This week’s crypto crash accelerated on Friday, with Bitcoin plunging below $110,000 and the market value of all coins falling below $3.8 trillion. This plunge has triggered a sharp jump in liquidations this week.

Crypto Crash Continues as Liquidations Jump

The ongoing crypto crash has led to substantial liquidations among market participants. Data shows that the liquidations jumped by 320% on Friday to over $1.19 billion.

Over 260k clients were liquidated, with one trader on Hyperliquid losing over $29 million as his Ethereum trade went south.

The current liquidation figure brings the total weekly amount to $3.45 billion. It is the biggest liquidation since Monday this week, when they jumped to over $1.65 billion.

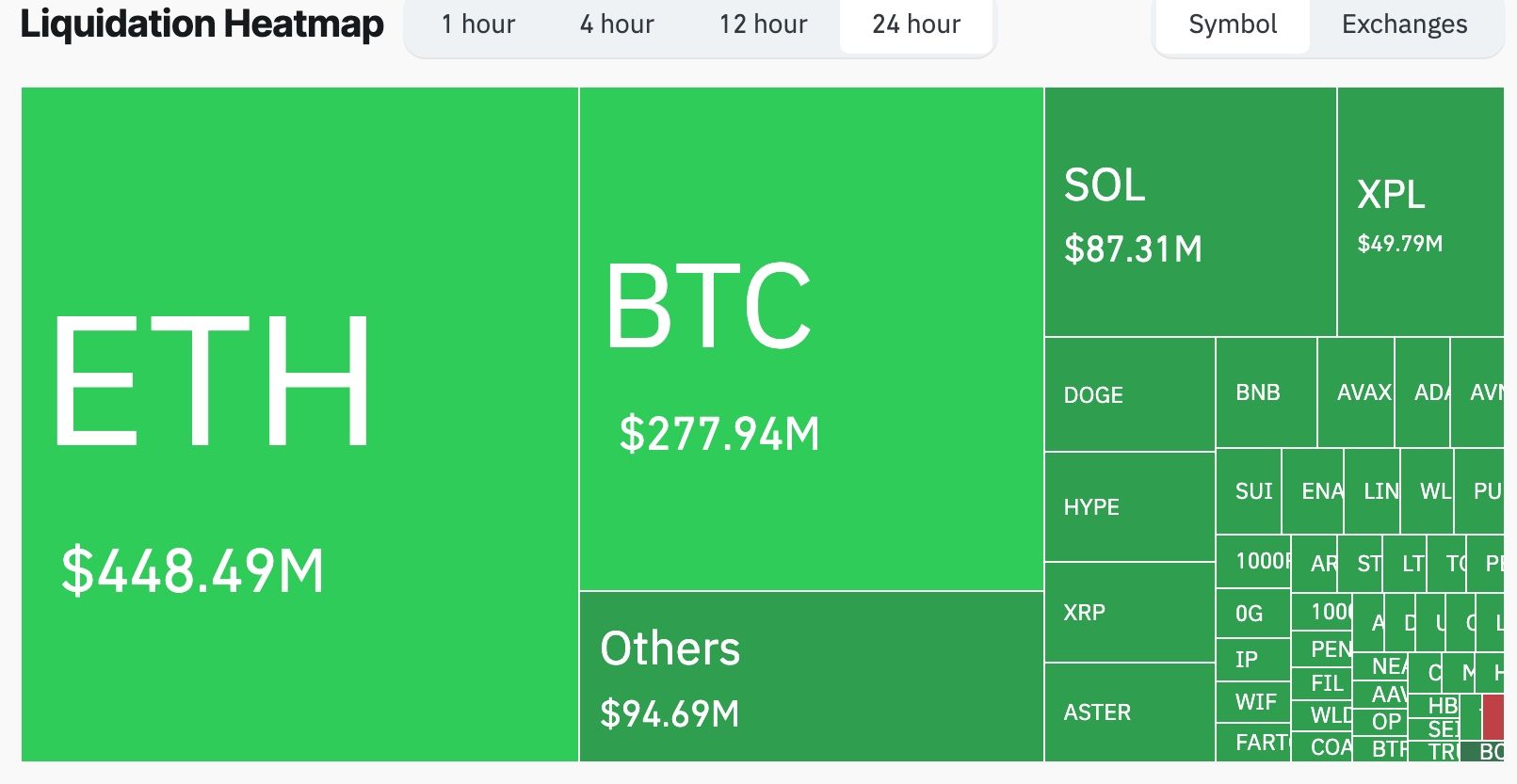

Ethereum bets worth over $448 million were liquidated in the last 24 hours. Bitcoin, Solana, XPL, and Dogecoin were among the most liquidated tokens.

Liquidations happen in the crypto market when companies like Binance, OKX, and HTX are forced to close leveraged positions due to the collateral falling to a low level.

READ MORE: Lombard Crypto Price Jumps as South Koreans Buy: Is a Crash Coming?

Why the Crypto Market Crash is Happening

The ongoing crypto crash is happening for three main reasons. First, it may be a shakeout ahead of the upcoming crypto market rally. A shakeout is a situation where an asset plunges to eliminate weak market participants.

The case of this being a shakeout is that traders are positioning themselves for the upcoming fourth quarter, when the crypto industry normally surges.

Second, the crypto market crash is occurring due to uncertainty surrounding the Federal Reserve. While the bank slashed rates last week, officials have recently warned about cutting so quickly.

In a statement this week, Jerome Powell noted that the bank was still concerned about inflation in the country. As such, there is a likelihood that the pace of cuts will be slower than expected.

In line with this, investors are likely waiting for the upcoming personal consumption expenditure (PCE) data. This is an important report because it is the Federal Reserve’s favorite inflation gauge.

Third, the crypto crash is happening as sentiment in the industry wanes. Data shows that the Crypto Fear and Greed Index has plunged from the greed zone of 73 earlier this month to the fear point of 38 today. Cryptocurrencies typically decline when the fear gauge decreases.

Additionally, the sentiment has worsened since the Altcoin Season Index rose above 82. In most cases, cryptocurrencies retreat when this happens as investors book profits.

READ MORE: Linea Price Crashes as TVL and DEX Volume Hit ATH, Stablecoins Dive