A crypto rally that started on Monday is continuing, with Bitcoin price soaring to over $91,500, adding over $10,000 from its lowest level this month. Other top altcoins, such as Merlin Chain (MERL), Dash, Kaspa (KAS), and Flare, were among the top gainers.

The crypto market rally pushed the valuation of all tokens upwards to $3.12 trillion. This means that the crypto industry has added over $300 billion in value in the past few days.

Crypto Rally Mirrored the Performance in Stocks

One of the main catalysts for the ongoing crypto market rally is this week’s stock market gains. The Dow Jones Index rose by 315 on Wednesday, while the S&P 500 and the Nasdaq 100 Indices rose by 50 and 200 points, respectively.

These indices have been in a strong uptrend over the past few days, erasing losses from last week after Nvidia’s strong earnings.

Analysts are highly optimistic that the stock market will continue rising in the near term. In a statement, JP Morgan Private Bank predicted that the S&P 500 Index will jump by 20% by 2028. It expects it to jump to $7,600 next year, joining other Wall Street banks such as Deutsche Bank and Morgan Stanley that have issued bullish estimates.

READ MORE: Dogecoin Price Prediction: Sits at Key Level Ahead of Bitwise DOGE ETF Launch

Analysts point to the ongoing AI boom in the United States and to the Federal Reserve’s expected rate cuts next year. Also, corporate earnings have been strong, a trend that will continue in the near term.

Therefore, stocks have triggered gains in the crypto market by triggering a risk-on sentiment.

Federal Reserve Interest Rate Cuts

The crypto rally today is happening as the odds of a Federal Reserve rate cut rise. Data compiled by Polymarket shows that the odds have jumped to 83%, well above this month’s low of below 40%.

The likelihood of an interest rate cut increased after the Federal Reserve released its Beige Book on Wednesday. The report indicated that economic activity has slowed in recent weeks, and employment has declined during this time. Additionally, a report from ADP released on Tuesday showed that the economy lost jobs last week.

Crypto prices and other risky assets tend to rise when the bank cuts interest rates or officials turn dovish.

Crypto Market Rally Boosted by Dip Buying

Meanwhile, the crypto market rally is happening as investors continue buying the dip after the recent crash. It is common for investors to buy the dip whenever cryptocurrencies drop sharply.

More data shows that futures open interest continued to rise this week. It started the week at around $120 billion, a figure that has now moved to over $135 billion.

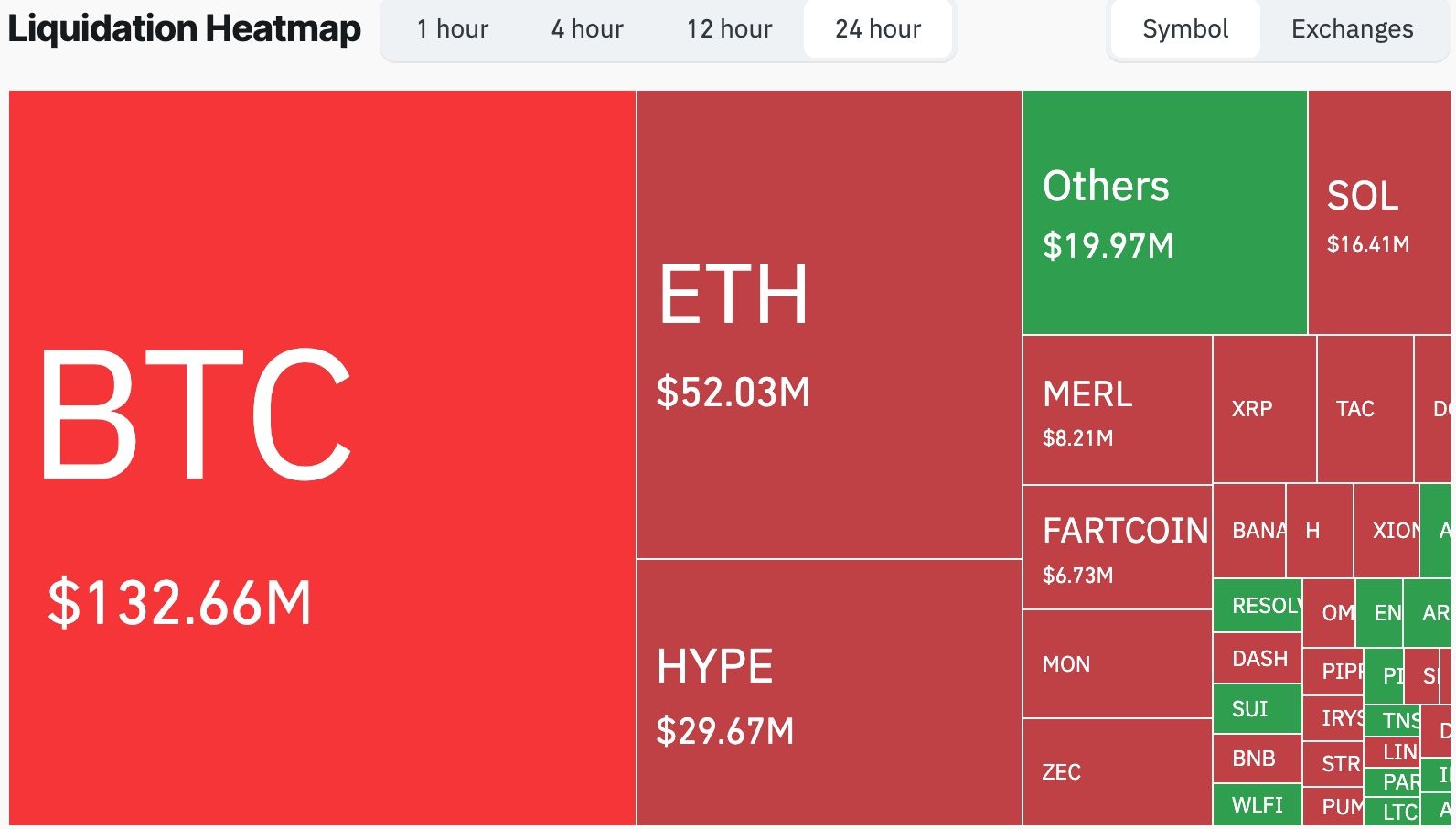

This is a sign that investors are deploying more cash to the market. At the same time, short sellers have continued to be liquidated, with the 24-hour figure rising 6% to $323 billion. Bitcoin short liquidations jumped to $132 billion, while Ethereum and HYPE positions worth $52 billion and $26 million were liquidated.

The crypto market recovery may continue into the Thanksgiving weekend, now that Bitcoin price has moved above the important $90,000 resistance level.

READ MORE: Top Reasons Why the MSTR Stock Price is Ripe for a Rebound