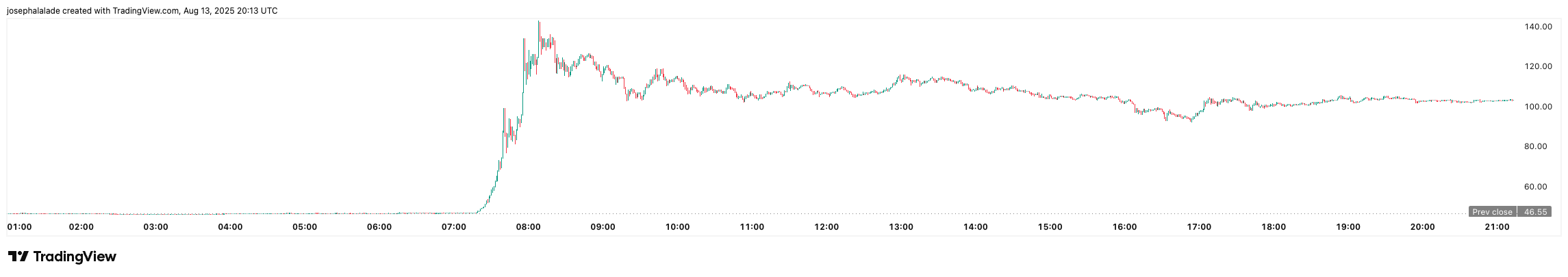

OKB, the native exchange token of OKX, has stunned the crypto market with an almost 200% rally in a single day, surging from $46 to over $104 and briefly touching $142 before stabilizing near the $102–$104 zone.

The explosive move came amid a broader bullish backdrop, with the global crypto market capitalization crossing the $4.13 trillion mark today. However, the bullish performance of the OKB coin price was driven by a fundamental supply shock and a targeted utility expansion.

Supply Shock: OKX Executes Largest-Ever Burn

On August 13, 2025, OKX confirmed a one-time burn of 65.26 million OKB, worth roughly $7.6 billion, slashing the total supply from 300 million to just 234.74 million and the circulating supply to 21 million. The burn effectively removed more than 52% of all circulating OKB, creating Bitcoin-like scarcity overnight.

The immediate market reaction was a parabolic price move. Within an hour of the announcement, OKB was up over 100% according to CoinGecko, with 24-hour trading volume exploding over 21,000% to $1.25 billion. Such sudden supply contraction historically fuels exchange-token rallies, with Binance’s BNB being the closest parallel.

By compressing circulating supply while maintaining liquidity, OKX Exchange reduced potential sell pressure and bolstered long-term value perception, a classic deflationary play.

READ MORE: Altcoin Season: Why are Crypto Like Chainlink, Polkadot, Cardano Prices Going Up?

X Layer Upgrade Targets DeFi, Payments, RWAs

Coinciding with the burn, OKX rolled out a major upgrade to its zkEVM-based X Layer blockchain. The network now delivers 5,000 TPS, slashed gas fees, and integrated Polygon CDK technology, setting its sights on DeFi protocols, payment rails, and real-world asset tokenization.

Crucially, the OKB token is now positioned as the sole gas token for X Layer, centralizing on-chain activity around it. This change aligns with OKX’s strategic push to phase out Ethereum-based OKB transactions, pulling users deeper into its proprietary ecosystem.

Integration with OKX Wallet, OKX Pay, and the core exchange further strengthens token utility, which is a key factor traders will be watching as TVL, dApp launches, and active addresses start reflecting the upgrade’s impact.

OKB Price Momentum Holds, but $100 Support in the Crosshairs

OKB coin’s breakout was decisive. The token smashed through its 200-day EMA and the 23.6% Fibonacci retracement level with ease, triggering a cascade of buy orders. The rally was supported by a bullish MACD crossover and a Relative Strength Index (RSI) reading of 83.7. This often signals strong momentum, but it is edging toward overbought territory.

TradingView’s summary shows a “Strong Buy” across both oscillators and moving averages, with 17 buy signals versus zero sell signals on the weekly chart. Immediate support now sits at the $100 psychological level, with secondary support at $74.63. Resistance is expected at $147.33, which marks the highest price reached during the day.

Further, volume patterns show liquidity between $95 and $110, indicating that a drop below $100 could trigger profit-taking. Conversely, holding above $105 might lead to a retest of the $140–$150 range.

While the OKB token may experience short-term price swings in the next 24 hours, factors like a major decrease in supply and increased use in its ecosystem suggest that the token could maintain higher prices than before the supply reduction.

If the exchange can turn short-term excitement into lasting activity on the blockchain, the OKX Coin may stay above the $90–$100 range, leading to a stable increase in value instead of just a temporary rise.

READ MORE: Solana Price Prediction: SOL Eyes $457 as Analyst Forecasts