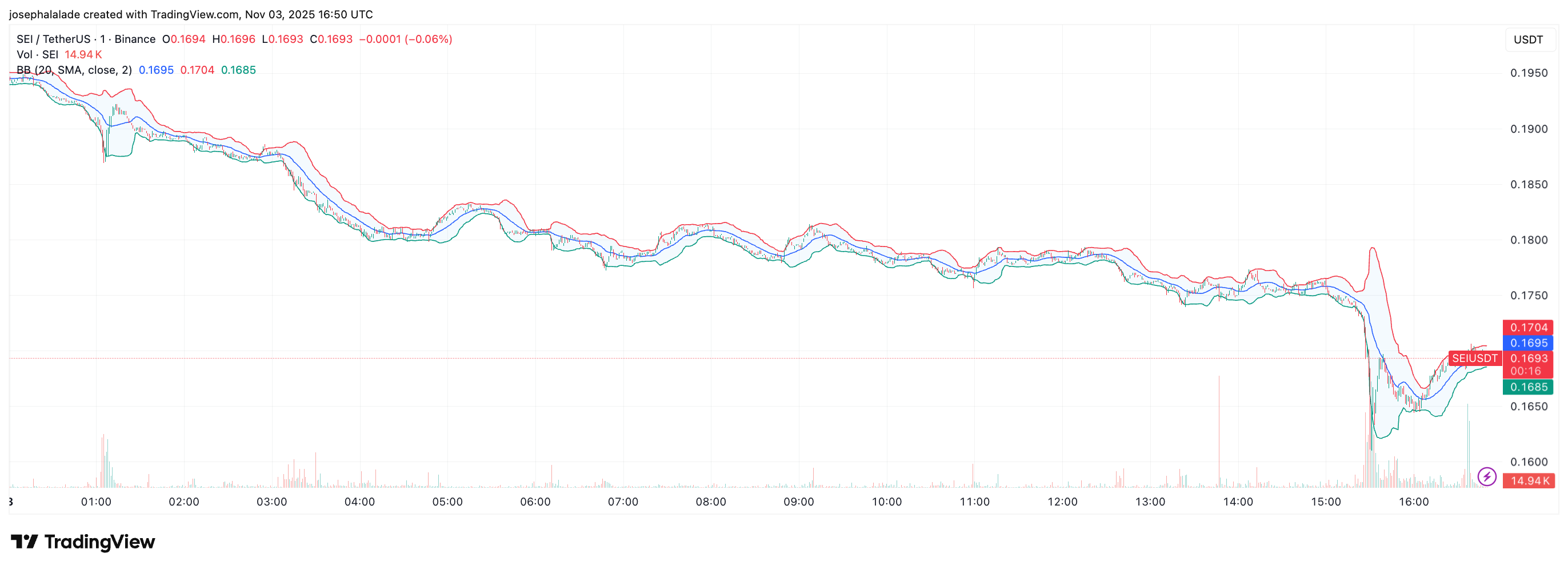

Sei’s much-anticipated Robinhood debut failed to deliver the upside many traders hoped for. After rallying nearly 15% in the days leading up to the October 30 listing, the Layer-1 token slid sharply, falling over 13% in the past 24 hours to around $0.165.

The selloff came despite a strong uptick in trading volume, highlighting a classic case of “buy the rumor, sell the news” behavior.

The Robinhood listing exposed Sei coin to more than 25 million retail users, theoretically boosting accessibility and liquidity. Instead, the token faced a wall of profit-taking.

Meanwhile, the broader market downturn this week only worsened the decline. The Federal Reserve’s late-October warning about delaying rate cuts sparked a wave of risk aversion, wiping nearly $200 billion off the crypto market cap.

READ MORE: XRP Price on Edge Ahead of Ripple Swell Event and Bitwise ETF Launch

Today, Bitcoin fell 4.6%, Ethereum lost 6.1%, and the Fear & Greed Index sank to 36 (Fear), reflecting a clear shift in sentiment.

Sei Price Buckles Under Macro and Technical Stress

The technical setup flipped bearish after the SEI token broke below a key support level at $0.19. The failure triggered algorithmic selling and stop-loss cascades across exchanges.

Technical indicators point to mounting downside momentum, as the RSI dropped to 40.21, while the MACD slipped further into negative territory at –0.0159, confirming short-term weakness.

Chart patterns reinforced the bearish tone. The token’s death cross (a 50-day moving average crossing below the 200-day) confirmed a shift in momentum to the downside.

Traders observed that the structure resembles an inverse cup-and-handle, often signaling deeper corrections. If this trend continues, the next significant support is around $0.15, coinciding with Fibonacci retracement levels.

Analysts Eye “Relief Rally” Before Another Leg Down

Market watchers aren’t optimistic about an immediate rebound. In a post on X, market analyst The Wyckoff Architect warned that Sei might revisit unfilled liquidity zones before another leg lower.

“There’s still some untapped liquidity above,” he wrote. “It makes more sense for price to revisit that area before targeting the final leg lower. This zone would be an ideal spot for the relief rally to end.”

The remark means the SEI price could see a brief bounce toward the $0.18–$0.19 range before resuming its descent.

Moreover, Sei’s fundamentals tell a very different story from its chart. The network continues to record some of the most impressive user metrics among Layer-1s. Data from Token Terminal shows 768,000 daily active users, placing Sei 7th among all blockchains.

Dune Analytics confirms similar momentum, with over 4.5 million daily transactions, 78 million total wallets, and cumulative transactions exceeding 4.36 billion.

READ MORE: Aster Coin Jumps 35% After CZ’s $2M Purchase, Faces Key $1.15 Level