The crypto market rally that started on Tuesday continued today, Dec. 3, as Bitcoin and most altcoins surged. Bitcoin price soared to $92,000, while the market capitalization of all tokens hit $3.1 trillion.

Why the Crypto Market Rally is Happening

Pudgy Penguins was one of the top gainers, jumping 25% in a high-volume environment. Some of the other gainers included tokens such as Sui, PUMP, SPX6900, Chainlink, Ethena, and Pepe. All these tokens rose by more than 12% over the last 24 hours.

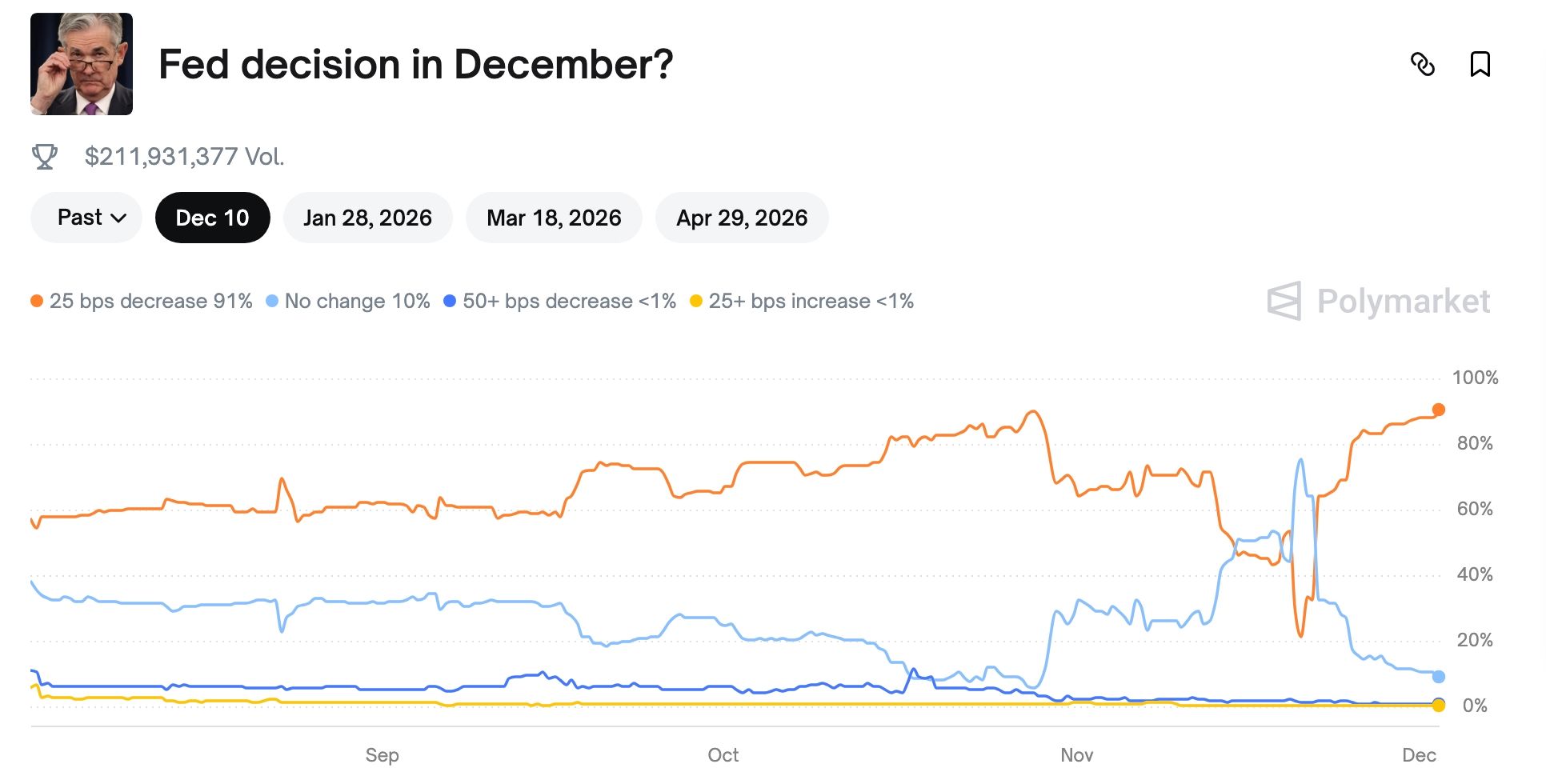

The crypto market rally occurred as investors embraced a risk-on sentiment amid rising odds of Federal Reserve interest rate cuts. These odds have now soared to over 90% on Polymarket and Kalshi, two of the most popular prediction platforms.

The rising odds of rate cuts also explain why the stock market gained momentum, with the top indices like the Dow Jones Industrial Average and the S&P 500 rising by 0.75%. Also, the CBOE VIX Index, the most common fear gauge on Wall Street, dropped by over 5% on Tuesday.

