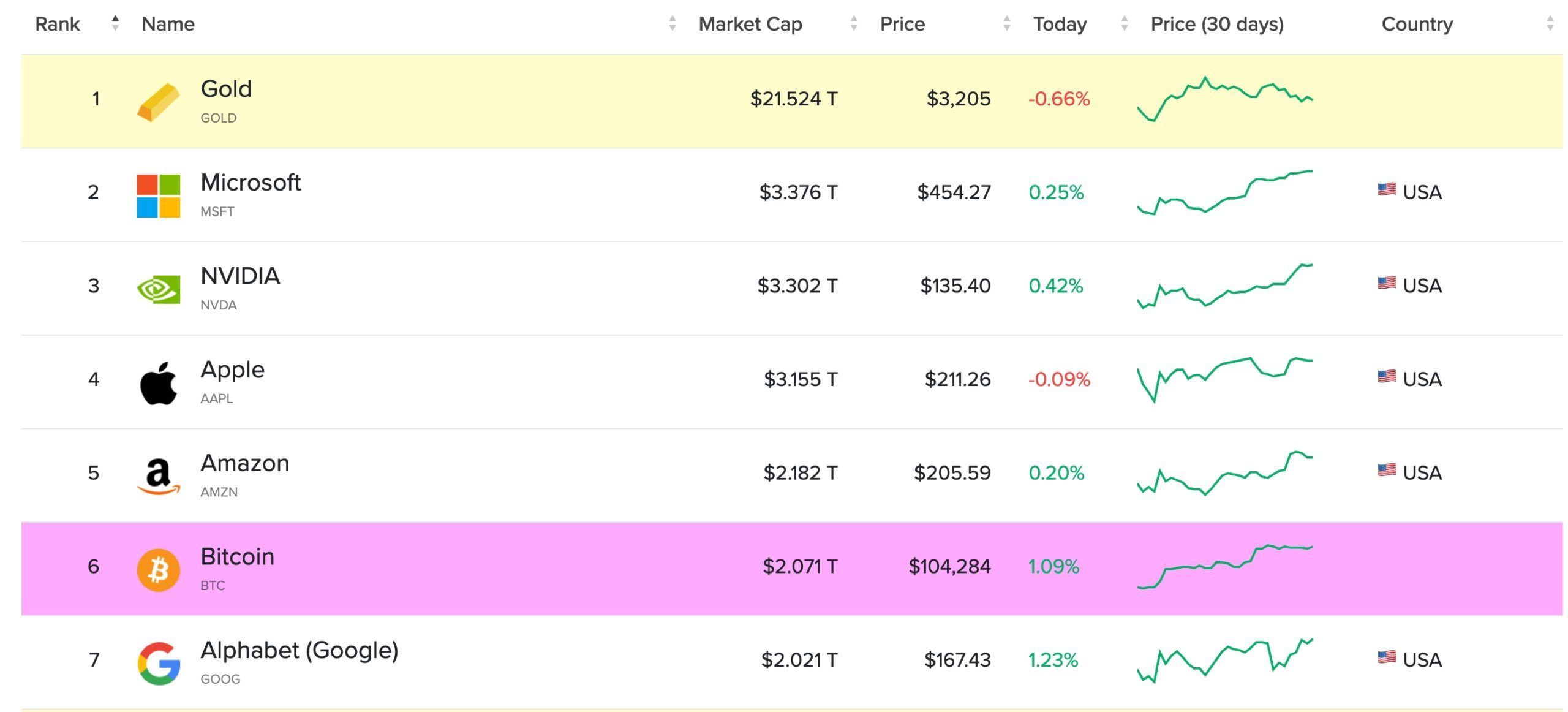

Now that Bitcoin’s market cap has surpassed that of top companies like Meta, Google, and Berkshire, the question is whether it can surpass other leading firms like Microsoft, Apple, and NVIDIA, which have a market cap of $3.37 trillion, $3.30 trillion, and $3.15 trillion, respectively.

Bitcoin has a market cap of $2.07 trillion, meaning that it needs to rise by 62.80% to reach Microsoft’s market cap. It then needs to increase by 59.4% and 52.17% to reach Apple’s and NVIDIA’s valuations.

Based on the current circulation, the Bitcoin price needs to jump to $165,000 to surpass Microsoft and become the second-biggest asset in the world after gold. It also needs to jump to over $157,000 to surpass Apple and NVIDIA.

Most importantly, Bitcoin price needs to jump to $1.11 million to surpass gold’s market cap of over $22 trillion.

Although the figure seems enormous, it aligns with analysts’ predictions. For example, Ark Invest analysts expect that the Bitcoin price will soar to $2.4 million by 2030, while Michael Saylor sees it reaching $5 million. If these scenarios occur, they would push its market cap to $47.2 trillion and $95.5 trillion, respectively.

Technical indicators suggest that Bitcoin’s price may surge, potentially surpassing the valuations of companies like Microsoft, Apple, and NVIDIA. Bitcoin has been on a strong rally since its inception. This path was not linear, and it has had some major dips in the past. These dips have proven to be temporary, and the coin has always bounced back.