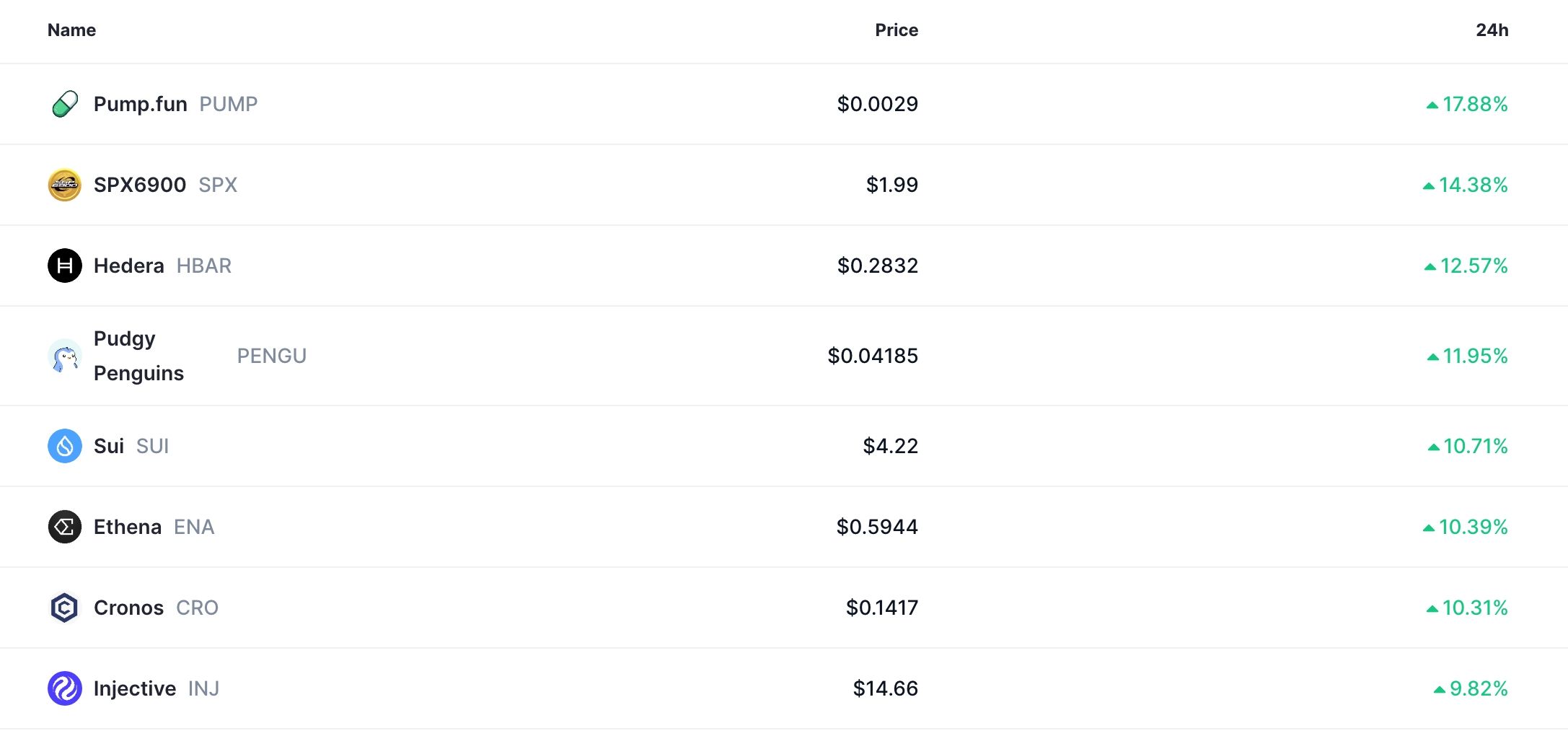

Top altcoins like Sui (SUI), Cronos (CRO), Pudgy Penguins (PENGU), and Pump (PUMP) bounced back on Saturday, 26. $PUMP jumped by 16% in the last 24 hours, giving it a market capitalization of over $1 billion.

Pudgy Penguins token jumped by 13% in the last 24 hours, and is now up by nearly 1000% from its lowest level this year. CRO price has soared to its January highs and is 105% above the year-to-date low.

Sui also jumped to its January highs. Other small-cap altcoins, such as Nervos Network, Hedera Hashgraph, Chainbase, Vine Coin, and Blast, were also up by double digits. Altogether, the market cap of all cryptocurrencies jumped by 1.8% in the last 24 hours to $3.8 trillion.

These altcoins rebounded as the Bitcoin price jumped above $118,000 for the first time in two days. It has jumped by nearly 3% from its lowest level this week.

Bitcoin is normally the main catalyst for most altcoins. Many of them typically surge when BTC rises slightly, and vice versa. For example, many altcoins plummeted by double digits after the coin’s price dropped from its all-time high.

There is a chance that the Bitcoin price will resume its uptrend soon, triggering more gains among altcoins. For one, as we wrote here, Bitcoin is now forming the highly popular bullish flag pattern.

READ MORE: HBAR Price Prediction: Eyes 45% Surge as Hedera Metrics Surges

Most importantly, Bitcoin’s future open interest has soared to over $85 billion. Historically, rising open interest during a consolidation market is a sign of soaring demand, which is a bullish sign.

Altcoin prices have also jumped as data showed that institutional demand remains high. Spot Bitcoin ETFs added over $72 million in inflows this week, while Ethereum funds added $1.8 billion.

Looking ahead, the next key catalyst for these altcoins will be the upcoming earnings reports from popular crypto companies such as Coinbase, Robinhood, and PayPal.

Further, the Federal Reserve will deliver its interest rate decision next week. Analysts expect the bank to maintain interest rates unchanged between 4.25% and 4.50% and hint towards two cuts this year. Crypto prices are likely to react positively if the bank delivers a dovish decision.

READ MORE: XRP Price Prediction: Why BlackRock May Apply for Ripple ETF