Additionally, there are signs of more liquidity in the market after the Federal Reserve pumped over $13 billion into the banking sector on the same day it ended its quantitative tightening program. QT is a process that helped the Fed shrink its balance sheet by over $2 trillion in the past two years.

READ MORE: Top Catalysts that May Boost the Pi Network Price in December

Further, the ongoing crypto market rally is driven by traders deploying leverage, with data showing that futures open interest rose by 4.5% to over $130 billion from Monday’s $120 billion. Daily liquidations plunged by 35% to $393 million.

The other reasons for the crypto market rally are Vanguard’s embrace of the industry and news that Trump has made his decision on the next Federal Reserve Chair.

Is this the Start of a Crypto Bull Run?

With the crypto market roaring back, there are now questions on whether this is the start of a new bull run or whether the recent crash has ended.

It is still too early to predict whether the bull run is starting now, as this rebound could be part of a dead-cat bounce, also known as a bull trap. A dead-cat bounce is a brief price rebound followed by a resumption of the downward trend. It can happen within a day or weeks.

Also, it is hard to predict as Bitcoin and most altcoins remain below the 50-day and 100-day Exponential Moving Averages (EMA) and the Supertrend indicator.

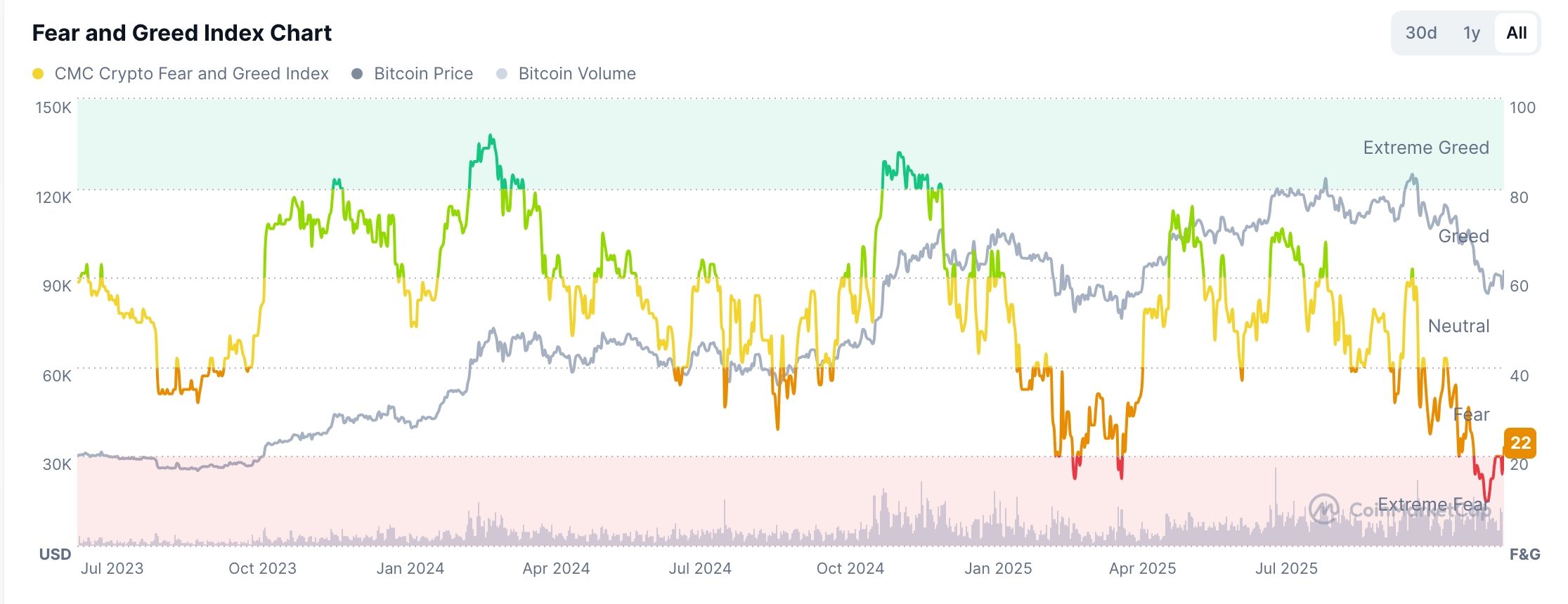

Still, the best indicator that this could be the start of the Santa Claus rally is that the Fear and Greed Index dropped to the extreme fear zone of 8 and has now rebounded to 22. In most cases, bull markets usually start when this index drops to the extreme fear zone.

Whether this is the start of a new crypto bull run will be confirmed by Bitcoin’s price rising above the important resistance level at $100,000. It will also be confirmed when it moves above the important 50-day and 200-day Exponential Moving Averages (EMA).

READ MORE: Will the Crashing MSTR Stock Price Rise or Crash in December?