The crypto market is down today, Oct. 29, despite the presence of three catalysts: Federal Reserve interest rate cuts, the upcoming meeting between Donald Trump and Xi Jinping, and the approval of an altcoin ETF.

Crypto Market Crash Triggered by Profit-Taking

Bitcoin price dropped from this week’s high of $116,600 to $112,000, while the market cap of the industry fell by 1.8% to over $3.79 trillion. Some of the most notable laggards included tokens such as Ethena, World Liberty Finance, Dash, Zcash, Arbitrum, and Filecoin.

The crypto market crash is occurring as investors book profits after a period of rising prices over the past few days. For example, Dash and Zcash prices have soared by triple digits in the past few weeks.

It is common for top-performing tokens to experience a pullback. At times, this happens as these assets move to the distribution or markdown phases of the Wyckoff Theory.

READ MORE: MSTR Stock Double-Top Points to a Crash After Strategy’s Junk Rating

Selling the Altcoins ETF Approval News

The crypto crash is also happening as investors start to “sell the news.” One news update they are “selling” is the approval of the Solana, Hedera, and Litecoin ETFs by the Securities and Exchange Commission (SEC).

Traders have now factored in the upcoming approval of other crypto ETFs, including XRP, Dogecoin, Chainlink, and Avalanche.

Additionally, market participants are likely selling off the news of the Fed decision and the Trump-Xi meeting. That’s because odds of a Fed cut have jumped to 98% on Polymarket. Traders also anticipate a deal between the US and China.

As such, if these events happen, it will not be unexpected news. It is common for traders to sell an asset ahead of a major macroeconomic news event.

The cryptocurrency market is also experiencing a decline due to deleveraging in the derivatives market, as traders await significant events. Data compiled by CoinGlass shows that open interest in the futures market dropped by 1.49% in the last 24 hours to $162 billion.

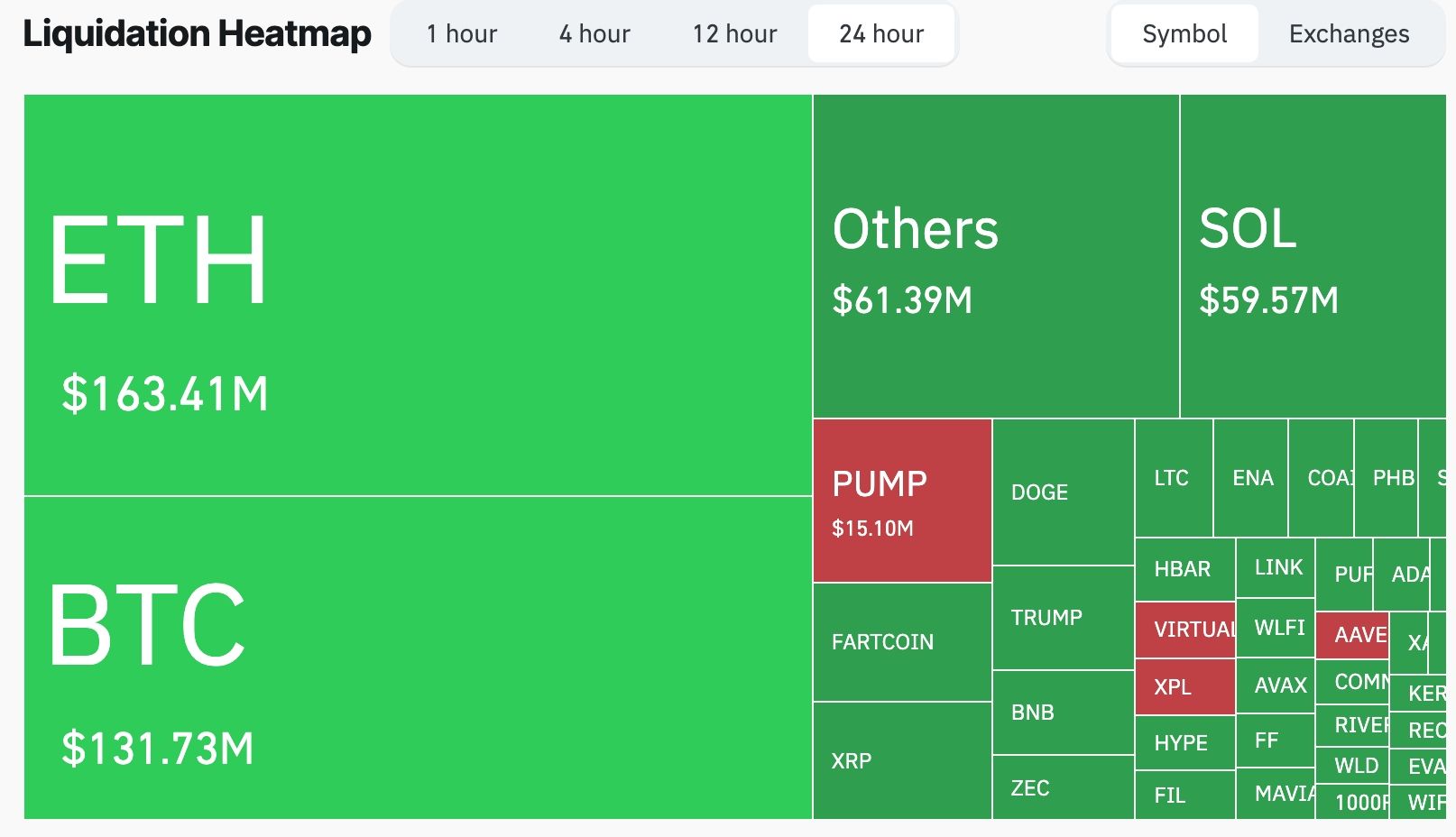

Soaring liquidations have also contributed to the ongoing crypto market crash. Data reveals that these liquidations soared by 71% in the last 24 hours to $565 million. Ethereum and Bitcoin had the most liquidations at $163 million and $131 million, respectively.

The liquidations brought memories of what happened on October 11 when positions worth over $19 billion were liquidated. Over 1.6 million traders were wiped out.

READ MORE: Bitcoin’s JEPI ETF Yields 63%: Is BTCC a Good Fund to Buy?