Chainlink price remained on edge today, Nov. 3, as whales sell and exchange balances fell ahead of the upcoming SmartCon Conference. LINK token was trading at $17.20, down nearly 40% from its year-to-date high.

LINK Exchange Balances Fall Ahead of SmartCon Conference

Chainlink price could be on the verge of a bearish breakout despite the upcoming SmartCon Conference. This is a major conference that brings together top Chainlink executives and senior leaders from some of the largest financial companies.

The event will feature leaders from top crypto and financial companies, including Swift, DTCC, Broadridge Financial, Aave Labs, Tron, Consensys, State Street, Kamino Finance, and Securitize.

READ MORE: Algorand Price Prediction as Transactions, Active Addresses Surge

The main themes of this event will focus on key areas such as Real-World Asset (RWA) tokenization, decentralized finance (DeFi), and bridging traditional finance (TradFi) and Decentralized Finance (DeFi).

There is a chance of important announcements during this event. The potential announcements are partnerships and product launches.

For example, Stellar, a top player in the crypto industry, joined the Chainlink Scale program and is now using its data feeds, data streams, and CCIP.

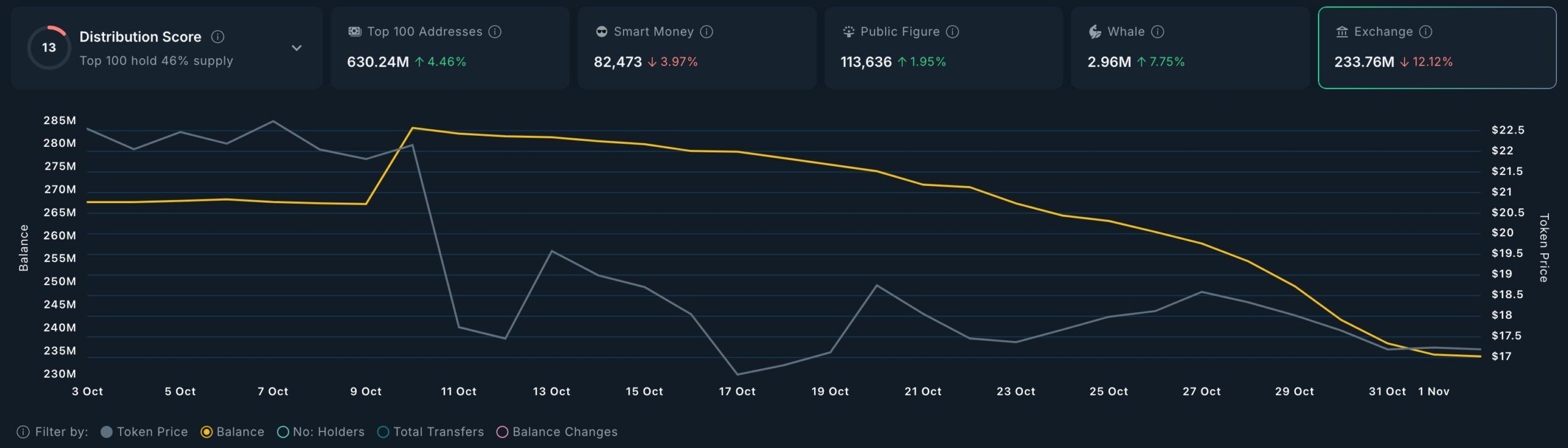

The event comes as the number of LINK tokens on exchanges continues to fall. There are now over 233.7 million tokens on exchanges, down from last month’s high of 283 million.

Falling exchange reserves are bullish because they signal that investors are moving their tokens to self-custody.

More data shows that whale investors are selling their tokens. These investors now hold about 2.98 million tokens, down from October 30th’s high of 3.18 million. Their holdings peaked at 3.38 million tokens last month, a sign that these investors anticipate the price to keep falling.

Chainlink Price Technical Analysis

The daily timeframe chart shows that the Chainlink price has dropped in the past few months. It has dropped from a high of $27.8 in August to its current level of $17.21.

The coin has now formed a bearish pennant, a pattern composed of a vertical line and a symmetrical triangle.

LINK price is also about to form a death cross pattern as the 50-day and 200-day moving averages near their crossover. This cross often leads to more downside.

Therefore, the most likely Chainlink price forecast is bearish, with the next key level to watch at $14.92, its lowest level on October 11. A move below that level will point to more downside, potentially to the key support at $10.87.

READ MORE: Crypto News to Watch this Week: Ripple Swell, Sonic Upgrade, and More