Bitcoin price stabilized above the psychological $100,000 level as investors bought the recent dip. The BTC coin was trading at $103,740, down 18% from its year-to-date high. This article explores why the Bitcoin price may be on the verge of a strong bearish breakout in the near term.

Bitcoin Price Technical Analysis

The daily timeframe chart shows that BTC remains under pressure, having plunged from a high of $126,300 in early October. It has now moved below the important support at $107,390, its lowest level in August. This is a key support because it is the neckline of the double-top pattern at $124,500.

A double-top pattern often signals more downside, as it indicates the bull run has ended.

The coin has moved below the Supertrend indicator, meaning that bears remain in control for now. It is also about to form a death cross pattern, as the spread between the 50-day and 200-day Exponential Moving Averages (EMAs) widens.

READ MORE: ZachXBT Goes After SBF for $40M Transfer to Chinese Authorities

Most importantly, Bitcoin is now forming a bearish flag pattern, consisting of a vertical line and a small rectangle. Therefore, the most likely Bitcoin price forecast is bearish, with the next key level to watch at $94,288, the 61.8% Fibonacci Retracement level.

On the flip side, a move above $107,390 will invalidate the bearish Bitcoin price forecast and signal more upside.

Spot BTC ETFs are Shedding Assets

One potential bearish catalyst for the Bitcoin price is that spot ETFs are shedding assets. Data compiled by SoSovalue shows that these funds shed over $1.2 billion last week, bringing the cumulative inflows to $59.97 billion.

BlackRock’s assets have plunged from over $96 billion earlier this year to $82 billion. The other top Bitcoin ETFs like Fidelity, Grayscale, and Ark have all shed assets in the past few weeks.

Bitcoin price is also struggling amid developments in the spot and futures markets. Bloomberg reported that long-term holders and whales have sold tokens worth over $45 billion in the past few months. It is common for a cryptocurrency to fall when whales and other long-term investors are selling.

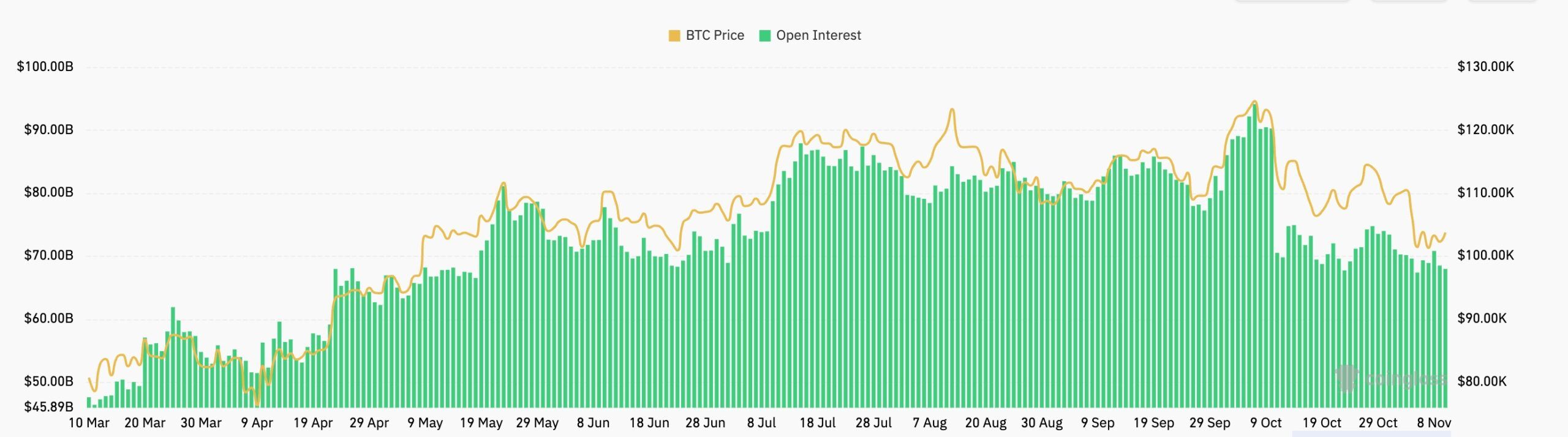

The same trend is happening in the futures market, where open interest has been in a freefall following last month’s liquidation. The futures open interest has plummeted to about $68 billion from the year-to-date high of $94 billion.

Falling futures open interest is a sign that investors are using less leverage and are remaining on the sidelines. Indeed, the Fear and Greed Index has remained in the fear zone recently.

Still, on the positive side, there are signs that open interest is now starting to move upwards.

READ MORE: Cardano Price Forms Risky Patterns as Hoskinson Bets on Leios and Midnight