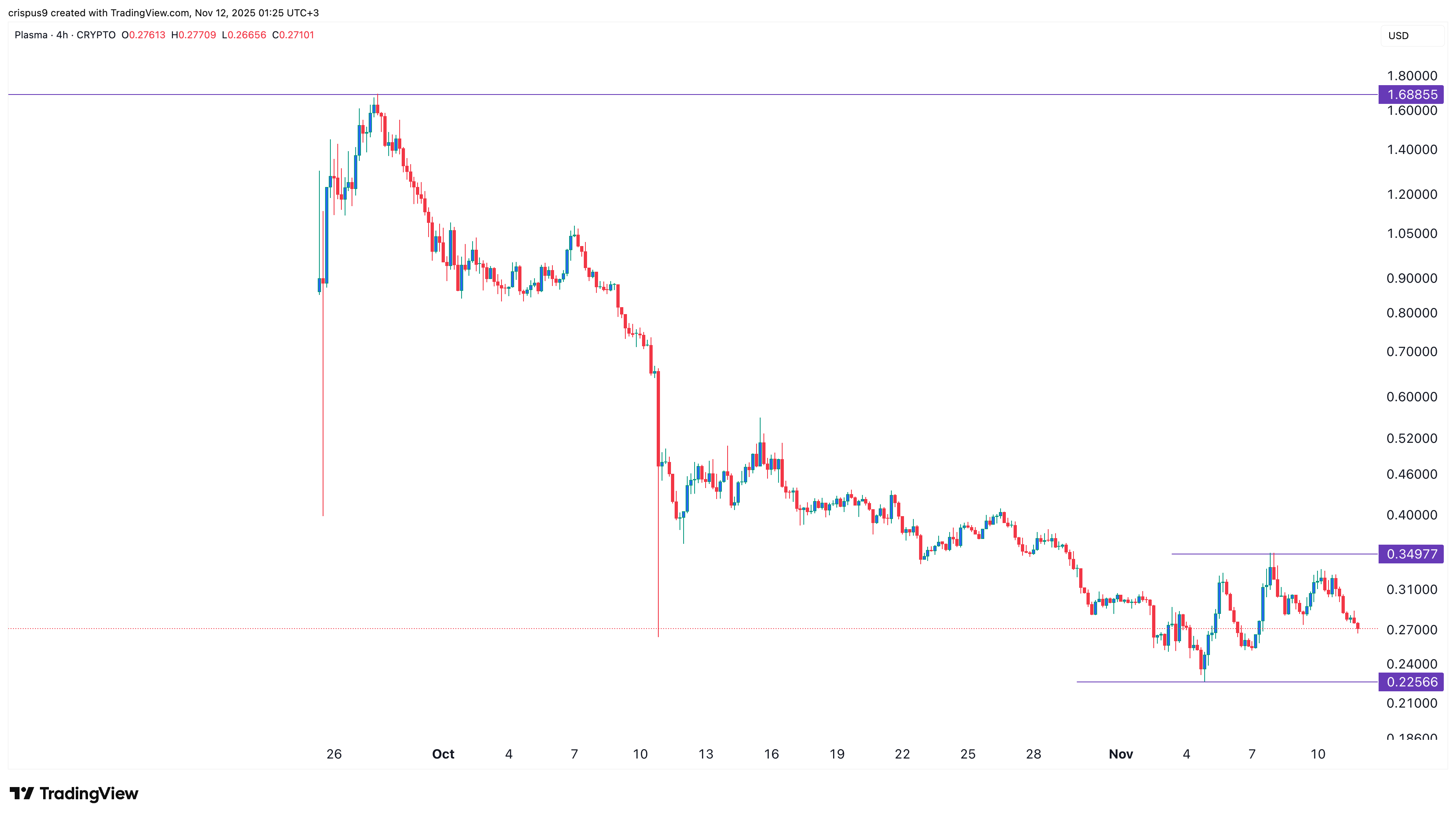

The XPL price continued its freefall this week, now hovering near its all-time low as the crypto market retreats and its key metrics plunge. Plasma token traded at $0.2700 at press time, down from its year-to-date high of $1.68, and its market capitalization fell from nearly $3 billion to $483 million.

Top Plasma Metrics Have Plunged

The ongoing XPL price crash is driven by broader weakness in the crypto market, with Bitcoin and top altcoins either in a correction or a bear market.

At the same time, the network’s ecosystem has imploded in the past few weeks, turning one of the fastest-growing chains into a fallen angel. Data compiled by DeFi Llama shows that the total value locked in its network has been in a freefall, moving from a high of $11.6 billion to $4.87 billion.

Aave’s TVL in the ecosystem has plunged by 47% in the last 30 days to $2.06 billion. Fluid, Veda, Plasma Saving Vaults, and K3 Capital have plunged by over 30% in this period. The only platforms to see a surge in assets in this period are Pendle and Travee Earn, which have gained 100% and 5%.

More data shows that activity on Plasma has continued to fall over the past few weeks, with decentralized exchange (DEX) volume falling to just $39 million in the last 24 hours, down from $133 million on November 7.

READ MORE: Bitcoin Price Prediction: Reasons BTC May Crash Below $90k Soon

Most importantly, the supply of stablecoins on Plasma has been in a freefall in the past few months. This supply has moved to $1.58 billion, down by $1.43 billion in the last seven days. It has plunged from over $6.1 billion from its all-time high.

Most of this drop is driven by Tether (USDT), which has fallen 74% over the last 30 days to $1.27 billion. Ethena USDe has plunged by 64% to $304 million, while USDai is down by 7% to $147 million. These numbers mean that the network’s growth has imploded in the past few weeks.

XPL Price Technical Analysis

The four-hour chart shows that the XPL price has remained on edge in the past few days. It has plunged to a low of $0.2700, down from this month’s high of $0.3497.

Plasma price has moved below all moving averages, a sign that bears remain in control. Its all attempts to rebound have faced substantial resistance in the past few days.

Therefore, the most likely scenario is that the Plasma price continues to plunge, potentially to an all-time low of $0.2256. A move below that level will signal more downside, potentially to the psychological level at $0.200.

READ MORE: XRP Price Prediction and Target Ahead of Ripple ETFs Launch