The crypto crash accelerated on Sunday, with Bitcoin plunging below $100,000 for the first time since May 8. It has moved into a correction after falling by over 10% from its highest point this year.

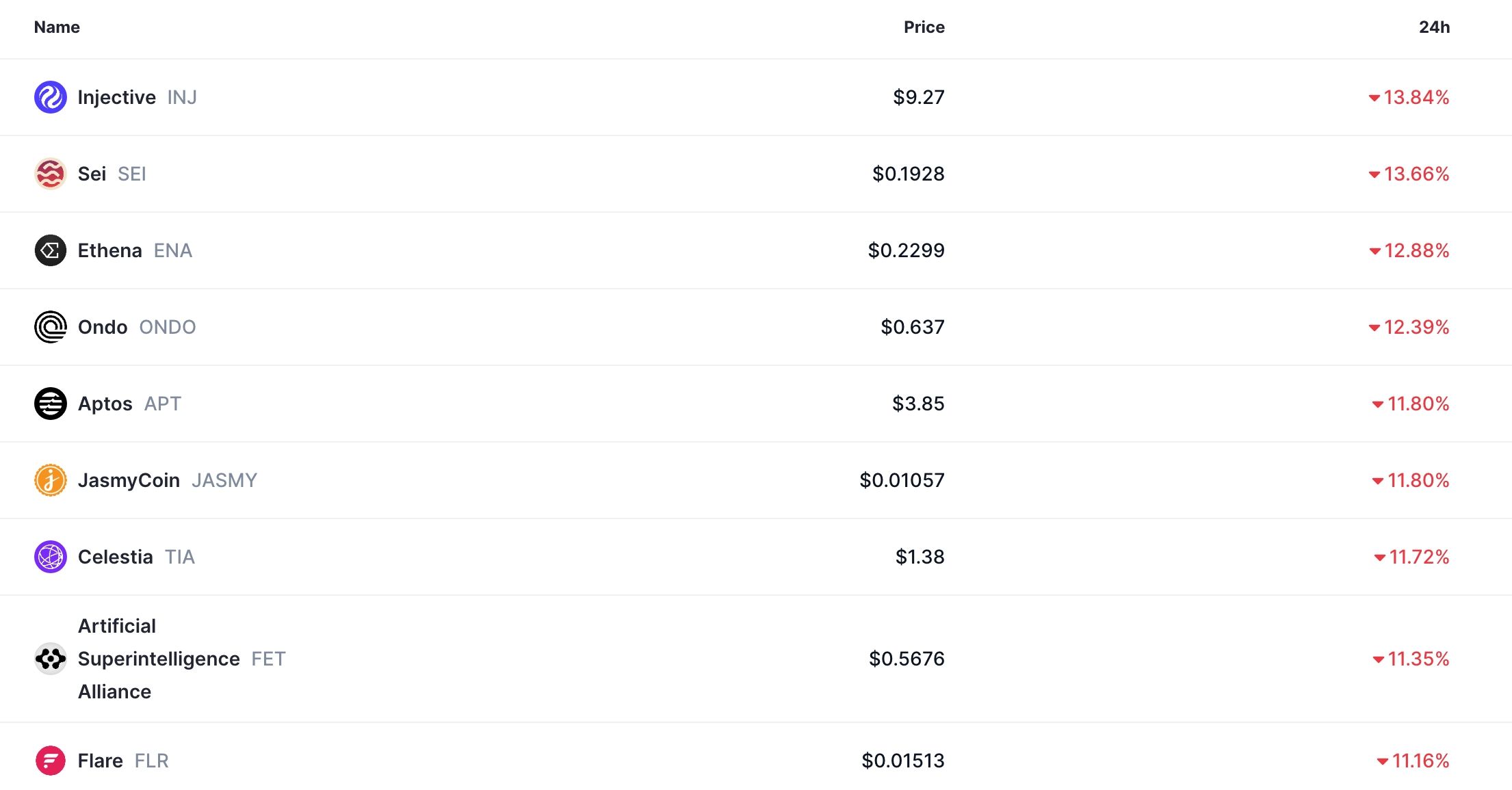

Altcoins have experienced a deeper crash, with popular tokens such as Sei, Injective, Ondo, Ethena, and Jasmy falling by over 10% in the last 24 hours. The total crypto market cap has declined by over 4% in the last 24 hours to $3 trillion, while liquidations have surged by 154% to exceed $1 billion.

Crypto Crash Accelerates After Trump Bombs Iran

The cryptocurrency market crash gained momentum on Sunday as traders reacted to heightened geopolitical tensions in the Middle East. This crisis escalated after Donald Trump launched a barrage of bombs at three nuclear targets in Iran, risking a prolonged war in the region.

Iran and its Houthi leaders have vowed to retaliate against the US and Israel. Indeed, Iran continued launching missiles towards Israeli targets on Sunday.

Bitcoin and other altcoins plunged because of the significance of this attack. Historically, risky assets like stocks and cryptocurrencies tend to plunge when a major black swan event occurs. For example, they all plunged after the recent Liberation Day, in which Trump announced sweeping tariffs.

READ MORE: Axelar Price Prediction: Here’s Why AXL Token May Rebound

Recall that crypto prices also crashed after the COVID-19 pandemic and after the collapse of top crypto projects like FTX and Terra.

Another reason is that the crisis in the Middle East is likely to lead to higher crude oil and shipping costs. Data shows that Brent crude oil has increased by over 30% in the last few weeks, and analysts worry that it could soon reach $100.

Higher oil and shipping costs will make it harder for the Federal Reserve and other central banks to cut interest rates as inflation rises. Bitcoin and other altcoins tend to perform well when the Fed is cutting rates.

READ MORE: Pepe Price Prediction at Risk of a Crash as Risky Pattern Forms

Key Macro Data Ahead

Looking ahead, the main catalyst for the crypto market will be Iran’s response to Trump’s bombing. A sign of limited response and talks could boost these assets.

A major risk is if Israel and the US strike Iranian oil refineries and terminals, and its energy plants. Such a move would push the crypto market much lower.

The other top catalysts will be the upcoming US macroeconomic data, like the GDP report on Thursday and the latest US personal consumption expenditure (PCE) data.

Based on historical trends, there is a likelihood that Bitcoin and cryptocurrency prices will rebound once geopolitical tensions ease.

READ MORE: Top Crypto Price Predictions: Hedera (HBAR), VELO, and Flare (FLR)