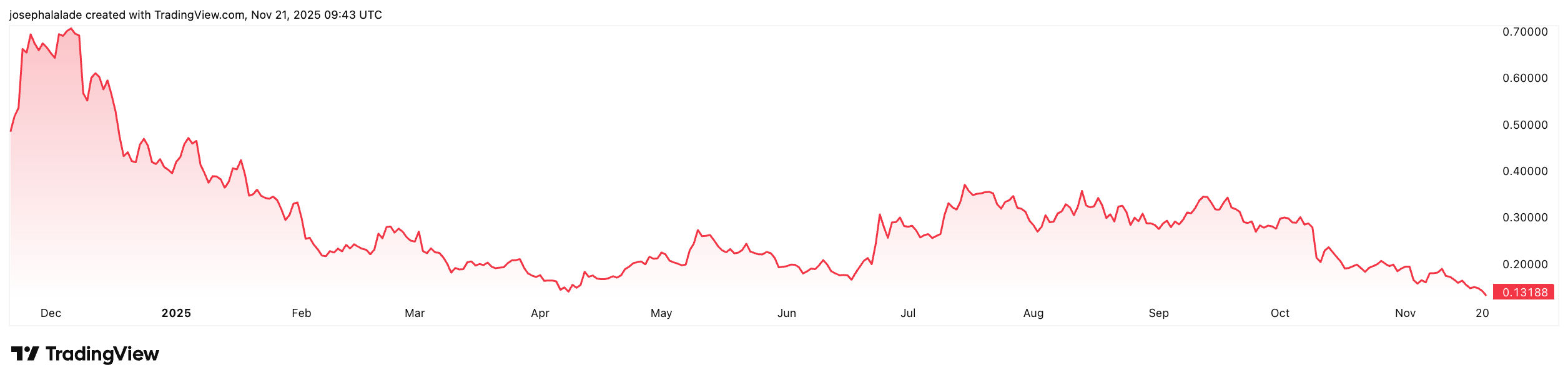

SEI coin is catching heavy downside pressure again, sliding toward the lower end of its multi-month range just as the broader crypto market loses $230 billion in 24 hours. The Sei price is now hovering around $0.133–$0.134, down more than 11% on the day, while Extreme Fear (11) dominates sentiment across altcoins.

SEI Coin Breaks Lower With Altcoins

The sell-off didn’t spare the Sei ecosystem. The total crypto market cap dropped from $2.89T to $2.66T (-8.01%) today, and SEI crypto mirrored that weakness almost perfectly with a 10–11% intraday decline.

TradingView data shows the Sei price has shed 30% in a month and 70% year-on-year, slipping to its lowest range since early Q1.

The slide isn’t entirely project-specific. Liquidity rotated out of altcoins all week, and SEI coin was dragged alongside sector-wide fear. Still, the move pushed the token directly into a technical zone that traders seem to have been watching for months.

Analysts Call the $0.15–$0.13 Range a Historical Bid Zone

Despite the bleeding, two widely followed analysts argue that SEI may be nearing an exhaustion point.

Michaël van de Poppe, a well-known technical analyst with over 800k followers on X, describes SEI coin as “starting to look better,” noting the token has returned to a weekly support band that acted as the base for previous expansions. “Uptrends start slow,” he said, adding that fundamentals on Sei remain strong enough to justify a rebound once selling pressure cools.

Ali Charts takes an even firmer stance: $0.15–$0.13 is the ideal accumulation zone before what he believes could be a 400% rally toward $0.70.

His chart shows a long-term descending trendline compressing directly into the current price area, a structure that historically precedes violent breakouts once sellers are depleted.

Meanwhile, on the fundamentals side, Sei’s network activity remains abnormally high for a token this deep in a correction. Token Terminal data shows 686K daily active users, placing Sei 8th among all Layer-1 blockchains, ahead of Ethereum and Bitcoin in user count.

READ MORE: Chainlink (LINK) Sits on a Knife’s Edge as Charts Tighten