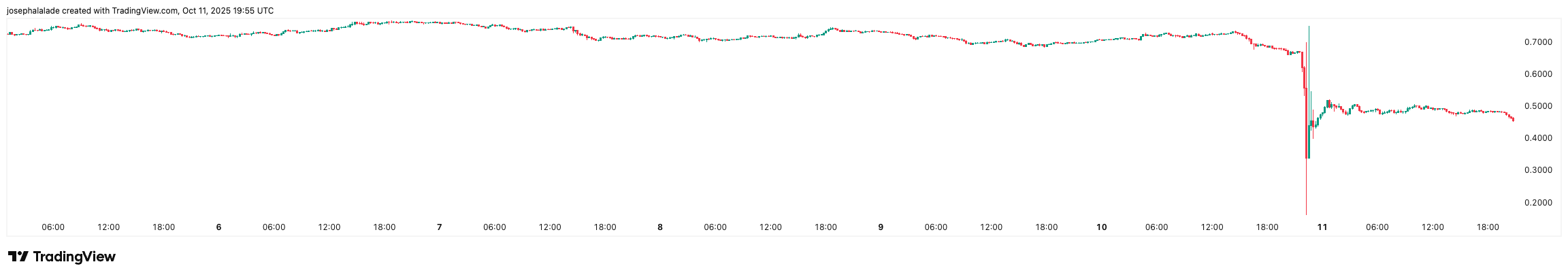

Optimism token (OP) plunged 29.4% in the past 24 hours, trading around $0.48 at press time after cascading liquidations swept across the broader crypto market.

The market drop occurred during a major crypto market crash, during which the total value of cryptocurrencies fell by 6.87%. This decrease wiped out over $250 billion in a single session.

Analysts explained that investors became cautious due to Bitcoin’s sudden drop from last week’s all-time high of over $126,000 to around $111k today and a decisive shift away from riskier assets.

According to CoinMarketCap data, 24-hour trading volume of the Optimism coin surged 237% to $680 million, a typical sign of capitulation as leveraged traders rushed to exit positions.

Layer-2 tokens bore the brunt of the crash, with Arbitrum (ARB) and Story Protocol (IP) also recording double-digit losses, as investors pulled capital from Ethereum ecosystem plays.

Market Panic and Layer-2 Rotation Weigh on Sentiment

Market-wide risk aversion pushed Bitcoin dominance to 59.6%, a 2.36% surge in the last 24 hours, signaling an investor preference for relative safety.

Meanwhile, the Altcoin Season Index fell to 33, marking a sharp 45% weekly decline, and the Fear & Greed Index dropped to 35 (Fear), consistent with panic selling across the board.

On-chain data from Token Terminal shows that while OP’s active addresses jumped to 176K, making it the 5th most-used Layer-2, the increase failed to translate into $OP price support.

READ MORE: Will the Crypto Market Go Back Up Soon?

Revenue on the Optimism mainnet climbed to $1.1 million over the past 30 days, ranking 3rd among Layer-2 blockchains, behind Base and Arbitrum One. This means that network fundamentals remain intact despite the price drawdown.

Technical Breakdown Deepens the Sell-Off

From a technical standpoint, the Optimism price breached key support at $0.715, invalidating its previous consolidation range and triggering algorithmic liquidations.

The drop sliced through the 200-day EMA ($0.698) and the Fib 61.8% retracement at $0.483, establishing a new lower low on the daily chart.

Momentum indicators confirm the bearish bias, with the RSI at 28.7 showing oversold conditions but no bullish divergence. The MACD remains negative, and TradingView’s weekly summary (14 sell, 9 neutral, 1 buy) underscores a strong sell consensus.

Despite the sell-off, trader Michaël van de Poppe highlighted the correction as a potential accumulation opportunity, calling OP at $0.50 “a massive discount across the board.”

Optimism Price Prediction: Cautious Rebound Possible

If Optimism can close above $0.50 for the day, it might get a short-term boost as short sellers take profits and buyers step in. The first resistance level to watch is between $0.55 and $0.58, while $0.48 is critical support in the short term.

If it doesn’t maintain this support, the Optimism coin price could drop to $0.40, which is its low for 2025, a level where buyers have shown interest before.

Traders should look for decreasing sell volume or signs of a price reversal before making any decisions.

For now, the price of Optimism is in a risky area. It might appeal to long-term investors, but it’s still vulnerable due to larger market trends.

READ MORE: SEI Price Rebounds as Institutional Adoption Accelerates