AAVE, the token powering the popular DeFi protocol Aave, is starting to show real breakout potential. AAVE crypto increased by 2.39% in the last 24 hours and is now trading at about $282.60, approaching the $300 to $400 range.

With strong technical indicators, good on-chain data, and growing interest in its ecosystem, AAVE appears poised for its next move, provided it can maintain its position above key price levels.

AAVE Crypto Shows Bullish Technical Signals

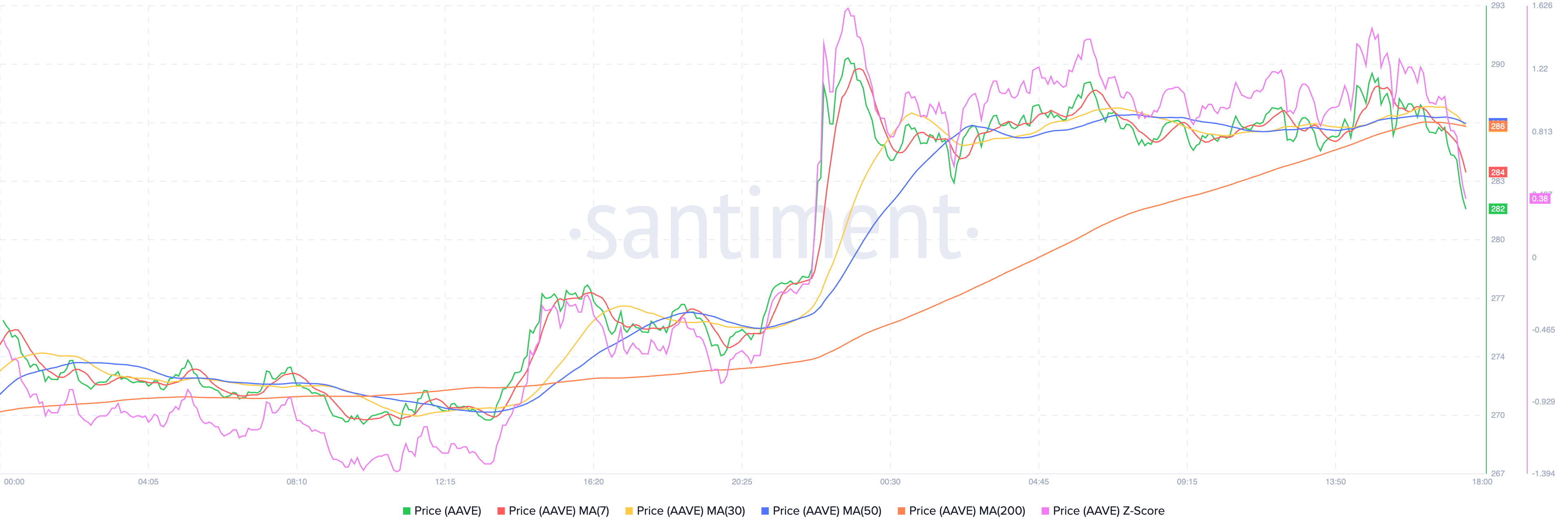

On July 7, AAVE broke past the key resistance zone between $270 and $273, reaching an intraday high of roughly $290.93. This breakout has caught traders’ attention, as it could signal more upside in the near term.

According to Santiment data, AAVE is hovering close to its 7-day average of $284.42 and holding above major moving averages, the 30-day, 50-day, and 200-day, all clustered around the $286 mark. That kind of alignment often points to strong underlying momentum.

The MACD histogram has also turned bullish, with a reading of +1.87. The RSI is at 58.56, indicating strong momentum, but the market is not yet overbought.

READ MORE: Hedera (HBAR) Set for Takeoff as ETF Deadline, Bullish Chart Patterns Align

According to trader Manbit, the key level to watch is $291.24. If the price goes above this area, it could lead to a retest of $300 and possibly a rise to $330–$350, which are previous resistance levels. A clear breakout above $390 might even support a long-term target range between $1,400 and $2,000 before this market cycle ends.

However, if AAVE crypto fails to hold $283, bears may try to push it back to the $270–$273 support band. For now, AAVE crypto remains inside this technical “decision zone.”

DeFi Leadership Fuels Optimism

AAVE remains the undisputed heavyweight of the DeFi sector, currently sitting at the top of DeFiLlama’s protocol rankings with a TVL of $43.26 billion, ahead of Lido and EigenLayer. That gives Aave control of over 20% of the total DeFi TVL. Aave also leads in flash loan volume, having processed $7.5 billion in year-to-date transactions.

Its annualized fee revenue stands at $580 million, further demonstrating that the protocol is efficiently monetizing its capital. The protocol generates more than $230,000 in daily revenue and continues to attract users and developers thanks to its consistent innovation.

Notably, founder Stani Kulechov’s roadmap includes V4 upgrades such as “Spokes” and a Liquidity Hub, which will connect fragmented liquidity and offer advanced risk management.

Another tailwind is Aave’s expansion into Real World Assets (RWAs) through the “Horizon” initiative, which aims to bring regulated institutions into DeFi by tokenizing assets like treasuries and invoices.

These developments add long-term value to AAVE crypto and give investors more confidence in holding or accumulating during dips.

READ MORE: Shiba Inu Price Prediction as New Coin Steals Its Shine