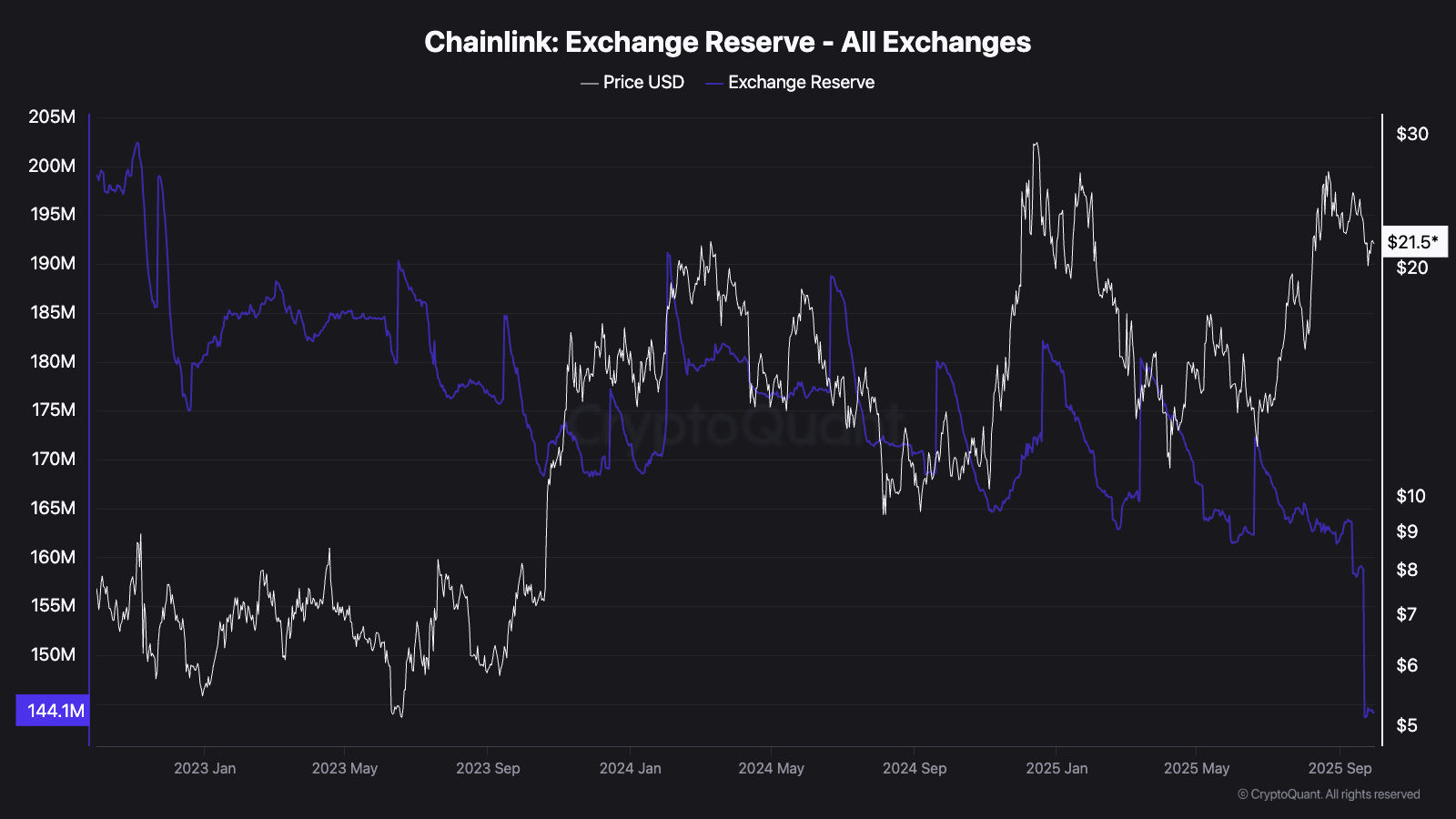

Chainlink price (LINK) is trading around $21.7 after holding steady through a volatile week, with intraday movements contained between $21.2 and $22.0.

While price action remains muted, the on-chain backdrop has shifted dramatically. Data from CryptoQuant shows a near-vertical collapse in LINK exchange reserves, a move that traders often interpret as a looming supply shock.

This structural shift comes just as institutional headlines reignite investor focus on Chainlink’s role in bridging traditional finance and blockchain infrastructure.

SWIFT Ledger Announcement Reignites LINK Hype

At the Sibos 2025 conference, global payments giant SWIFT announced that it is building a new blockchain-based shared ledger in collaboration with Consensys and more than 30 international banks, including JPMorgan and HSBC.

While the project itself does not directly involve Chainlink, its historical ties to SWIFT’s tokenized asset settlement pilots placed LINK back into the spotlight.

In previous cases, similar announcements from SWIFT have triggered double-digit rallies in the Chainlink price within days.

SWIFT’s blog post emphasized the importance of building interoperability across existing and emerging financial systems.

Analysts quickly connected this language to Chainlink’s proven track record of enabling cross-system communication through its oracle networks. The narrative emerging from Sibos is that even as banks experiment with permissioned chains, Chainlink’s middleware layer remains indispensable.

Chainlink Institutional Adoption Expands

Chainlink’s own announcements reinforced that momentum. The network revealed that its corporate actions initiative has now expanded to 24 financial institutions, including ANZ, Schroders, and Zürcher Kantonalbank.

In trials, the AI-powered framework reduced costs by 65 percent, a significant decrease for an industry facing a $58 billion annual burden from corporate action inefficiencies.

Each addition to this initiative strengthens Chainlink’s argument for long-term utility, positioning LINK as an operational backbone for financial markets.

Chainlink Price Faces Key Resistance at $22.5

Chainlink’s daily chart shows the token consolidating just below a descending resistance trendline at roughly $22.50.

A break above this zone would be the first clean technical signal for continuation, with room to target $25 and even $27 if momentum builds.

Indicators remain mixed. The Relative Strength Index is hovering near 45, suggesting the asset is neither overbought nor oversold. MACD levels remain marginally bearish, and moving averages are skewed toward sell signals, so confirmation before calling a breakout is critical.

For now, support levels around $20.5 are providing a cushion, but failure to hold that line could drag the price back to $18.8.

With exchange reserves at record lows, institutional adoption headlines piling up, and Chainlink (LINK) positioned once again as a key bridge in financial infrastructure, the fundamentals lean bullish. Yet, as technicals show, confirmation will come only if resistance finally gives way.

READ MORE: Quant Price Prediction as QuantNet Boosts Market Sentiment