A crypto rally is happening today, November 24, with Bitcoin and many altcoins being in the green. Bitcoin price jumped from last week’s low of $80,000 to $87,000, while the market cap of all tokens crossed the $3 trillion.

Why the Crypto Rally is Happening

There are at least four main reasons for the crypto rally today. First, Bitcoin and most altcoins have been in a freefall over the past few weeks, reaching extreme oversold levels.

As a result, crypto prices often rebound when this happens, as investors buy the dip. This buying occurs as these traders go bargain-hunting.

Second, data from the futures market shows that open interest rose by 2% over the last 24 hours to $128 billion. This jump coincided with the 24-hour liquidation of $207 million, down by about 2% from a day earlier. This liquidation figure is much lower than last week’s peak of over $2 billion.

READ MORE: HBAR Price Sits at a Key Support as Hedera ETF Inflows Rise, But Risks Remain

A combination of rising open interest and falling liquidations always leads to higher prices. Still, daily open interest remains significantly lower than where it was a few months ago.

Third, crypto prices are rising as the odds of a Federal Reserve rate cut rise. These odds have risen to 70% on Polymarket, up from last week’s low of 50%. The odds soared after a statement from New York Fed’s John Williams, who said

“I view monetary policy as being modestly restrictive, although somewhat less so than before our recent actions. Therefore, I still see room for further adjustment in the near term to the target range for the federal funds rate to move the stance of policy closer to the range of neutral.”

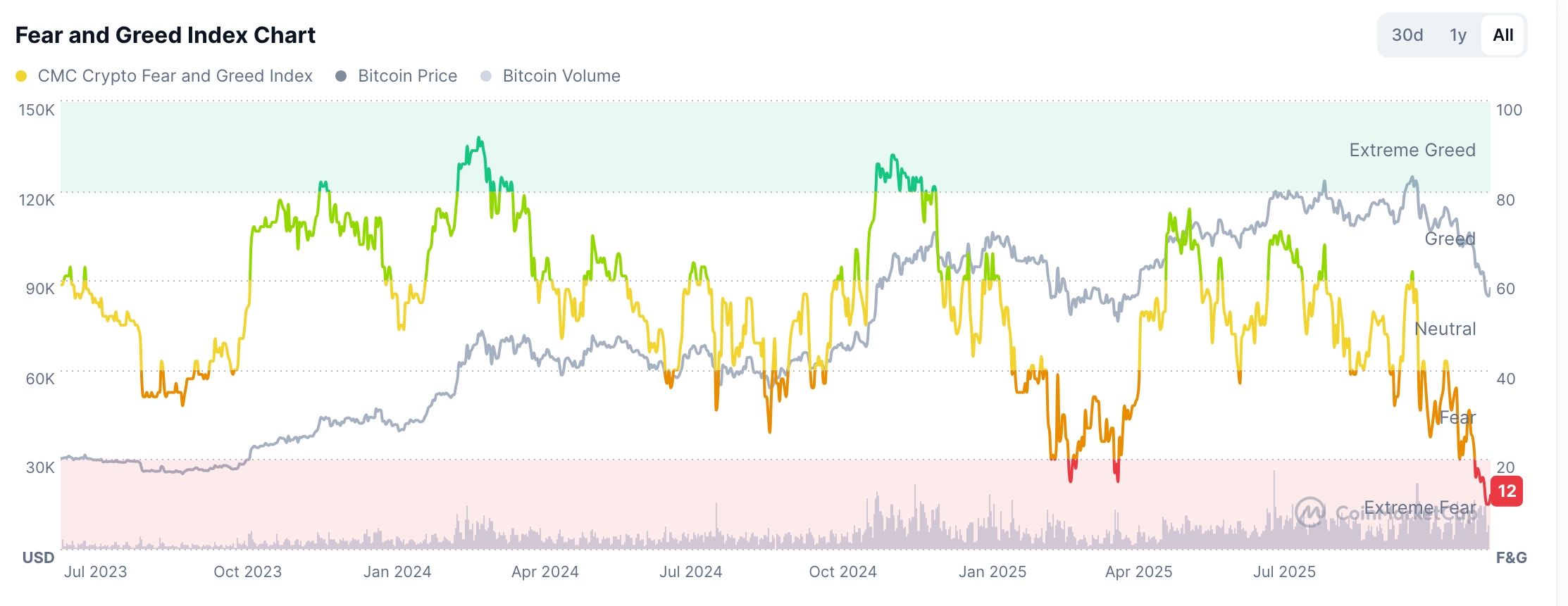

Additionally, cryptocurrencies are rising as the Fear and Greed Index moves to the red zone. It has plunged to a low of 11, its lowest level this year. It is common for the crypto industry to rebound when the index moves to the fear zone.

Dead Cat Bounce?

Still, there is a risk that the ongoing crypto market rally is a dead-cat bounce (DCB). A DCB is a situation in which an asset that is falling bounces back briefly before resuming the uptrend. It is also known as a bull trap.

The fact that this is a bull trap calls for caution as Bitcoin and altcoins remain in a bear market. They all remain below their short- and long-term moving averages, a sign that selling pressure persists.

As we wrote on Friday, the crypto recovery is likely to occur when Bitcoin forms a double bottom. It has already formed the first part of this pattern, meaning that it may retest it soon.

READ MORE: Why is Pi Network Price Suddenly Beating Bitcoin and Ethereum?