Shiba Inu price has imploded this month and is now hovering near its lowest point this year. SHIB token plunged to a low of $0.000010, down by over 40% from its highest point in May. It has plunged by almost 70% from the highest point in November.

Shiba Inu Price Could Crash as Funding Rate Falls

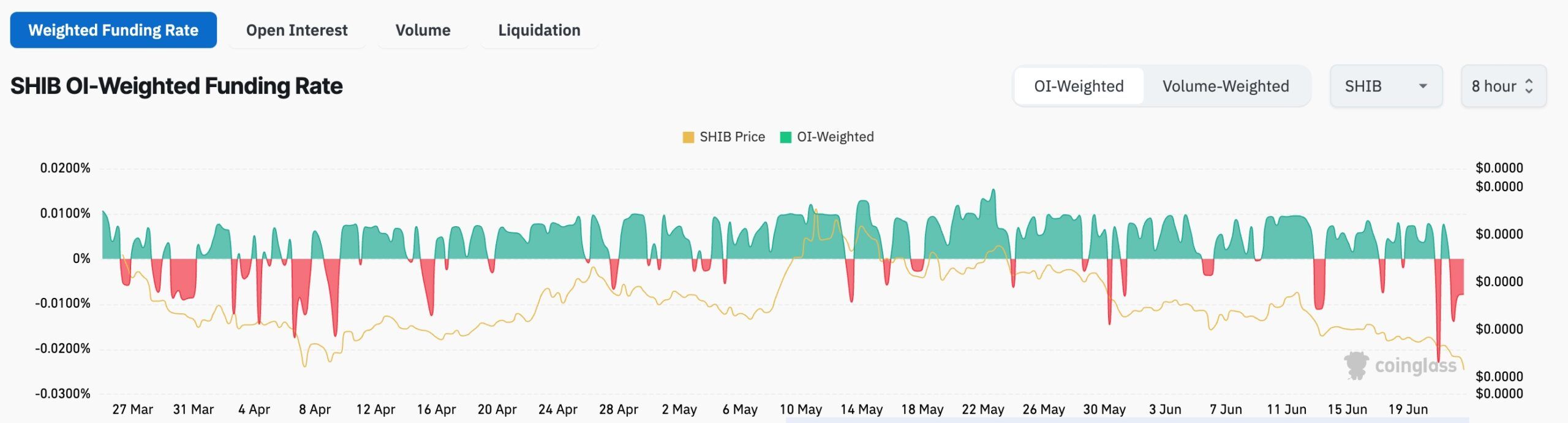

Futures data shows that Shiba Inu price may crash further in the coming days. CoinGlass shows that the funding rate has turned negative and is hovering at its lowest point since Friday.

A negative funding rate means that shorts are paying a fee to long traders. It signals that bears are expecting the price to be lower in the future than it is today.

More data shows that Shiba Inu’s futures open interest has plunged in the past few weeks. It moved from a peak of $542 million in January to $131 million today. A falling futures open interest signals that demand has plunged.

Shiba Inu’s volume has also dried up in the past few months. The 24-hour volume stood at over $122 million, down from almost $2 billion in December.

This performance has coincided with the ongoing selling by smart money and whales. Smart money holdings have plunged by over 33% in the last 180 days to 13.1 billion, while whale holdings have crashed by 81% to 34 billion.

More data shows that Shiba Inu’s burn rate has plunged in the past few months, while Shibarium’s network has deteriorated.

READ MORE: Pepe Price Prediction at Risk of a Crash as Risky Pattern Forms

SHIB Price Technical Analysis

The daily chart shows that the SHIB price surged and peaked at $0.00003340 in December last year and then plunged as the crypto market crash accelerated.

Shiba Inu token peaked at $0.00001750 on May 11 and then retreated to a low of $0.00001035. It has moved below the 50-day moving average.

Technical indicators point to more downside. For example, the Average Directional Index (ADX) has jumped to 28, the highest point since March 24 this year. A high ADX is a sign that the downward momentum is continuing.

The Relative Strength Index (RSI) has plunged to the oversold level of 25, while the Stochastic Oscillator has moved below 20.

Therefore, the most likely scenario is where the SHIB price may continue falling as sellers target the key support at $0.0000090.

On the positive side, the coin has formed a double-bottom pattern at $0.00001035 and a neckline at $0.00001750. A double bottom is one of the most bullish signs in technical analysis.

READ MORE: Sei Price Prediction: Here’s Why it May Stage a Comeback