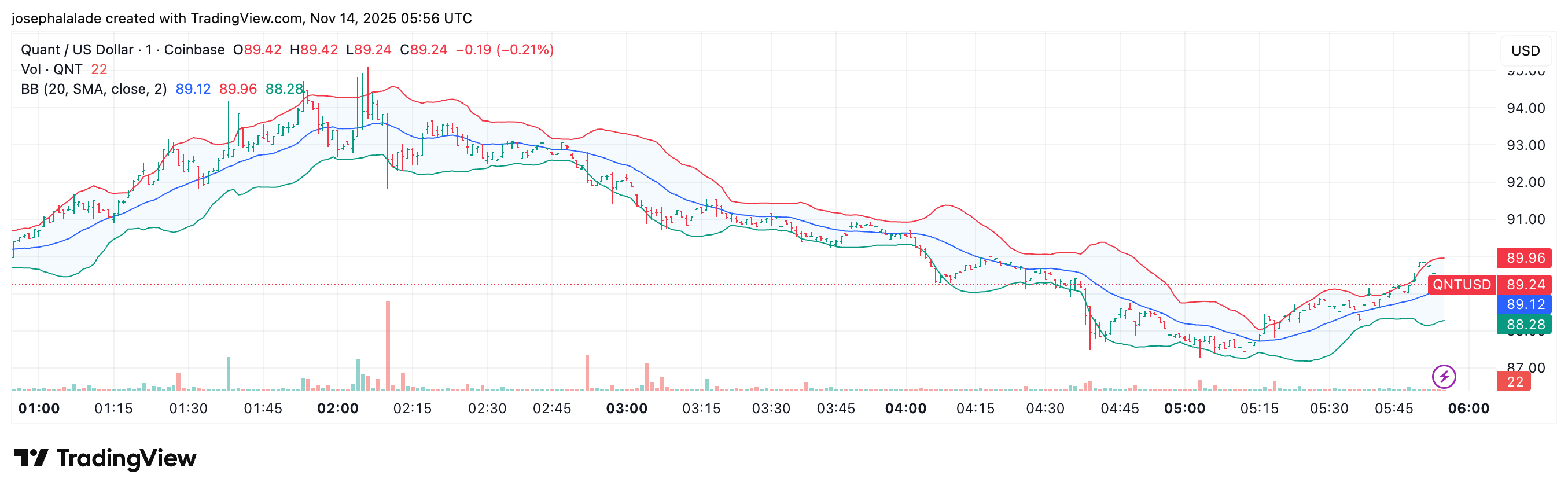

Quant QNT coin climbed more than 3% on Friday, stabilizing around $89 after a volatile overnight range that stretched from $84.7 to above $94. The move helped restore some confidence after several days of muted action, with QNT continuing to trade inside its broader November range.

The bounce looked more like a technical reset than a news-driven rally. Traders described it as a quick reaction after the token slipped into a familiar liquidity pocket and snapped back.

However, volume remained thin and price action stayed close to the 20-day moving average, an area that has repeatedly acted as a pivot throughout the month. Momentum is improving, but the market hasn’t committed to a clear direction.

Market Signals Mixed as QNT Price Tests Its Range

The technical picture still leans cautious. TradingView’s 1-day summary keeps the Quant Coin in Neutral territory, with oscillators evenly balanced and moving averages offering little conviction in either direction.

Earlier in the session, QNT spent hours pressing the lower Bollinger Band before reclaiming ground during the 3% recovery, typical volatility-squeeze behavior rather than a decisive trend shift.

Even with the rebound, the Quant QNT price remains well below the $92–$94 zone that has repeatedly capped upside attempts this month.

Support in the $84–$86 region continues to hold, and each revisit has produced a slightly higher reaction, suggesting sellers are losing strength even as buyers remain patient.

Markets behaving this way are usually waiting for a larger macro or narrative catalyst before choosing direction.

One analyst capturing trader attention this week is World of Charts, who noted that the Quant price broke out of a multi-week base and is approaching a long descending trendline dating back to early summer.

His setup doesn’t promise an immediate breakout, but it does reflect growing pressure within the structure, with a potential move toward $100 if the trendline test holds.

Quant News Turns to the UK’s Tokenized Deposits Pilot

The long-term story supporting Quant crypto also continues to strengthen. The UK’s 2025–2026 tokenized sterling deposits pilot, powered by Quant’s interoperability tech, is quickly becoming the dominant anchor in Quant QNT news.

With major institutions such as HSBC, Barclays, Lloyds, NatWest, Nationwide, and Santander participating, the initiative is being viewed as one of the most ambitious regulated tokenization efforts to date.

If successful, the system will route programmable deposits and cross-ledger transactions through RTGS, the backbone of the UK’s high-value settlement infrastructure.

Crucially, access to this network requires the QNT token for authentication and interoperability, giving the asset direct exposure to a potentially enormous transaction environment.

READ MORE: Top Reasons Behind the Ongoing Crypto Market Crash