Ethereum price continued its strong recovery this week as most cryptocurrencies gained steam. ETH token jumped to $2,800 on Thursday, up by over 30% from its lowest level this year. It has soared by 100% from its April lows.

Ethereum Projections and Analysis

The daily timeframe shows that the Ethereum price has staged a strong rally over the past few days, moving from a low of $2,116 in June to its current level of $2,752.

It moved to the 50% Fibonacci Retracement level and has officially formed a golden cross pattern. A golden cross happens when the 50-day and 200-day Exponential Moving Averages (EMA) cross each other.

The Relative Strength Index (RSI) has jumped to 64, the highest level since June 11. Other oscillators, such as the MACD and the Stochastic Oscillator, have all pointed upwards.

Ethereum price has formed a bullish flag pattern, comprising a vertical line and a rectangular channel. Therefore, by measuring the length of the flag, the price target increases to $4,287, which is significantly higher than the current level.

READ MORE: ZBCN Price Analysis: Here’s Why Zebec Network Crashed

Bullish Catalysts for ETH Coin

Ethereum has numerous catalysts that may push it higher in July. First, data show that Wall Street demand for Ethereum ETFs continues to rise. These funds have added assets in the last ten days, bringing the total inflows to $4.5 billion.

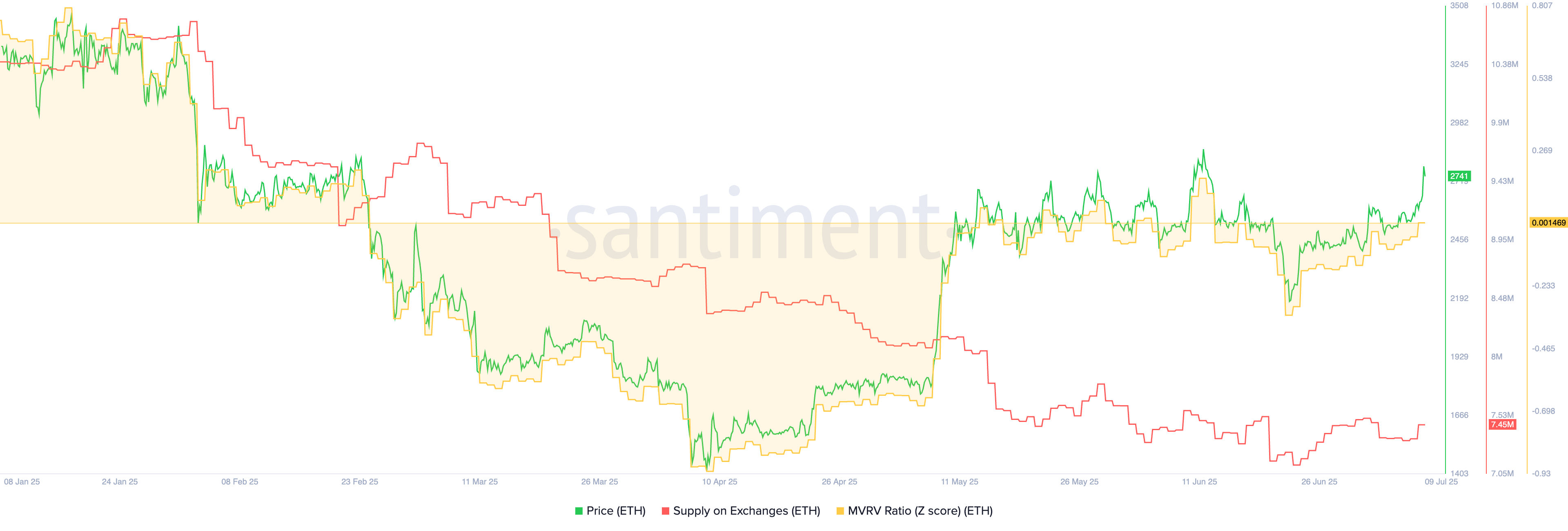

Second, more data shows that Ethereum’s demand is surging as the supply on exchanges has plunged in the past few months.

There are now 7.45 million coins in exchanges, down from the year-to-date high of over 10.5 million. Falling balances indicate that investors are not selling their coins.

Third, there are signs that Ethereum remains relatively inexpensive despite its recent price increase of over 100%. The closely-watched market value to realized value (MVRV) stands at 0.0014, up from last month’s low of minus 0.34. Still, the figure remains significantly lower than its historical highs, making it more attractive to investors.

Additionally, data shows that the total value locked (TVL) in Ethereum has increased by 6.5% over the last 30 days to exceed $146 billion. The bridged assets have soared to over $403 billion, a trend that may continue in the coming months.

Furthermore, the stablecoin supply on exchanges has reached a record high of $126 billion, up from the year-to-date low of over $115 billion.

Therefore, despite recent concerns about Ethereum, the data show that the network is performing well.

READ MORE: Polygon Price Rare Pattern Signals a Rally as Ecosystem Rebounds