Aerodrome Finance (AERO), the top decentralized exchange on Base, is making waves in the DeFi space with a 22.2% price jump in the last 24 hours. The token soared from $0.73 to $0.90, pushing its market cap to over $758 million, backed by surging trading volume, bullish technical signals, and growing traction from its integration with Coinbase’s retail app.

Multiple factors suggest that AERO’s rally may have legs, though short-term caution is warranted as indicators flash “overbought.”

AERO Coin’s Coinbase–Base DEX Integration

The primary catalyst behind AERO’s surge is Coinbase’s June 12 announcement that it will embed Base-native DEXs, including Aerodrome, directly into its retail app.

This exposes Aerodrome Finance to millions of Coinbase users, massively increasing visibility and potential on-chain volume.

This move mirrors Coinbase’s recent integration of Morpho, which helped the protocol secure $550M in BTC collateral. Aerodrome’s role as the dominant DEX on Base positions it to benefit most from this retail access funnel.

According to on-chain data and official dashboards, Aerodrome processed more than $15.4B in volume over the past 30 days, outpacing rivals like Uniswap and PancakeSwap on the Base chain.

Base Ecosystem Boom Boosts AERO’s Use Case

The Base’s broader DeFi ecosystem growth is also reinforcing the AERO price surge. Over the past year, Base has seen a 10x increase in activity, and Aerodrome is at the center of that momentum. According to DefiLlama, Aerodrome now has a TVL of $1 billion and dominates liquidity provision on Base.

A recent tweet from Aerodrome highlighted its capital efficiency: with only half the TVL of Uniswap’s top pool, Aerodrome generated nearly twice the volume, signaling smart liquidity routing and user adoption. This kind of efficiency attracts both traders and yield farmers.

The further bullish sentiment stemmed from a new cbXRP market launch on Base, integrated with Moonwell, which allows users to borrow against tokenized XRP. As the liquidity backbone of Base, Aerodrome is positioned to absorb inflows from these cross-chain DeFi expansions.

Aerodrome Finance Price Clears Resistance, Signals Momentum

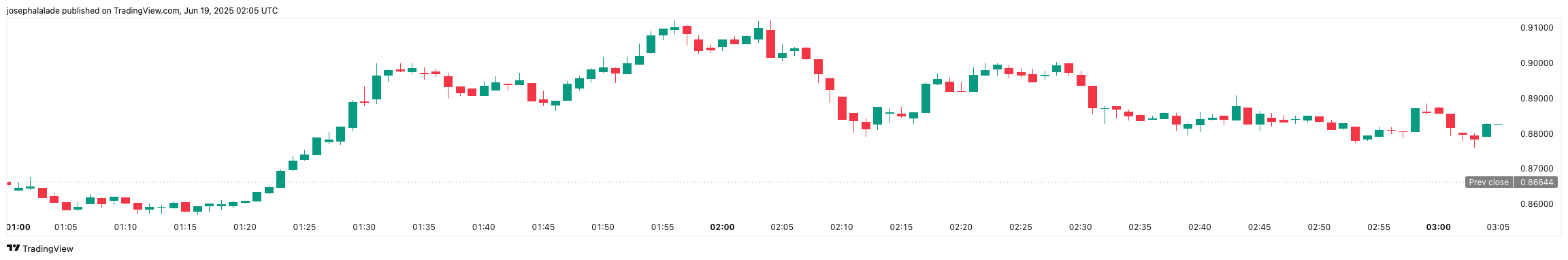

Aerodrome Finance (AERO) has recently broken through an important resistance level between $0.78 and $0.85, which is also the 23.6% Fibonacci retracement level. Strong indicators support this breakout, with the 7-day RSI reaching 71.71 and the MACD showing a positive crossover as the histogram increased to +0.0371.

The price rose to an intraday high of $0.8974 and is currently stable around $0.9033, indicating ongoing demand even with possible profit-taking by investors.

The next key level for Aerodrome Finance is $1, which may serve as both a target and a barrier. If positive momentum continues and retail interest from platforms like Coinbase, a rise above $1 could happen in the next few days.

However, traders should watch for short-term cooling. There is a potential for profit-taking around current levels. Any pullback would need to hold support around the $0.85–$0.87 range to keep the uptrend intact.

READ MORE: Best Crypto to Buy Now as Bitcoin and Altcoin Crash Accelerates