The crypto market rally continued for the second consecutive day as investors embraced a risk-on sentiment amid hopes of Federal Reserve interest rate cuts. Bitcoin price retested the important resistance at $89,000, while the market capitalization rose to $3.02 trillion.

Crypto Market Rally Happens as Open Interest Rises

One of the top reasons why the crypto market rally is happening is that futures open interest rose modestly. Data compiled by CoinGlass shows that the open interest rose by 2.9% in the last 24 hours to over $129 billion.

Rising interest rates are bullish because they signal higher liquidity and investor demand. Bitcoin’s open interest rose to $60 billion from the weekend low of $58 billion. Ethereum’s interest soared to $36 billion, while Solana’s figure stood at over $7 billion.

Still, open interest remains well below last month’s high of over $250 billion. In a CNBC interview on Monday, Anthony Pompliano, a top crypto expert, argued that the drop in open interest was a good thing for the industry, as it had brought it back to normal levels.

READ MORE: Monad Price to Crash After the Airdrop and Mainnet Launch: Here’s Why

Federal Reserve Interest Rate Cut Odds Jump

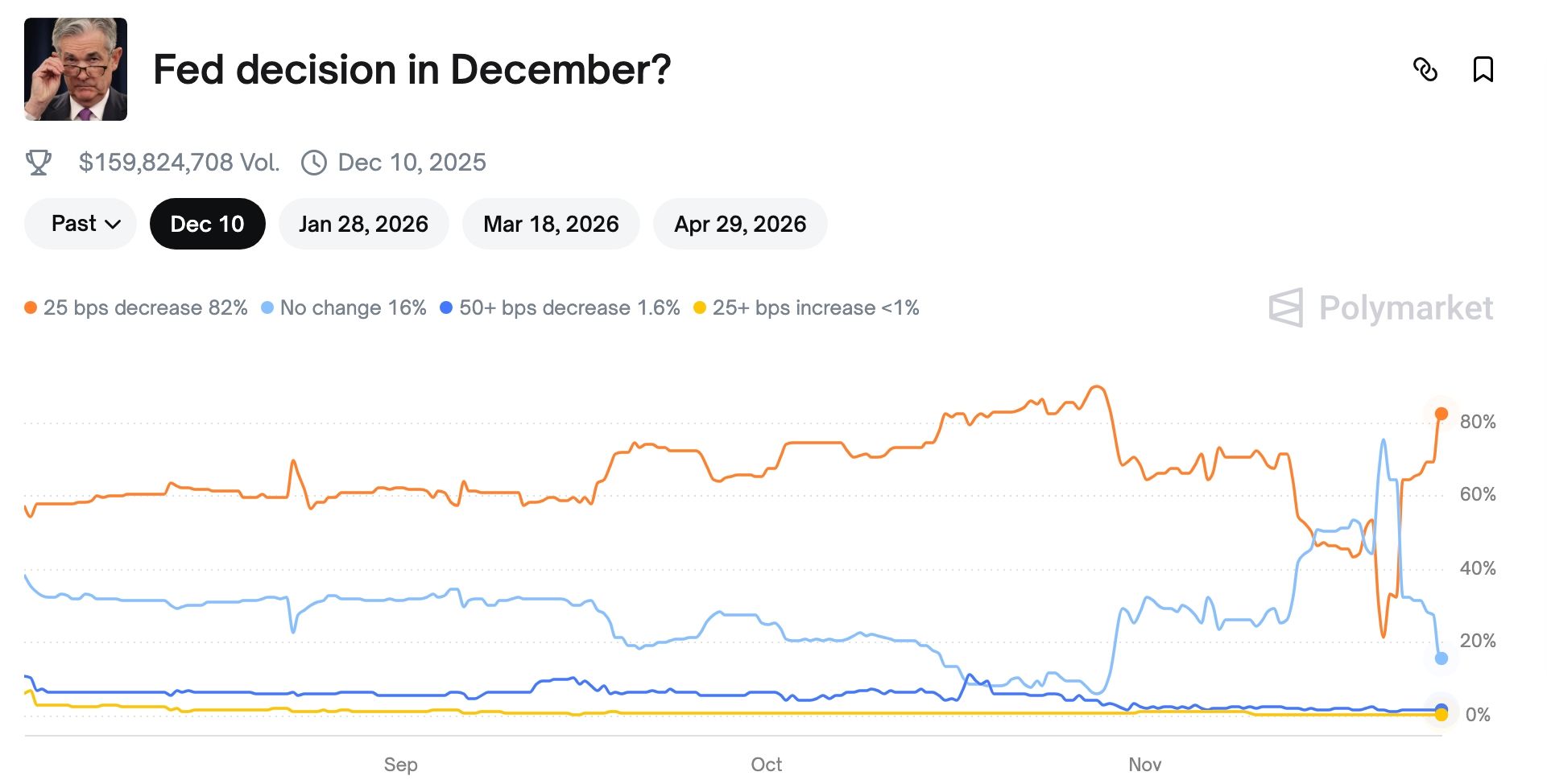

The crypto market rally is underway as the odds of the Federal Reserve cutting interest rates in December have risen. A Polymarket poll with over $160 million in assets boosted the odds of a cut to 83%. Another poll brought the odds of three cuts this year to 83%.

These odds jumped after multiple statements from Fed officials like Christopher Waller, Mary Daly, and John Williams. These officials have pointed to the labor market, which has remained under pressure in the past few months.

US Stock Market Rally

The crypto market is also rallying amid ongoing developments in the stock market. The main benchmark indices, including the Nasdaq 100 and S&P 500, soared by over 1% on Monday.

Top technology companies like Micron, Broadcom, AMD, and Sandisk were among the top gainers on Monday. The same trend occurred across other indices, such as the Hang Seng, KOSPI, and Nifty 50. It is common for the crypto market to do well when stocks are rising.

Other Reasons for the Crypto Bull Run

The ongoing crypto market rally is being fueled by a sharp drop in the Crypto Fear and Greed Index. Historically, Bitcoin and most altcoins tend to rebound strongly when the index plunges.

The rally also follows strong investor interest in the newly launched XRP ETFs, which pulled in over $164 million in inflows on their first day, a clear signal of growing demand for altcoin-backed ETFs.

At the same time, Upbit, South Korea’s largest crypto exchange, has announced plans to go public in New York, joining Coinbase, Bullish, and Gemini on the list of publicly listed crypto firms.

There’s a real possibility that the recent crypto market crash has run its course. Still, traders should be cautious, as the current upswing could also be a dead-cat bounce or a classic bull trap.

READ MORE: When Will Crypto Go Back Up?