Ethereum price has pulled back this week as the recent momentum in the cryptocurrency market has faded. Still, an Elliot Wave analysis suggests that the ETH token will experience a strong comeback as cumulative inflows continue to soar.

Ethereum Price Elliot Wave Analysis

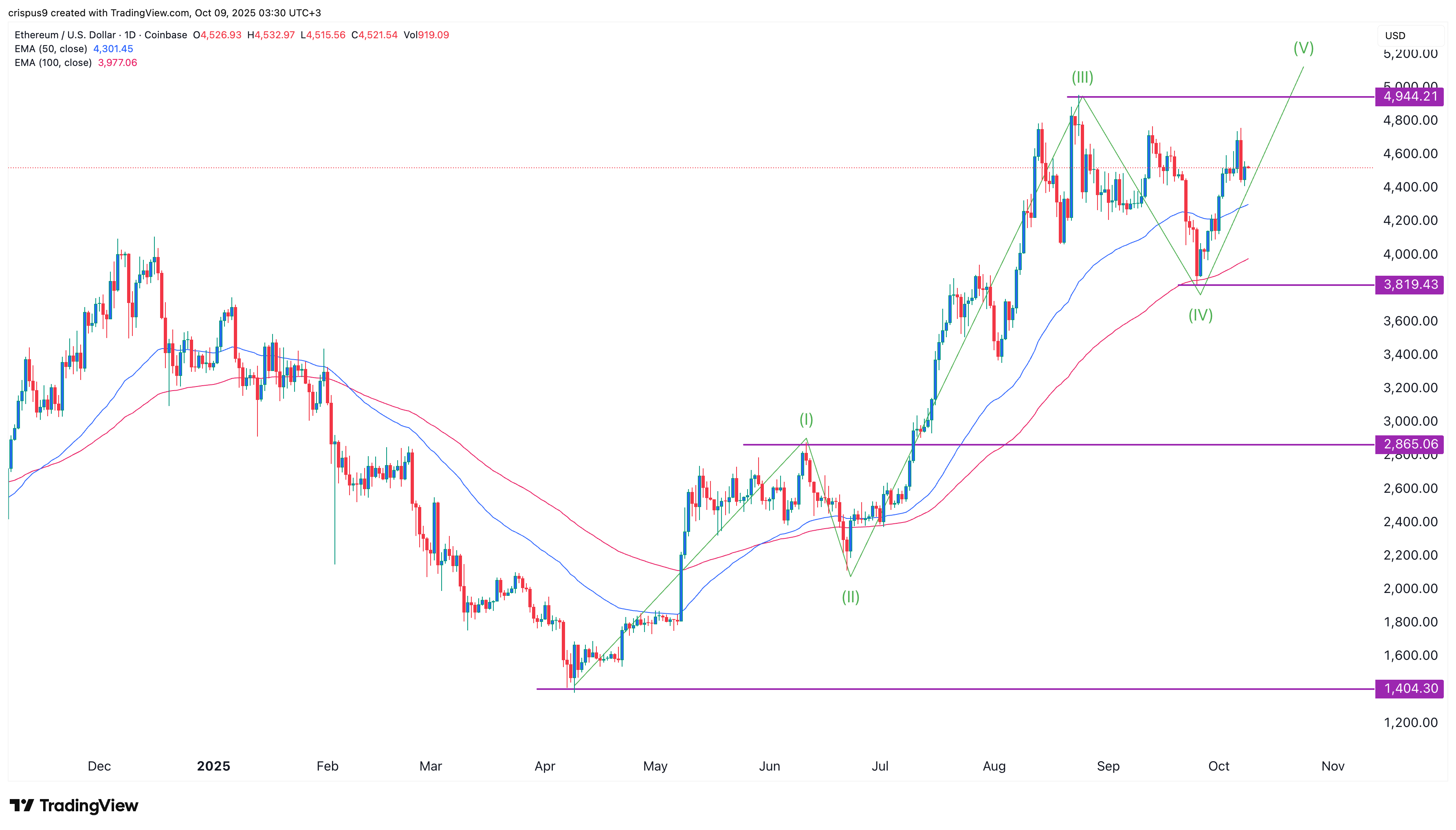

The daily timeframe chart shows that the coin bottomed below $1,300 in April this year and has been in a strong uptrend since then. A closer look shows that it has moved into the impulse phase of the Elliot Wave analysis.

The first phase began in April and ended in June, when it reached a high of $2,865. It then moved to the second phase and bottomed at $2,100. This phase is usually a corrective one, which bottoms at about the 50% Fibonacci Retracement level.

Ethereum price then moved to the third phase, which ended at its all-time high of $4,950. It then moved to the fifth phase, where it is now. This phase is usually highly bullish, which will likely lead to more gains, initially to the all-time high. A move above that level will point to more gains, potentially to $6,000 and above.

READ MORE: Here’s Why Trump Coin and WLFI Token Prices are Crashing

The other bullish catalyst for the coin is that it has formed a bullish flag pattern, which consists of a vertical line and a descending channel, resembling a hoisted flag.

The Ethereum price has also remained above the 50-day and 100-day Exponential Moving Averages (EMAs).

ETH ETF Inflows Have Crossed a $15 Billion Milestone

The most likely bullish catalyst for the Ethereum price is the ongoing ETF inflows, which have accelerated during the ongoing US government shutdown.

Data show that the cumulative ETF inflows have increased to over $15 billion, while the total assets have risen to over $30.9 billion.

BlackRock’s ETHA ETF has added over $ 4 billion in inflows and now has more than $10 billion in assets under management. This growth makes it one of the biggest crypto ETFs.

Ethereum has continued to attract assets over the past few months due to its fundamentals, including a growing market share in industries such as decentralized finance (DeFi), gaming, non-farm payrolls (NFP), and stablecoins.

Additionally, Ethereum is working on the upcoming Fusaka upgrade, which will introduce more features to the network. It is common for a coin to jump ahead after a major upgrade, as it did in the last Pascal.

READ MORE: Here’s Why Peter Brandt’s XRP Price Prediction is Wrong