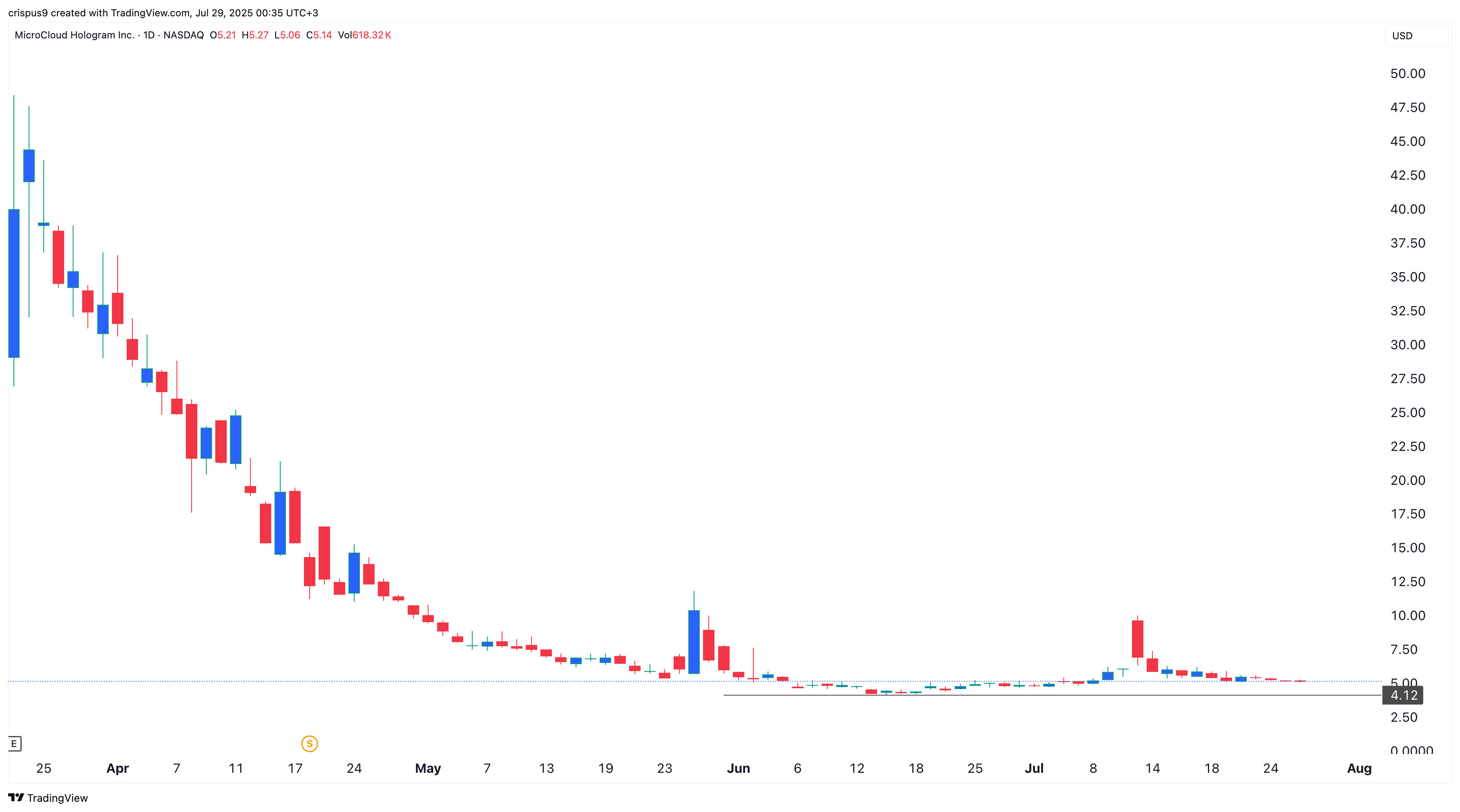

HOLO stock price has crashed, erasing millions of dollars in value over the past few days. MicroCloud Hologram, a popular meme stock, has plunged from this month’s high of $9.92 to $5.15, giving it a market capitalization of $78 million. This article explores what MicroCloud is and whether it is the next big Bitcoin Treasury bet.

What is MicroCloud Hologram?

MicroCloud Hologram is a Chinese company that provides Light Detection and Ranging (LiDAR) solutions, primarily used in the automotive industry. LIDAR is a huge industry that is growing as automakers incorporate the technology into their vehicles.

The challenge for MicroCloud, however, is that the industry has become highly competitive with companies like Veloyne, Luminar, Innoviz, and Aeva having a substantial market share.

Even so, the most recent results showed that MicroCloud’s business was doing relatively well. Its annual revenue jumped from RMB 203.5 million to RMB 290 million or $40.7 million. Its operating expenses rose to RMB 203 million, giving it an operating profit of RMB 87 million.

HOLO stock price has declined significantly over the past few years, prompting the company to implement a reverse split to maintain a share price above $1. This performance was due to the rising competition in the LiDAR industry and its losses.

Pivot to Bitcoin Treasury Strategy

Like many struggling companies, MicroCloud Hologram has been inspired by Michael Saylor’s Strategy and ventured into Bitcoin accumulation.

Data shows that the company has accumulated 2,353 coins, valued at over $277 million, which is significantly higher than its market capitalization of $75 million. This valuation gives it a NAV multiple of 0.27, much lower than other companies like Strategy and Metaplanet.

Most notably, MicroCloud Hologram did not raise money to buy its Bitcoin. Instead, it used the funds in its balance sheet to accumulate these coins, and data shows that its approach has been successful so far, with an average cost per BTC of $84,000 compared to the current $118,000.

At the same time, MicroCloud’s annual report shows that it had over $224 million in total assets against liabilities of $4.43 million. Its assets have now grown following its Bitcoin accumulation strategy. This situation will continue if the Bitcoin price rises as we predicted.

MicroCloud’s core business is also improving, with its revenue jumping to $40 million last year and its net loss narrowing to $9 million.

Will HOLO Stock Price Rebound?

HOLO stock chart | Source: TradingView

Fundamentals suggest that the HOLO stock price will bounce back as it is highly undervalued and its business is improving.

Technicals suggest that the HOLO share price is in the accumulation phase of the Wyckoff Theory and that it will bounce back once Bitcoin starts to recover. The bullish outlook will remain as long as it is above the key support level at $4.12.