The Official Trump Coin (TRUMP) is going up today after confirming a breakout from a long-term falling wedge pattern, a setup often viewed as a bullish reversal.

The $TRUMP price increase coincides with President Donald Trump’s vow to turn the United States into “the Bitcoin superpower,” likely reigniting trader interest in politically linked cryptocurrencies.

At press time, TRUMPUSDT trades near $8.22, up roughly 17% over the past 24 hours, according to data. That surge places it among today’s top gainers, with daily trading volume exceeding $1 billion.

Trump Coin Charts Turn Bullish Again

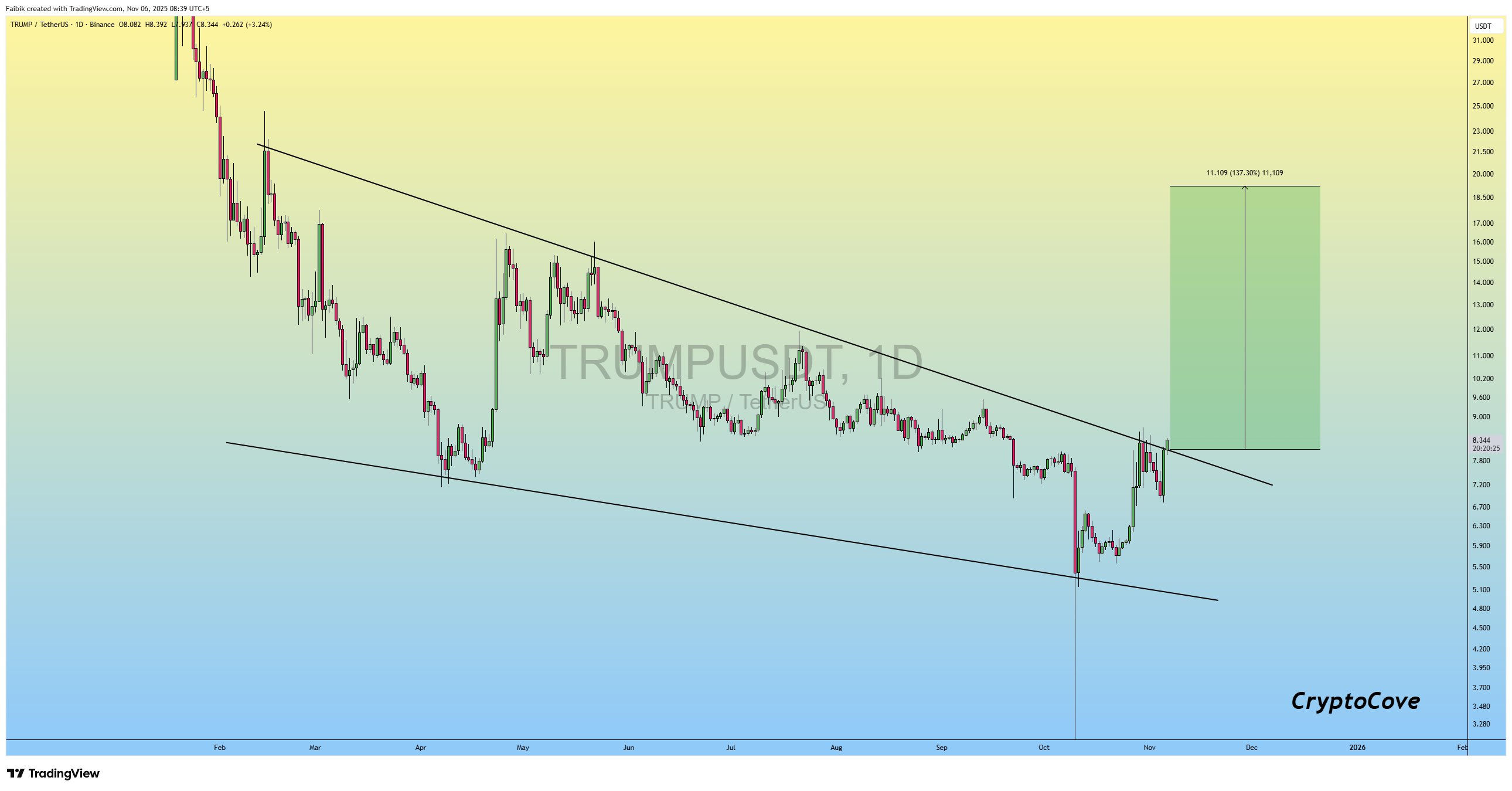

Chartist Captain Faibik, with over 100k followers on X, confirmed the wedge breakout earlier Thursday, showing the TRUMP Coin price closing decisively above trendline resistance that has capped rallies since early 2024.

“$TRUMP falling wedge breakout is confirmed,” he wrote on X, highlighting a potential upside target near $18–$20 if momentum holds.

Volume spikes across Binance and Bybit show renewed speculative activity, while order book data reveal strong bid support between $8.00 and $8.10. Still, resistance clusters near $8.40–$8.50 could slow immediate follow-through.

Donald Trump’s Crypto Comments Add Fuel to the Fire

Hours before the chart breakout, circulating video clips show President Trump promising to make the U.S. “the crypto capital of the world.” He said digital assets “take a lot of pressure off the dollar” and “do a lot of good things.”

Those remarks align with his administration’s plan to establish a strategic Bitcoin reserve and advance the GENIUS Act, legislation that integrates digital assets into U.S. financial policy amid competition with China.

Furthermore, Fight Fight Fight LLC, the issuer behind the Official Trump Coin, is reportedly in talks to acquire Republic.com’s U.S. operations, according to an earlier BanklessTimes report. The rumored deal could connect TRUMP’s ecosystem to mainstream crypto fundraising infrastructure.

Still, traders are wary: entities linked to Trump’s camp reportedly control about 80% of the token’s supply, drawing criticisms about centralization and a sell-off if insiders decide to take profits.

READ MORE: Pudgy Penguins Coin (PENGU) Rebounds 4% From Oversold Zone: What’s Next?