Most of the crypto market is struggling following Bitcoin’s fall below $100,000. However, the Hyperliquid (HYPE) token is going up. It has risen 8.8% in the last 24 hours to $40.77, according to CoinMarketCap.

This increase comes as data shows that large investors are buying a lot of $HYPE tokens. This indicates renewed confidence in the token, even though the overall market remains bearish.

Whale Accumulation Sparks Rebound

On-chain analytics from CryptoQuant reveal a sharp uptick in large order sizes across both spot and futures markets.

One whale reportedly deposited $19.38 million in USDC on Hyperliquid and placed buy orders at $45-$46.05, while another opened a $4.75 million leveraged long position at $42.26.

That influx of capital pushed 24-hour trading volume up 42.8% to $1.12 billion, marking one of HYPE’s most active sessions in weeks.

Historically, this kind of coordinated whale activity tends to precede short-term price breakouts, particularly after extended drawdowns like HYPE’s 15% decline over the past month.

According to Token Terminal, Hyperliquid earned $317.6 million in revenue in the last 90 days, holding over 91% of the market share among decentralized derivative exchanges.

Hyperliquid has maintained 338,000 active users per month, making it the top platform in the derivatives category, ahead of competitors such as GMX, dYdX, and SynFutures.

These numbers show that Hyperliquid continues to lead the decentralized derivatives market, even as the overall market experiences outflows and decreasing liquidity.

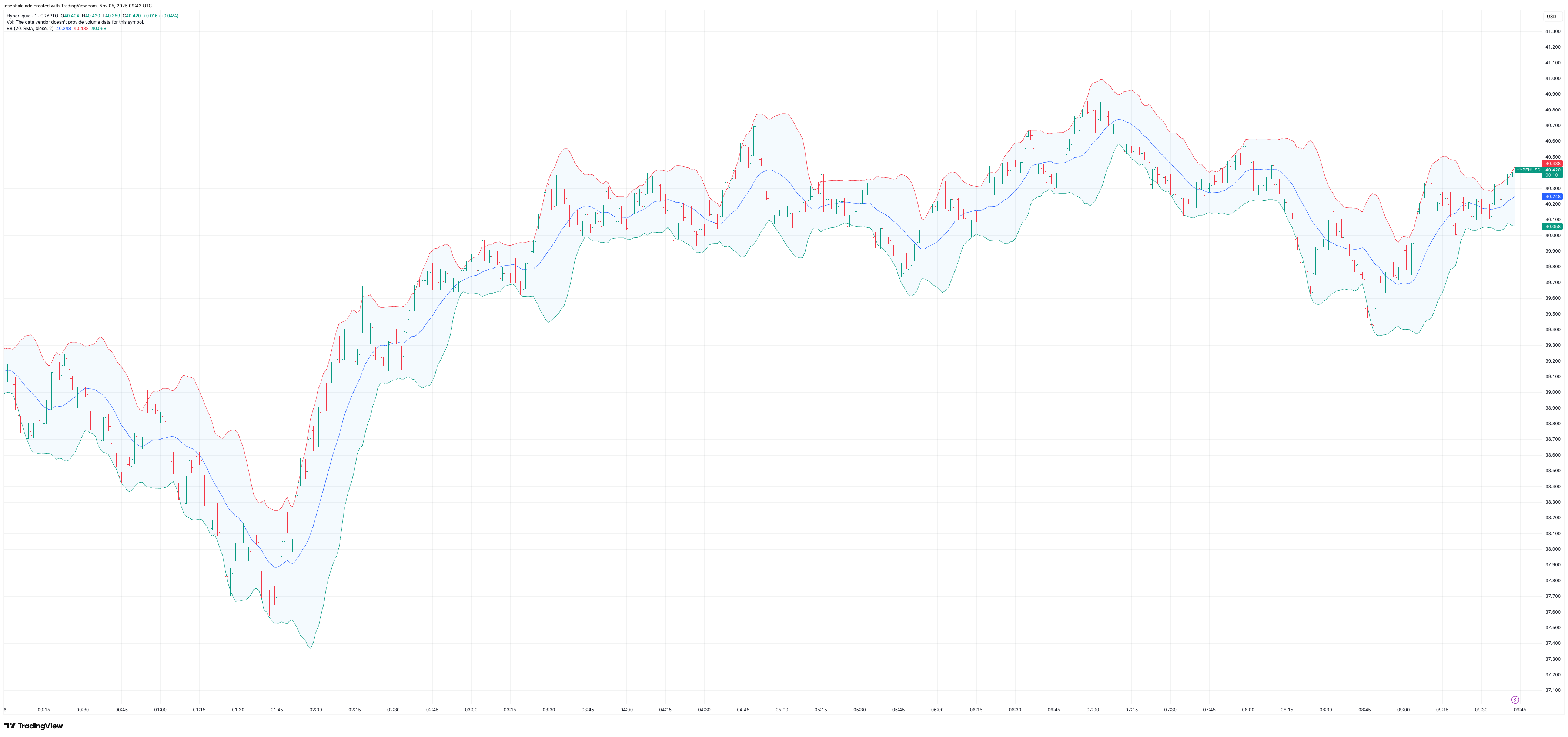

Hyperliquid Price Analysis: Technicals Still Flash Mixed Signals

Despite the surge, technical indicators remain conflicted. TradingView’s daily summary leans “Sell” across most oscillators and moving averages, with the RSI at 45.6, suggesting neutral momentum.

Short-term resistance sits near $44.36, aligning with the 23.6% Fibonacci retracement, while immediate support has formed around $37.6.

That means, while bullish momentum is building, the token still faces macro headwinds and the risk of rejection if volume cools before a confirmed breakout.

Further, analysts caution that this could be a dead-cat bounce amid macro pressure across all risk assets.

Bitcoin’s drop to around $100K dragged total crypto market capitalization down to $3.4 trillion, and if bearish momentum persists, short-term rallies like HYPE’s may fade quickly.

READ MORE: Will the BNB Price Rebound as BSC Transactions and Fees Surge?