Cardano price has stabilized this week, but could be ripe for a major bearish breakdown after forming a risky pattern, and as whales continued to sell. The ADA token was trading at $0.57 today, June 26, down by 35% from its highest level in May.

Cardano Price at Risk Amid Whale Selling

Whale transactions are a major leading indicator in cryptocurrency fundamental analysis. In most cases, whale dumping often leads to more downside because it sends a signal that the biggest investors are capitulating.

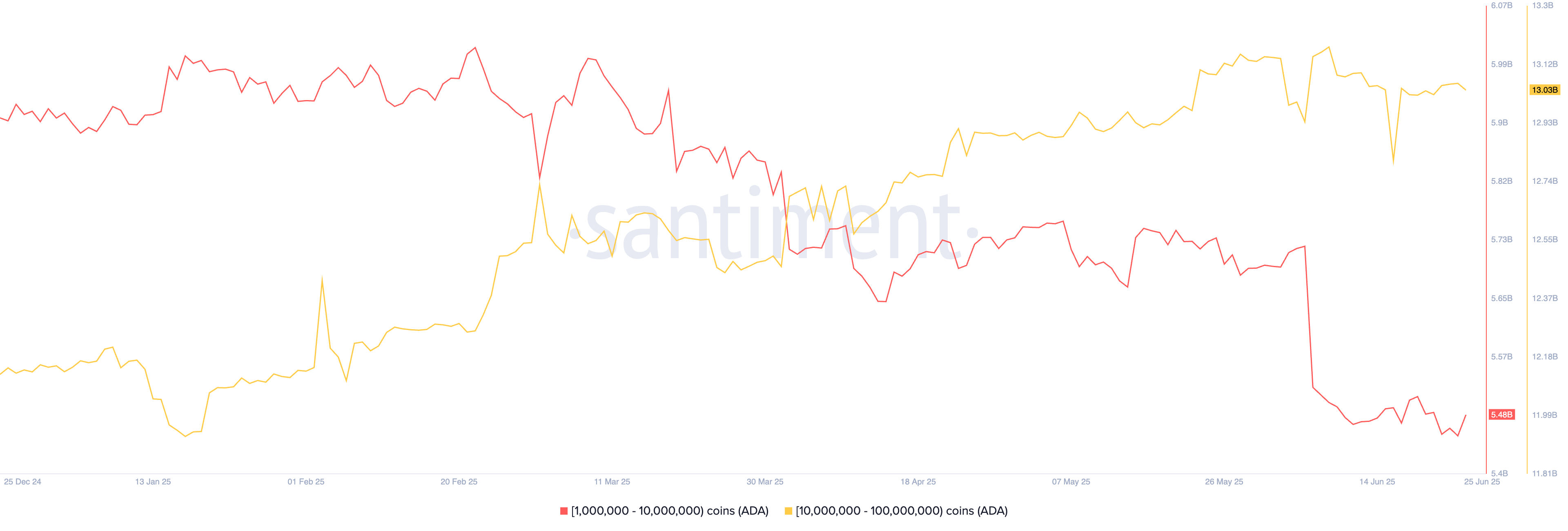

Santiment data shows that the whales holding between 1 million and 10 million ADA tokens now have 5.48 billion tokens, down from 6.2 billion earlier this year. Similarly, those holding between 10 million and 100 million tokens now have 13 billion, down from 13.17 billion a few weeks ago.

There are a few reasons why whales have capitulated and dumped their Cardano coins. First, the ADA token has plunged by more than 57% from its highest point this year. It is common for both small and large investors to sell their coins when their value falls.

Second, Cardano’s internal metrics are not doing well. For example, the number of daily active users dropped to 20,000 this month, down from 222,000 in November 2022 and its lowest level since 2021. Chain fees have dropped to $ 154,000, while chain transactions have fallen to a multi-year low of 654,000.

These are all negligible numbers for one of the biggest cryptocurrencies with a market capitalization of over $20 billion.

READ MORE: Tron Price Prediction as Monthly Transaction Volume Hits $634B

Third, Cardano also has weaker internal numbers, including a decentralized finance (DeFi) total value locked of less than $350 million and just $30 million in stablecoins, a figure that has stopped growing. Many smaller chains like Sei and Unichain have overtaken Cardano.

Furthermore, Cardano’s price is at risk due to rising concerns that its hopes for Bitcoin integration may not materialize. That’s because tools to help users earn a return on their Bitcoins already exist.

ADA Price Technical Analysis

The daily chart shows that the Cardano price has been in a strong downward momentum after peaking at $0.863 in May.

Notably, ADA has formed a death cross pattern as the 200-day and 50-day moving averages crossed each other on June 6. A death cross often leads to more downside over time.

The Cardano price has formed an inverse cup-and-handle pattern, with its lower side at $0.519 and its upper side at $0.863. This pattern also triggers more downside, which will be confirmed if it drops below the lower side of the cup. A crash below this level will point to more downside, potentially to $0.40.

READ MORE: SYRUP Price Prediction as Maple Finance AUM, Revenue Jump