The crypto market sell-off deepened on Nov. 20 as buyers stayed on the sidelines and a senior Federal Reserve official warned that rate cuts may not come as quickly as markets expect. Total crypto market capitalization slid to roughly the low-$3 trillion range as Bitcoin dropped toward $87,700 and Ethereum slipped below $3,000.

Major altcoins, including Solana, Tron, and Dogecoin, also extended losses, reinforcing the broad risk-off mood across digital assets.

Crypto Crashes After Senior Fed Official Warning

Bitcoin and most altcoins remained in a bear market after Michael Barr, a senior Fed official, warned that the bank should proceed cautiously with interest rate cuts, given that inflation remains above 3%. He said,

“I am concerned that we’re seeing inflation still at around 3% and our target is 2% and we’re committed to getting to that 2% target. So we need to be careful and cautious now about monetary policy, because we want to make sure that we’re achieving both sides of our mandate.”

His comments landed just a day after the Federal Reserve released minutes from its latest meeting, which revealed sharp divisions among policymakers over the timing of rate cuts. The split raised fresh doubts about officials moving forward next month, increasing the likelihood that rates will remain unchanged at the upcoming decision.

READ MORE: XRP Price Prediction: Bitwise Makes Ripple’s Case Ahead of ETF Launch

Odds of the Fed cutting rates in December dropped from 69% to 64% on Polymarket. They dropped further after the US published strong September jobs numbers. In a report, the Bureau of Labor Statistics (BLS) showed that the economy added 119k jobs in September, higher than the median estimate of 50k.

The crypto market tends to do well when the Federal Reserve is cutting interest rates. For example, it surged during the pandemic and then plunged in 2022 as the Fed hiked rates.

Cryptocurrencies also retreated as investors rotated into the surging stock market following robust Nvidia earnings. Some investors are now capitulating, as Bitcoin has given up its yearly gains while the stock market sits at a record high.

Will Crypto Prices Recover?

The ongoing crypto market crash has led to concerns about whether prices will rebound. While the mood is sour, there are reasons to believe that they will bounce back in the next few weeks.

First, while the Fed may not cut rates this time, there is a chance that they will go down sharply next year when Donald Trump replaces Jerome Powell as the Fed chair. He will likely replace him with an official willing to cut interest rates more aggressively.

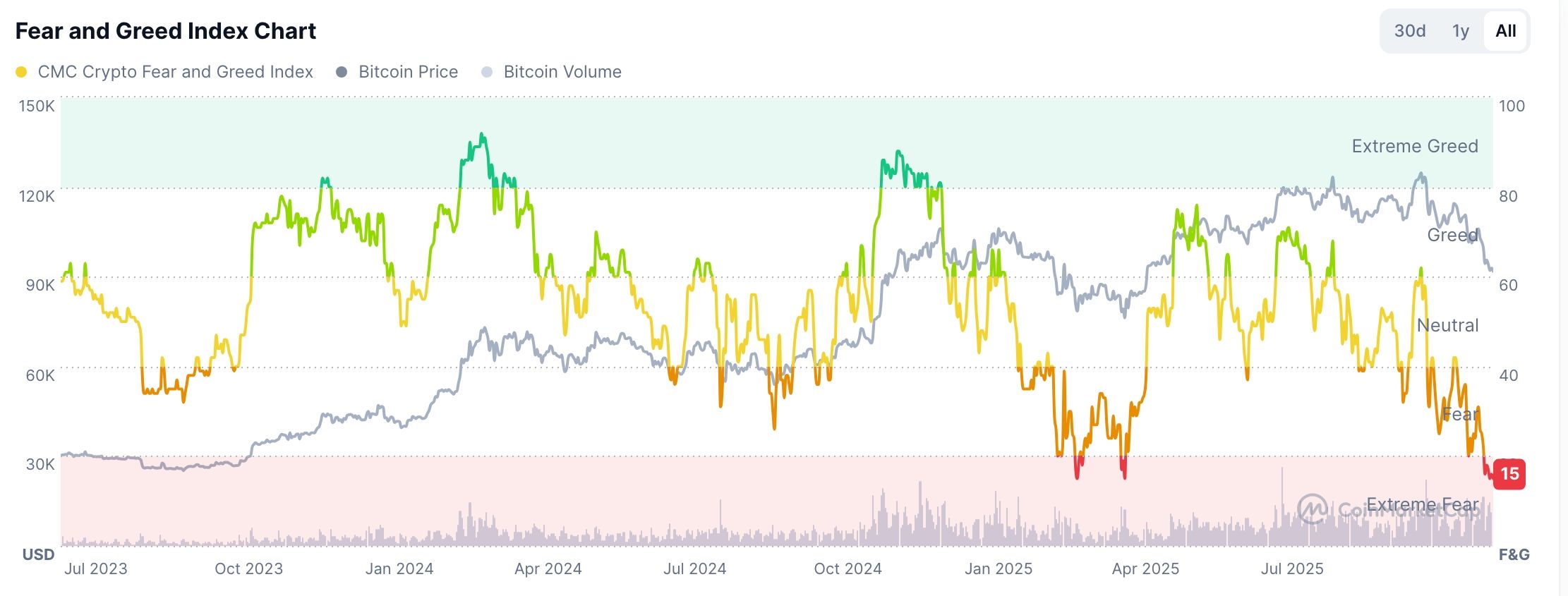

Second, the Crypto Fear and Greed Index has moved to the extreme fear zone. In most cases, bull markets begin when investors are extremely fearful. A good example is what happened in April this year when prices rebounded after the tariff announcement.

Third, history shows that cryptocurrency prices always emerge from their bear markets. For example, the Bitcoin price plunged by over 32% between January and April this year, then bounced back to a record high in March.

Additionally, most coins are bargains and highly oversold. For example, Bitcoin’s Relative Strength Index (RSI) moved to the lowest level since February. Its MVRV indicator has also crashed, meaning that it may attract bargain hunters.

READ MORE: Pi Network Price Prediction: A Coiled Spring Ready to Pounce?