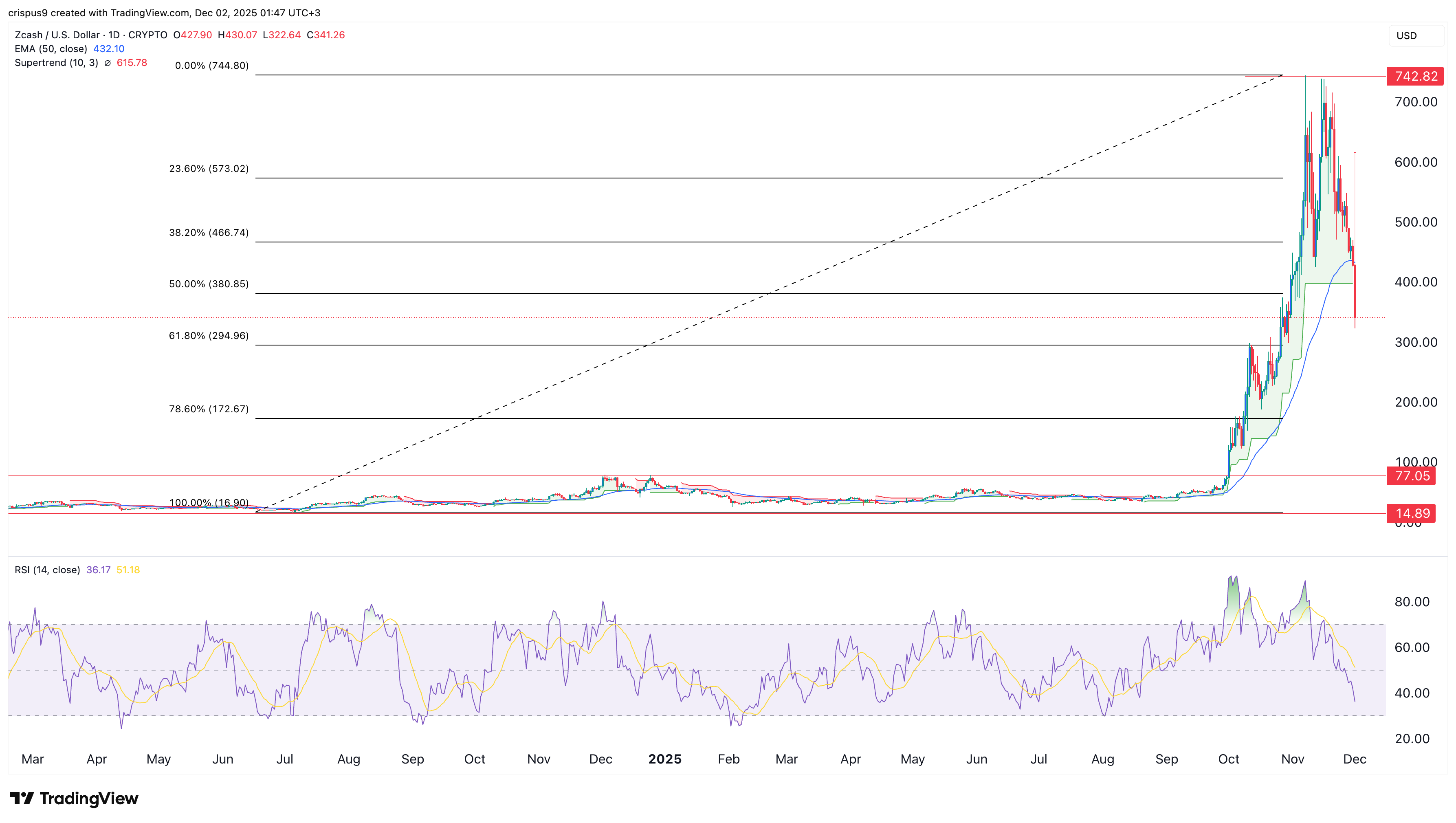

Zcash price has been in a freefall over the past few weeks, moving from a high of $742 to $340 today, and technicals suggest it has more downside to go in the near term. It has already crashed by over 50% from its year-to-date high and is now hovering near its October 3 low.

Zcash Price Technical Analysis Points to a Crash

The daily timeframe chart shows that the ZEC price has plunged in the past few months, moving from the year-to-date high of $742 to the current $343. It has moved below the 50% Fibonacci Retracement level at $380.

The token formed a double-top pattern at $740 and a neckline at $430, its lowest level on November 11. More data shows the Supertrend indicator is about to turn red, a move that will confirm the bearish outlook.

Top oscillators like the Relative Strength Index and the MACD have continued to move lower. Most importantly, there are signs that the coin has entered the markdown stage of Wyckoff Theory, characterized by panic selling among investors.

READ MORE: Will the Crashing MSTR Stock Price Rise or Crash in December?

Therefore, the most likely scenario is that it continues to fall, with the next key support level to watch being the psychological $294 level, the 61.8% Fibonacci Retracement. Dropping below that level will confirm the bearish outlook and point to a further crash to $250.

On the other hand, a move above the important resistance level at $466, which coincides with the 38.2% Fibonacci Retracement level, will point to more gains.

ZEC Price Lacks a Bullish Catalyst

The Zcash price has coincided with the ongoing crypto market plunge that has affected Bitcoin and most altcoins. Bitcoin has already dropped from the year-to-date high of $126,200 to $84,000 today. Similarly, Ethereum has dropped below the key support level at $2,800.

It has also dropped because it lacks an additional catalyst that may push its price higher in the near term. For one, Grayscale has already filed to convert the ZEC Trust into a spot ETF.

While this conversion will likely be achieved, it is unlikely to have a major impact on the token, as it has already been priced in. Also, the data show that ETF inflows are not correlated with a token’s price. A good example is Solana, which has dropped despite robust inflows into spot SOL ETFs.

Still, there is a likelihood that the Zcash price will go through a dead-cat bounce, a situation where an asset rises briefly during its downtrend. A strong bullish breakout will be confirmed if it moves above the $500 resistance level.

READ MORE: Is the IREN Stock Price a Bargain or at Risk of a Deeper Dive?