The IBIT ETF has become one of the best-performing funds ever launched as its assets have continued soaring this year. This trend will likely continue now that the Federal Reserve has started to cut interest rates. This article explained some of the top facts about BlackRock’s Bitcoin ETF.

IBIT ETF Approaches $100 Billion in Assets

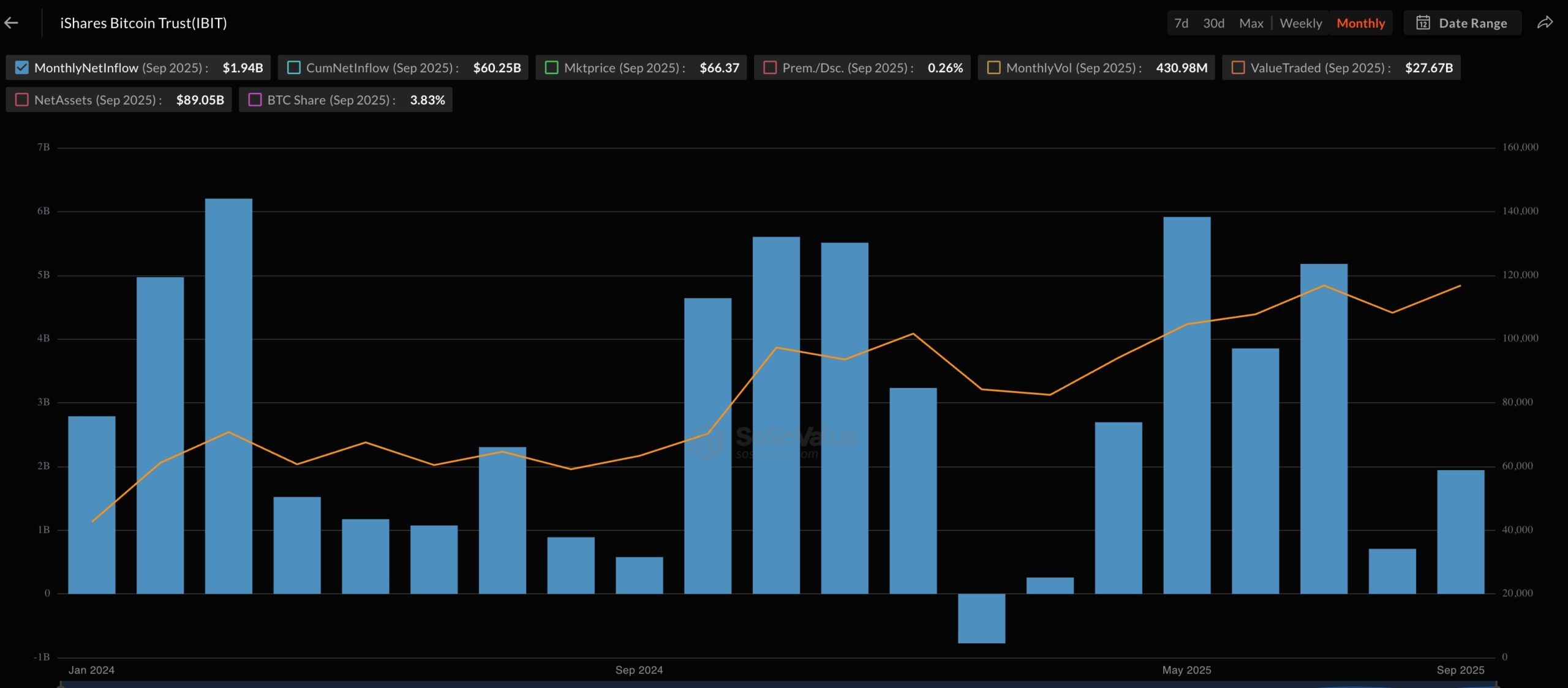

The first main fact about the IBIT ETF is that it is slowly nearing the $100 billion asset level. SoSoValue data shows the fund has had cumulative net inflows of over $60 billion and now holds $90 billion.

IBIT’s net inflows this month stand at $1.4 billion, a big increase from last month’s $707 million.

iShares Bitcoin ETF is the 8th Biggest BlackRock ETF

Another notable fact is that the IBIT Bitcoin ETF has become the eighth-largest BlackRock ETF, a significant achievement considering the company has a total of 462 funds.

The only BlackRock funds that are bigger than IBIT are the Core S&P 500 (IVV), Core MSCI EAFE (IEFA), Core Aggregate Bond (AGG), Russell 1000 (IWF), Emerging Markets (IEMG), and Mid-Cap (IJM).

Therefore, if the trends continue, it means that the fund could become the second-biggest BlackRock fund in the next few years.

READ MORE: Pepe Price Prediction as Whales Dump, Exchange Reserves Plunge

IBIT is the Most Profitable BlackRock Fund

While IBIT is the eighth biggest BlackRock fund, it is also its most profitable because of its 0.25% expense ratio.

With its assets at $90 billion, the fund will make about $225 million a year. On the other hand, the iShares S&P 500 Index has $634 billion in assets and an expense ratio of 0.03%, meaning it will make $190 million in revenue.

IBIT is Not the Best Bitcoin ETF to Buy

Although the IBIT ETF has experienced robust growth, it is not the best investment option.

The best Bitcoin ETF to buy is the Grayscale Bitcoin Mini Trust (BTC), which has over $5.5 billion in assets. This fund is better than IBIT because it has a lower expense ratio of 0.15%.

As such a $100,000 investment in the IBIT ETF will cost you $250, while a similar purchase of BTC ETF will cost about $150. While this difference is small, it will add up over time.

READ MORE: Justin Sun Net Worth and Crypto Portfolio Revealed