Sui price is showing breakout patterns as a wave of bullish catalysts sent the Layer-1 token climbing over 6% in 24 hours, trading around $3.71 at press time. The breakout follows a surge in investor interest and other catalysts that might push $SUI toward $5 and beyond in the coming weeks.

Institutional Capital Pours In as UX Gets a Web3 Upgrade

The first major tailwind comes from AMINA Bank, a Swiss-regulated financial institution that became the first bank to offer SUI custody and trading as of August 5.

This swiftly followed the news that Mill City Ventures, a Nasdaq-listed firm, allocated $450 million worth of reserves to SUI, highlighting growing trust in Sui’s long-term viability.

Add to this the pending SUI ETF application from 21Shares, expected for SEC review by January 2026, and the foundation for institutional legitimacy is clear.

At the same time, Sui Foundation launched “Passkey,” a sleek, passwordless authentication method enabling users to log in via Face ID, fingerprint, or a YubiKey without seed phrases or wallets. It’s a massive leap for Web3 user experience, lowering friction and increasing mainstream adoption potential.

As one tweet put it: “No seed phrases. No passwords. Just Web3 the way it should be.”

Passkey is already live on Sui mainnet, with Nimora Wallet being the first to implement it. This new real-world usability may attract more developers to build within the ecosystem.

SUI Price Forecast: What to Watch in the Short and Mid-Term

Technical indicators show that the SUI coin just breached a local wedge pattern on the daily chart, confirming a bullish reversal, as pointed out by prominent analyst and investor Rand on X.

As one of the most followed crypto analysts on Twitter (now X), Rand places $5 and $10 as the next upside targets, with the recent move breaking prior resistance levels.

A look at TradingView’s daily technicals aligns with this outlook. Data shows 13 Buy signals vs. 9 Neutral, based on indicators like MACD, EMA20, and RSI. The RSI sits at 52.23, offering enough room for further upside before entering overbought territory.

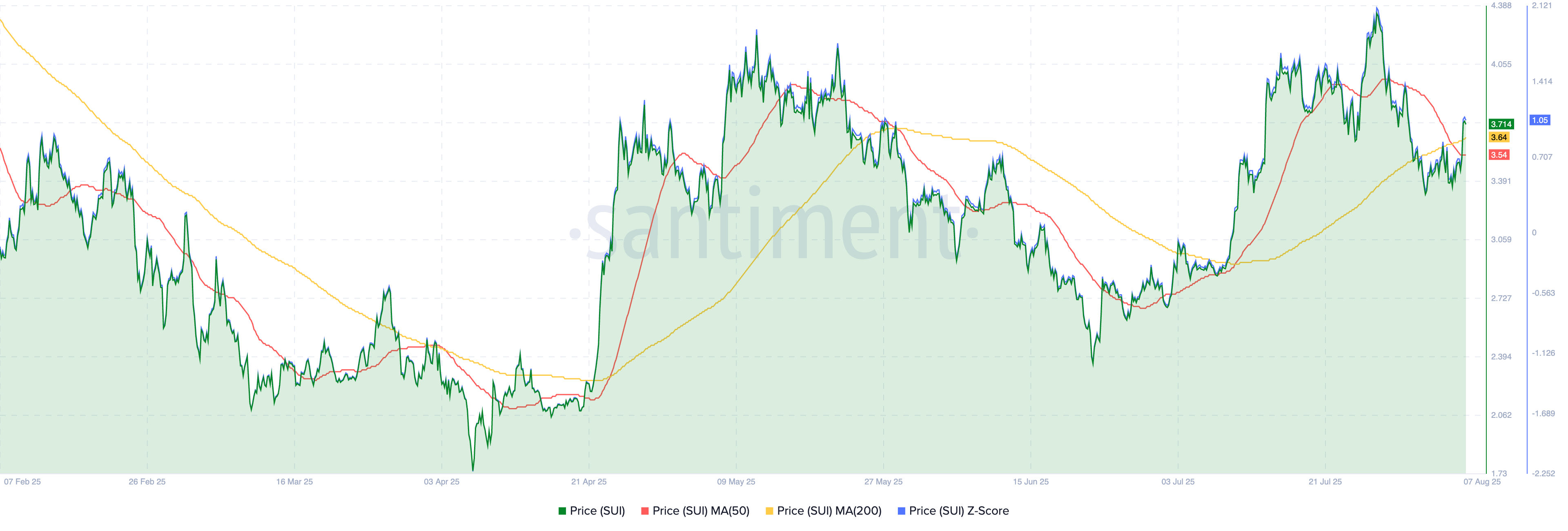

SUI is currently trading above the 50 and 200 moving averages (MA50: $3.54, MA200: $3.64), both turning into new dynamic support.

On Santiment, we also see the SUI coin price reclaiming the 200MA and breaking back above the 50MA, a reliable bullish signal after July’s dip. Support is around $3.45 to $3.50, which includes the day’s low and previous price range. Resistance is tightening at $3.78, the daily high for SUI coin.

In the short term, the SUI price could keep rising if buyers maintain above the $3.50 to $3.60 support zone. Trading volume is strong, and momentum indicators are showing positive signs. A confirmed flip of $3.78 resistance could open the door to the $4.20–$4.50 range in the coming weeks and $5+ before Q4.

READ MORE: XRP Price Prediction: Here’s Why Ripple is Set to Surge Soon