XRP price remains in a bear market after crashing by over 36% from the highest point this year. Ripple trades at $2.17 today, July 2, as investors wait for the next major catalyst. This article conducts a technical analysis and identifies the potential targets.

XRP Price Technical Analysis

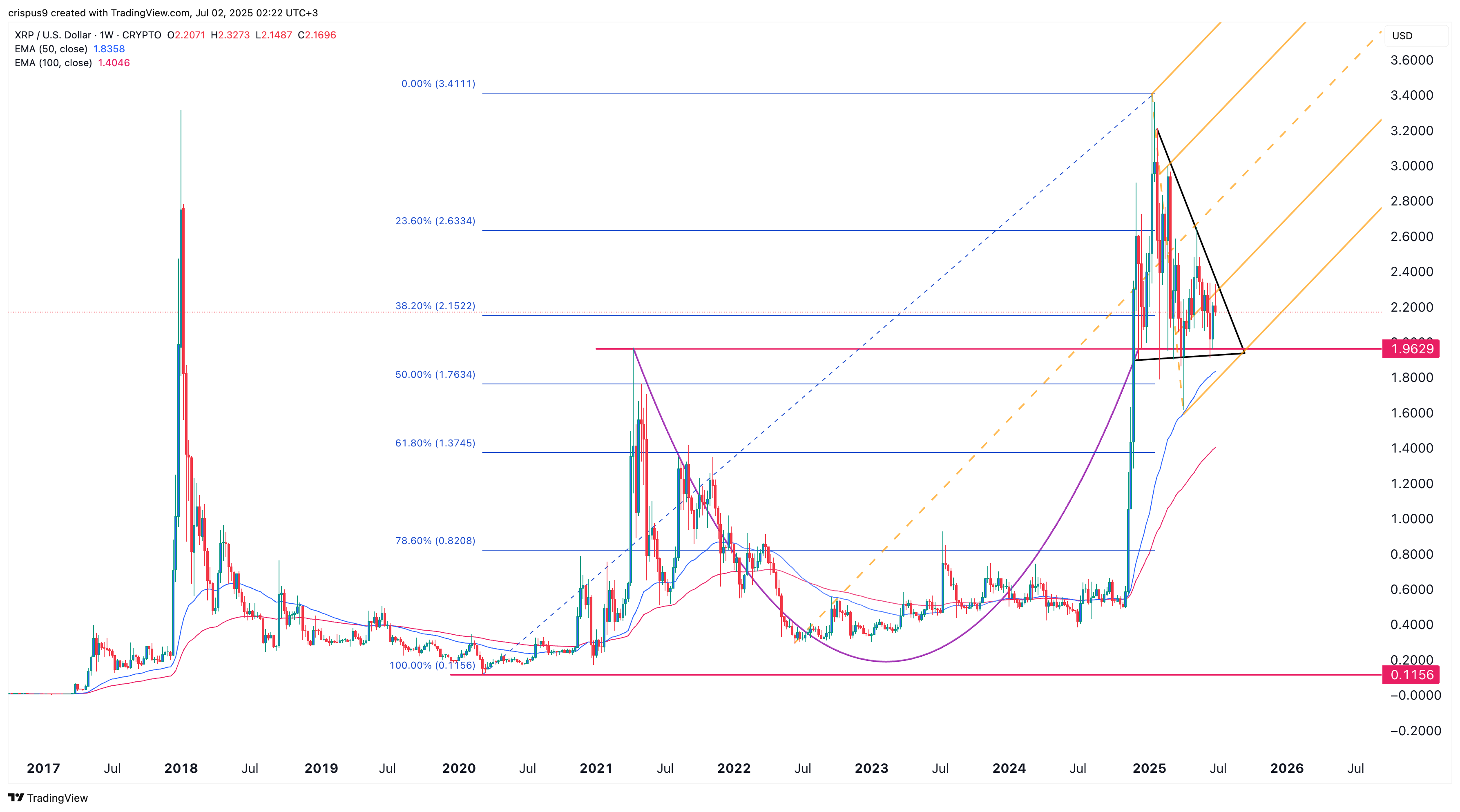

The weekly chart shows that the Ripple price bottomed at $0.1156 in 2020 and then surged to a high of $3.4 earlier this year. Most of this surge happened in November last year, when it surged by nearly 500% in November and December.

The token formed a cup-and-handle pattern, with its upper side at $1.9630. A C&H pattern is a highly popular bullish continuation sign, which is a popular continution sign.

XRP price has formed a bullish pennant pattern, another popular bullish continuation sign. This pattern comprises a vertical line and a symmetrical triangle sign. The two lines of this pattern are nearing their confluence level, where a bullish breakout is likely to occur.

READ MORE: SRM Entertainment Announces $100M TRON Treasury Strategy

XRP has moved above the 50-week and 100-week Exponential Moving Averages (EMA). Remaining above these averages is a sign that bulls are in control for now.

XRP has also moved slightly below the first support of the Andrews pitchfork tool. Therefore, the token will likely have a bullish breakout as long as it is above the important support level at $2.

Such a move will likely lead to further gains, potentially reaching an all-time high of $3.4. Rising above that level will point to more gains, potentially to the psychological point at $5.

On the flip side, a drop below the support at the 50% Fibonacci Retracement level at $1.7635 will invalidate the bullish XRP price forecast. Such a move will see it drop below the psychological level of $1.

Potential Catalysts for Ripple Token

Ripple has numerous catalysts that may push its price higher in the long term. First, there are signs that the coin has higher demand in the financial market. For example, the XXRP ETF, which has an expense ratio of 1.89%, has over $139 million in assets under management (AUM).

These assets are notable due to their high fees, which imply that a $10,000 investment incurs an annual fee of approximately $189.

Second, the XRP price could increase as the Ripple USD (RLUSD) stablecoin’s market share rises. The stablecoin has attained a market capitalization of over $450 million, making it one of the biggest stablecoins in the market.

Further, XRP price will benefit when the Securities and Exchange Commission (SEC) approves spot ETFs. Such a move will lead to more demand from Wall Street investors.

READ MORE: PENGU Price Surges on Game Launch & ETF Hype: Is $0.025 Next?