The Aave Coin fell more than 16% on November 14, one of its steepest intraday losses this quarter, as risk assets across the crypto market unwound.

Bitcoin slid 6.2%, Ethereum dropped more than 9%, and U.S. Treasuries spiked to multi-month highs, triggering $869 million in outflows from BTC ETFs, the largest in months.

Aave’s newly announced MiCAR regulatory approval in Europe, typically a bullish catalyst, barely made a dent against the broader selloff.

AAVE Price Breaks Key Levels Despite Rising TVL and New MiCAR Approval

The Aave price sank to the $175–$176 range after losing multiple support levels visible on Aave’s TradingView charts. The decline was steady and one-directional: volumes jumped only during breakdowns, and buyers showed little interest in staging a rebound.

Among major DeFi assets, the AAVE Crypto price was among the most brutal hit, currently topping CoinMarketCap’s daily decliners list.

The timing made the move more striking. Activity on the aave app remains historically strong, with borrowing, lending, and stablecoin flows comparable to early-cycle peaks.

Aave TVL sits near $55.7 billion, well above last year’s levels and almost double January’s level, and protocol revenue continues to climb, supported by heavy usage across V2 and V3.

Aave also secured a major regulatory milestone this week. After two years of engagement with Irish authorities, Aave Labs received MiCAR authorization to operate a zero-fee on- and off-ramp for GHO and other stablecoins across the European Economic Area. The approval positions Aave as one of the first DeFi protocols to run a regulated fiat gateway in the EU.

But with the crypto fear-and-greed index plunging to 22/100 and liquidity draining from risk assets, the announcement was quickly overshadowed by macro pressure.

On-Chain Signals Suggest Strength, but Thin Liquidity Accelerated the Drop

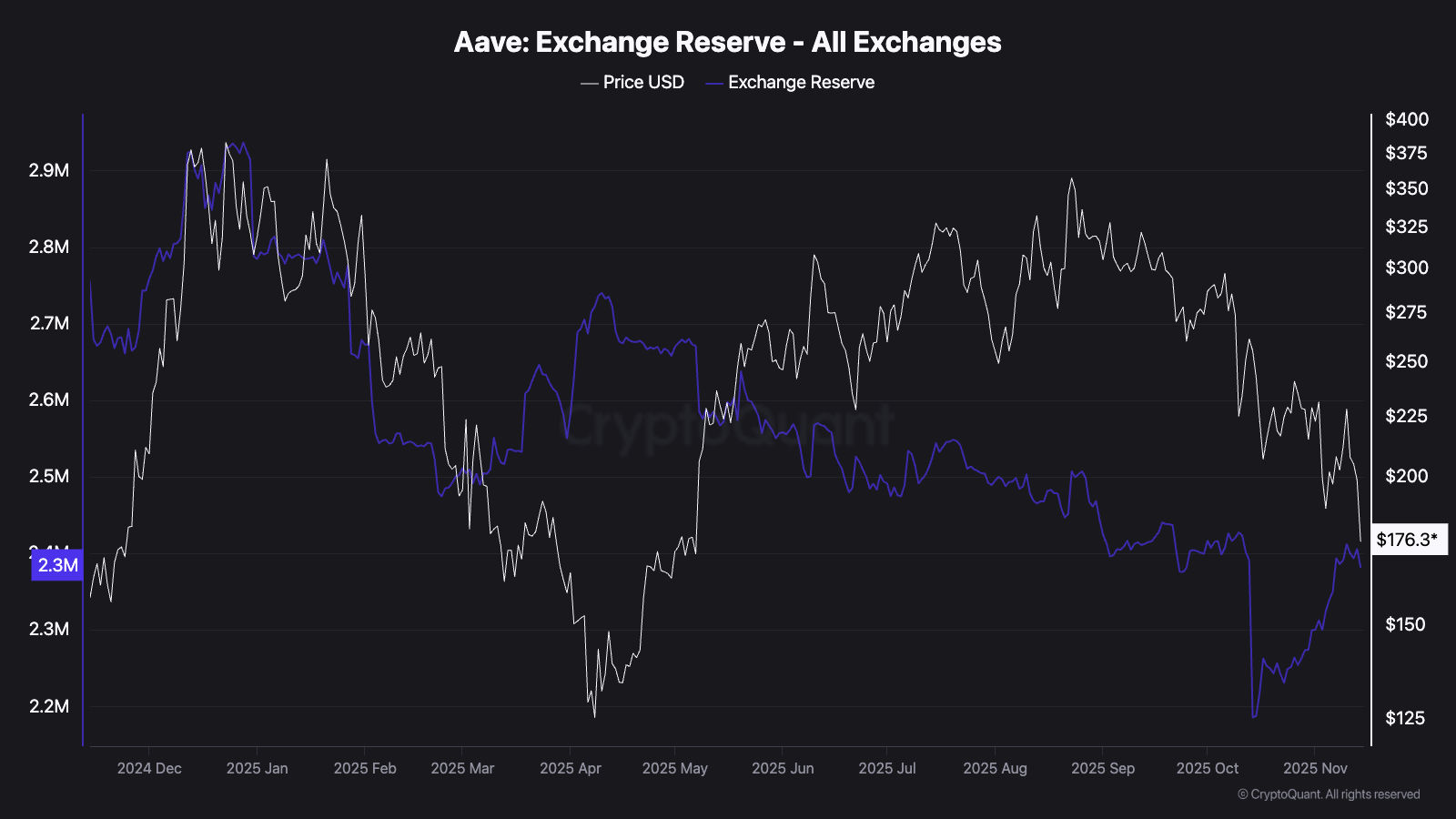

On-chain metrics paint a split picture. Exchange reserves for AAVE continue to fall on CryptoQuant, typically a sign of accumulation, but overall spot liquidity was thin during the selloff, leaving fewer bids to absorb outgoing supply.

Order-book data from major exchanges shows market makers stepping back as volatility rose, allowing even moderate selling to push the AAVE price lower.

Fundamentally, Aave’s performance remains solid. Revenue over the past 30 days stands above $12.7 million; annualized figures hover around $136 million.

Deposits data tracked by Blockworks Research recently climbed past $56 billion, reinforcing Aave’s lead in the lending sector. Still, strong fundamentals rarely counteract a macro-driven liquidation wave, and Thursday was no exception.

Technically, the market remains on the defensive. Indicators across the daily timeframe show AAVE firmly in a strong sell zone, with bearish signals across moving averages, MACD, and momentum. RSI has slipped into the mid-30s, weak, but not yet washed out.

The next key support sits between $165 and $168, with a deeper zone around $155 if Bitcoin volatility continues spilling into DeFi.

READ MORE: Quant Price Eyes $100 as Long-Term Catalyst Strengthens