The crypto market crash accelerated on Friday, with Bitcoin and other tokens plunging. This crash has already cost investors almost $1 trillion, with the market cap of all tokens falling to $3.29 trillion. So, will crypto tokens recover as the Fear and Greed Index nears a buy zone?

Crypto Fear and Greed Index is Nearing the Buy Zone

With the crypto market imploding and liquidations rising, the most common question among participants is whether they will bounce back and resume the previous rally.

Some popular crypto analysts and investors believe that these coins will bounce back. In a CNBC interview, Michael Saylor, whose firm holds the most Bitcoin units, maintained that a recovery will occur. Indeed, Strategy has continued to accumulate over the past few months during this crypto crash.

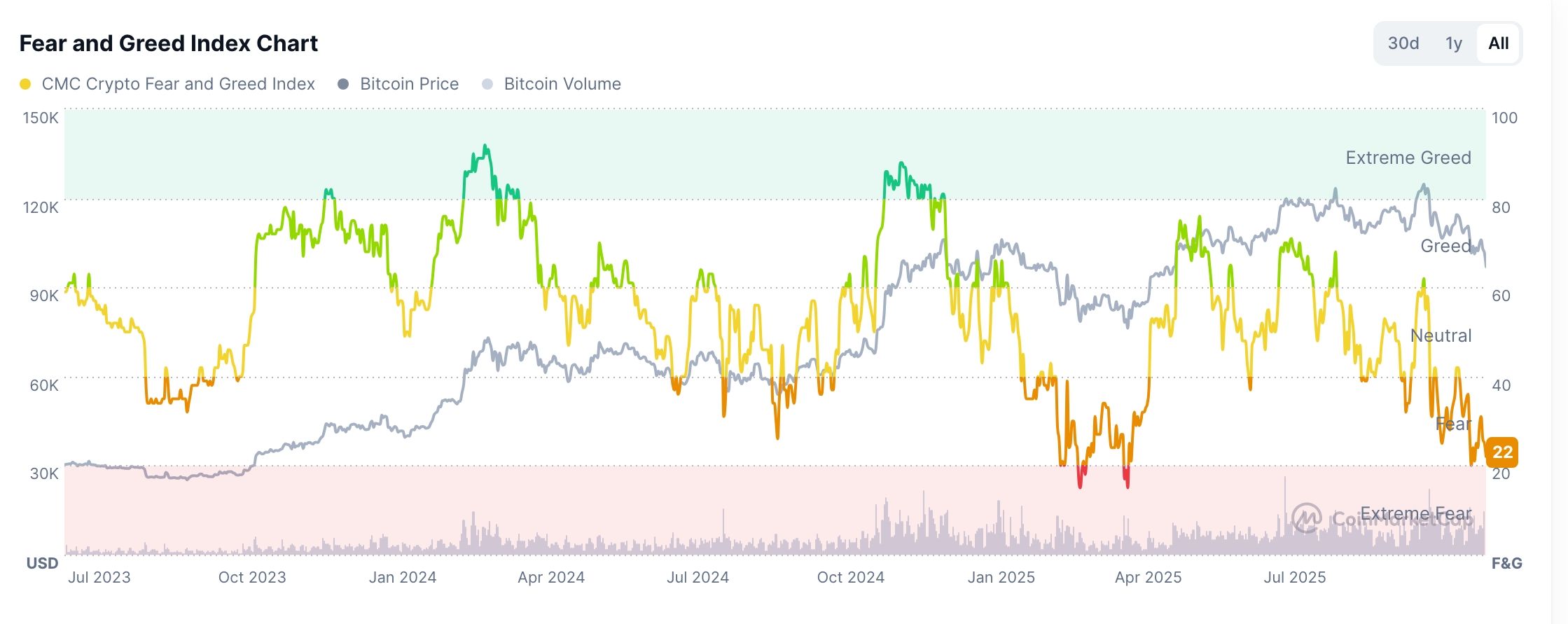

There are signs that the crypto recovery is nearing. One of the most important is the Crypto Fear and Greed Index, a key gauge of market sentiment in the industry. It looks at key factors like market volatility and the overall price action of Bitcoin and other tokens.

The chart below shows that the index has been in a freefall and is now at the fear zone of 22. It has plunged from the year-to-date high of over 80.

In most cases, crypto market rallies start when the index has crashed to the extreme fear zone. For example, it plunged to 19 in April when Donald Trump announced his “reciprocal tariffs”.

Bitcoin’s price dropped to $79,000 on that day, then began a strong rally, reaching a record high less than a month later.

Another good example of this is in August last year, when the index dropped to 26 while Bitcoin traded at $50,000. The coin rebounded and crossed $100,000 a few months later.

The opposite usually happens: Bitcoin typically starts its bear markets when it is in the greed or extreme greed zone. For example, the index jumped to 90 in November when Bitcoin was trading at $97,000. Months later, it was down to $79,000.

READ MORE: Top Reasons Why CORZ Stock Price is in a Freefall

Potential Catalysts for a Crypto Recovery

There are potential catalysts for a crypto recovery. First, history suggests that the Bitcoin price always bounces back after a major crash. In the current case, it has dropped by 23% from its year-high. In the last five years, it has fallen by over 20% from a local top at least six times.

Second, there is a possibility that the Federal Reserve will continue cutting interest rates at upcoming meetings. In most cases, Bitcoin and the crypto market do well when the Fed is cutting interest rates or when officials sound dovish.

Finally, the ongoing crypto market crash may attract dip buyers, as most tokens are now cheap and oversold.

READ MORE: IREN Stock Price Risky Pattern Points to 60% Dive to $20