Uniswap price went parabolic after a major proposal to boost UNI’s value, as whales continued to accumulate. The UNI token jumped to a high of $9.50, its highest level since September 19 and 100% above its lowest level last week.

Uniswap Price Surges After Proposal to Burn UNI

The main catalyst for the ongoing Uniswap price surge is a proposal by its creator, Hayden Adams. In a long post, he said he was proposing burning 100 million UNI tokens from its treasury, representing the protocol fees that would have been burned if fees were incinerated at launch. This is a major move, as these tokens are worth almost $1 billion at current prices.

At the same time, the network will start burning all fees it generates, which is significant, as the network has generated annualized fees of $2.8 billion. Fees generated on Unichain, its layer-2 network, will also be burned.

Hayden has also made some notable proposals, including introducing protocol fee discount auctions, aggregator hooks, moving foundation employees to Labs, and entering into a contractual agreement with Labs to ensure it makes decisions aligned with Uniswap’s interests. This proposal marks one of the biggest changes in the platform’s history.

READ MORE: “It Is an Encrypted Bitcoin” – Nansen Explains the Zcash Price Surge

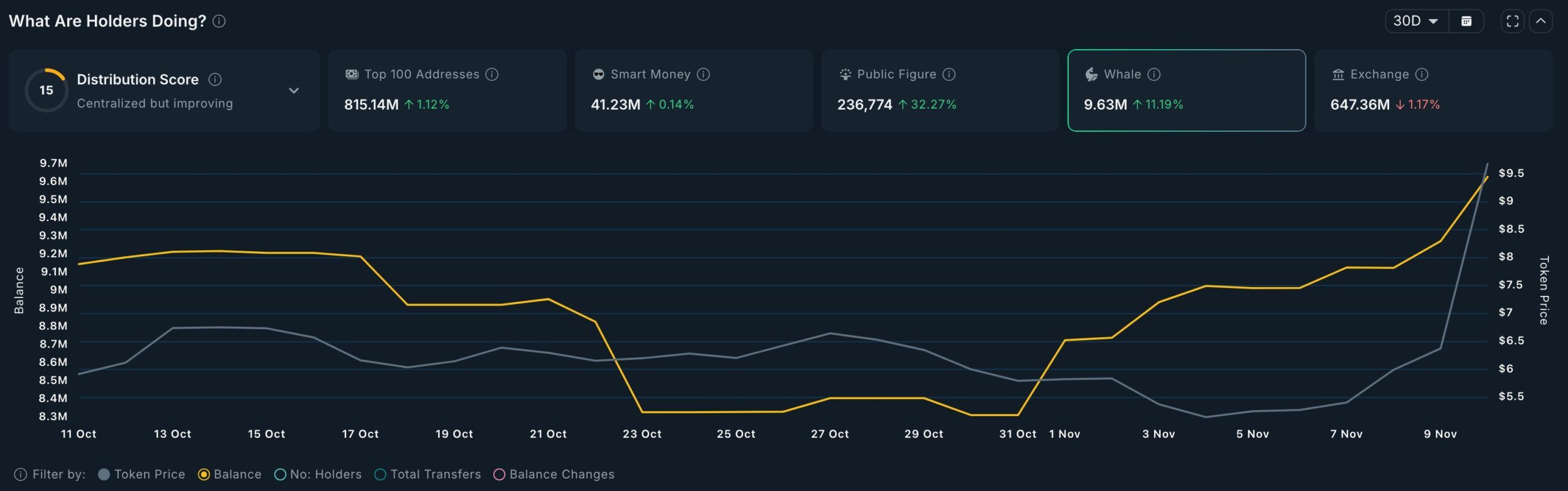

Meanwhile, whale investors continue to accumulate UNI tokens. Data compiled by Nansen shows that these investors now hold 9.63 million tokens, up from the October low of 8.31 million, a sign that they expect it to keep rising.

Public figure investors have also boosted their UNI holdings to 238,774, up from the year-to-date low of less than 20,000. Smart money investors have also continued to add to their positions, while the exchange balances have dropped to 647 million from a high of 655 million on October 18.

UNI Price Technical Analysis

The daily timeframe chart shows that the UNI price has surged from a low of $2.3885 in October to its current level of $9.76. It has moved above all moving averages and the upper side of the descending channel, which connects the highest and lowest swings since August this year.

UNI price has also moved above the Major S/R pivot point at $9.375 and is now nearing the important resistance level at $10. Also, the Relative Strength Index (RSI) has moved above the overbought level at 75.

Therefore, the most likely Uniswap price forecast is bullish, with the next key target being at the ultimate resistance level at $12.5. However, a brief retreat, potentially to the strong pivot reverse point at $7.8125, is possible.

READ MORE: Cardano Price Forms Risky Patterns as Hoskinson Bets on Leios and Midnight