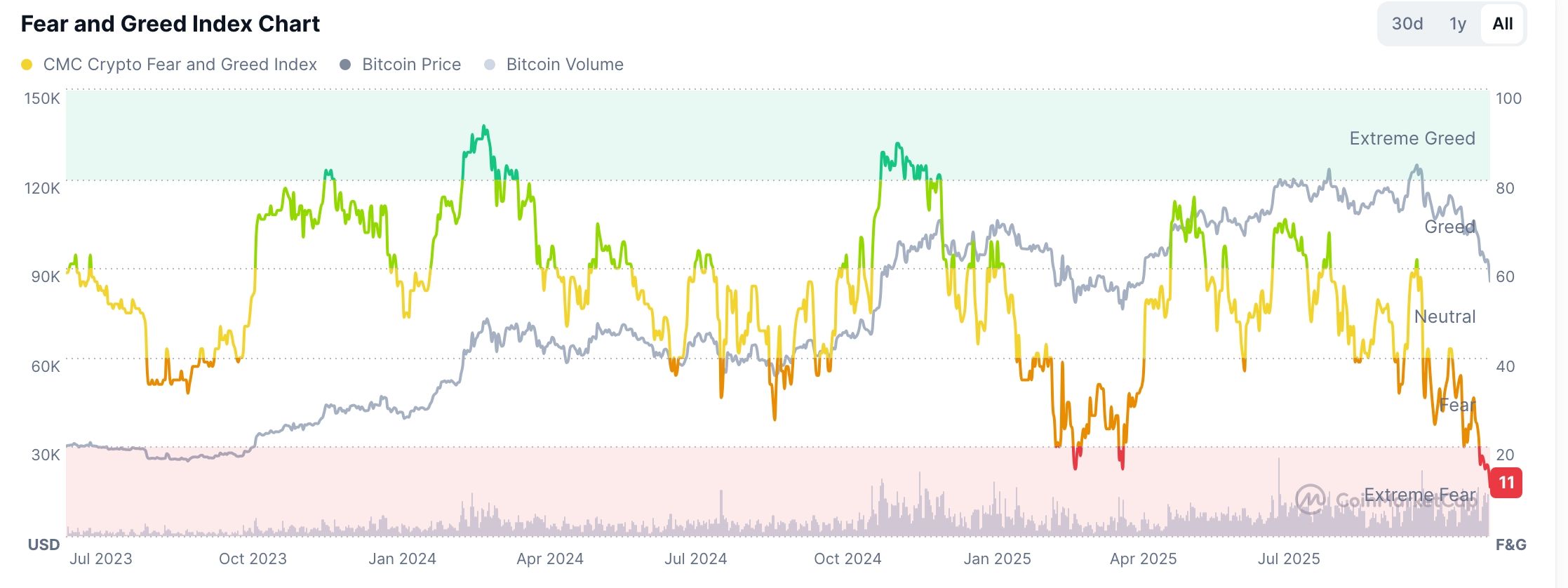

The cryptocurrency market has experienced a significant crash this month, wiping out over $1.2 trillion in value. Bitcoin tested a crucial support level at $80,000, and the Crypto Fear and Greed Index has fallen into the extreme fear zone. This article examines when the cryptocurrency market may recover to its previous levels.

Crypto to Go Back Up Amid Oversold Conditions

History suggests that crypto markets emerge from bear market conditions when they reach oversold territory. This happens as investors start to buy the dip, hoping for a rebound.

Fortunately, there are signs that the crypto industry has moved into the oversold level. The Relative Strength Index (RSI) of the Crypto Market Cap, excluding stablecoins, has tumbled to the oversold level of 25. Similarly, the two lines of the Stochastic Oscillator have moved to extreme oversold levels.

Crypto Fear and Greed Index to be in Extreme Fear Zone

History shows that most crypto bull runs start when there is extreme fear and panic in the market. Data shows the Crypto Fear and Greed Index has slumped to the extreme fear zone of 11, suggesting a rebound could be near.

A good example of this is what happened in March and April of this year when the Bitcoin price plunged. This crash coincided with the Crypto Fear and Greed Index moving to the extreme fear zone. After a short while, Bitcoin rebounded and hit a record high in May.

Therefore, while it is too early to predict, there is a likelihood of a new crypto bull run.

Potential Bitcoin Price Double-Bottom Pattern

The ongoing crypto crash began when Bitcoin formed a double top. This is a common pattern characterized by two peaks and a neckline. In this case, the two peaks were at $124,215, and the neckline was at $107,125.

Similarly, a crypto rebound occurs when Bitcoin forms a double bottom, resembling the letter W. This pattern occurs when the coin forms an initial low, rebounds, and then retreats to that initial low. Such a pattern will likely lead to a new Bitcoin rebound.

Macro Catalysts

On top of this, there will need to be potential macro catalysts for the new crypto bull run to start. One possible catalyst pushing Bitcoin and other cryptocurrencies higher is a clear signal that the Federal Reserve will cut interest rates.

Other potential catalysts include Donald Trump’s $2,000 stimulus deal, the Supreme Court’s ruling against Donald Trump’s tariffs, and a return to quantitative easing.

READ MORE: XRP Price Reaches Pivotal Support as ETFs Near a $500M Milestone