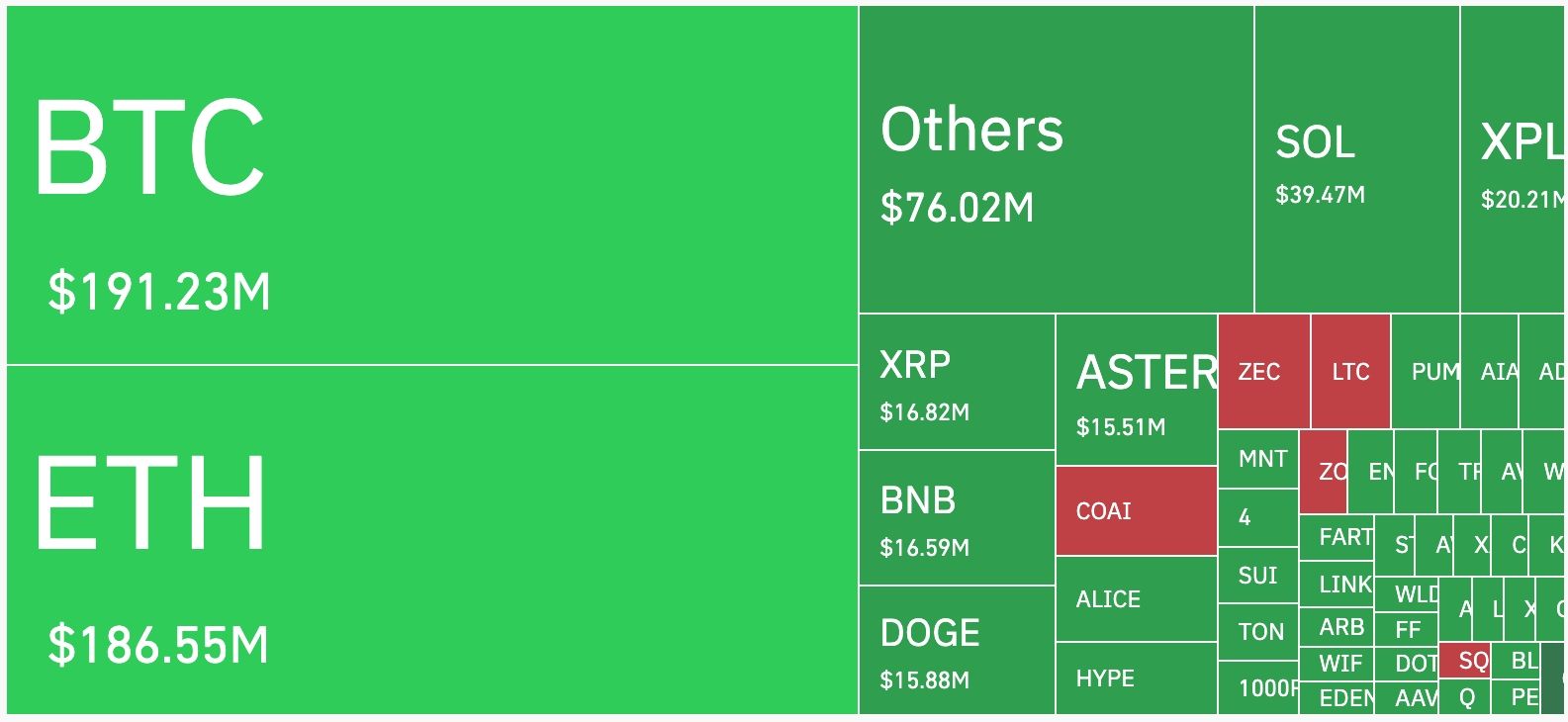

The crypto market is crashing today, with the market cap of all coins plunging by almost 2% to $4.26 trillion. Bitcoin remained below $122,000, while altcoins like Mantle, DoubleZero, FET, Pump, and Aster were the top laggards.

The crypto market crash coincided with the crashes in precious metals and the stock market. Top US indices like the Dow Jones, Nasdaq 100, and S&P 500 have all retreated. Gold and precious metals like silver and platinum also fell as investors booked profits.

One reason for the ongoing crypto market crash is that the US dollar has staged a comeback in the past few days. The US Dollar Index (DXY) has jumped by over 2% in the past few weeks as some Federal Reserve officials have urged caution. In a note, one analyst told Bloomberg:

“We have become a lot more positive on the dollar. The markets have priced in a very aggressive series of cuts, and it’s going to be difficult to execute them without a lot more labor-market pain.”

READ MORE: Chainlink Price Prediction: Why LINK is About to Soar

The crypto market crash is also happening as exchanges boost their bullish liquidations. Data compiled by CoinGlass shows that almost 200k traders were liquidated in the last 24 hours. Liquidations jumped by 113% to over $690 million, with Bitcoin and Ethereum longs suffering the most pain.

Additionally, altcoins have remained under pressure as the Bitcoin price has failed to retest the all-time high that it reached earlier this month. It has remained below $123,000. Altcoins normally follow in the footsteps of Bitcoin.

The ongoing government shutdown has also contributed to the crash, as it has led to a data drought in the United States. The Bureau of Labor Statistics did not publish its jobs report last week, and it is likely that the inflation report will not be released next week.

Most importantly for the altcoin market is the fact that the Securities and Exchange Commission (SEC) has not approved altcoin ETFs as investors were expecting. The most anticipated funds are for coins like XRP and Solana.

READ MORE: Ethereum Price Elliot Wave Analysis as ETH ETFs Hit $15B Milestone