Zcash price resumed its short squeeze this week, jumping to its highest point since 2022. ZEC jumped to a high of $186.9, up sharply from last month’s low of $34. This surge has made it one of the best-performing tokens this month.

Why Zcash Price is Soaring

Zcash is the second-largest cryptocurrency in the privacy sector, after Monero. It uses a unique approach to facilitate transactions in the crypto industry.

First, it has transparent addresses, which are known as t-addresses, whose transactions are publicly visible on the blockchain.

Second, it has shielded addressees known as z-addresses whose transactions are encrypted. Users can choose between transparent and shielded addresses, depending on their specific privacy needs.

The main reason for the surge in the Zcash price over the past few days is an announcement by Grayscale that it will establish a ZEC fund, providing it with access to institutional investors.

READ MORE: Here’s Why Peter Brandt’s XRP Price Prediction is Wrong

That announcement led to a substantial demand and short liquidations. Data compiled by CoinGlass shows that shorts worth over $1.8 million were liquidated in the last 24 hours.

The coin’s futures open interest also continued to soar, reaching a year-to-date high of almost $200 million. It is common for a coin’s open interest to jump sharply after a major development.

ZEC Price Technical Analysis

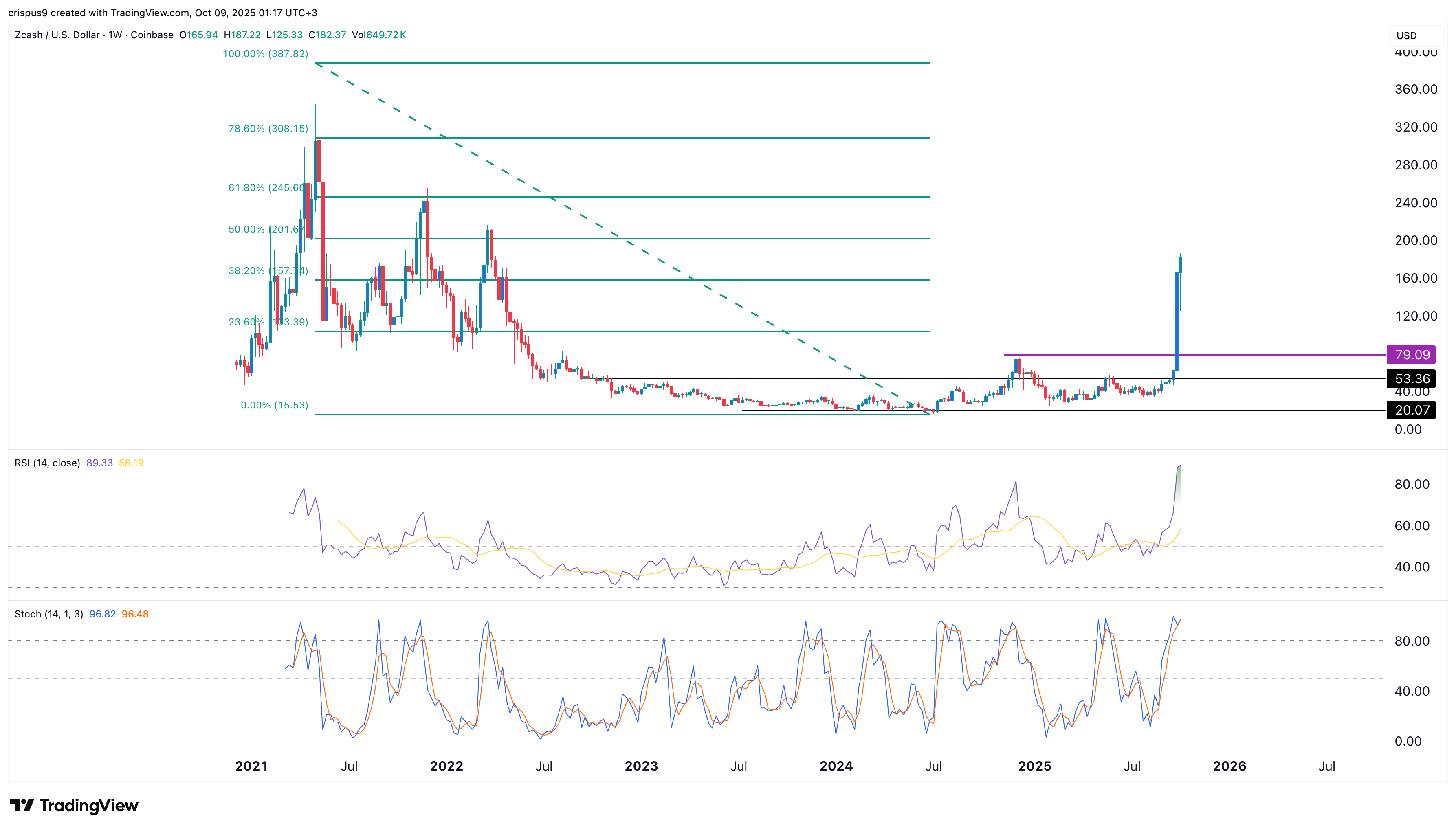

The weekly chart shows that the ZEC price has remained in a tight range over the past few years. It has remained inside the narrow range between $20 and $79 since 2022.

The coin was in the accumulation phase of the Wyckoff Theory during this period. It has now entered the markup phase, characterized by higher demand than supply.

The markup phase is then followed by the distribution, and then the markdown. It will likely enter these two phases in the near term as investors start to book profits.

Zcash price has moved above the 38.2% Fibonacci Retracement level. It is now nearing the 50% retracement point. Additionally, the Zcash price has reached a highly overbought level, with the Relative Strength Index (RSI) rising to 90.

Therefore, the Zcash price is likely to drop and possibly retest the support at $79, the highest point reached in December last year. Retesting that support will be notable as it will confirm the break-and-retest pattern, which is a common continuation sign.

READ MORE: Here’s Why Trump Coin and WLFI Token Prices are Crashing