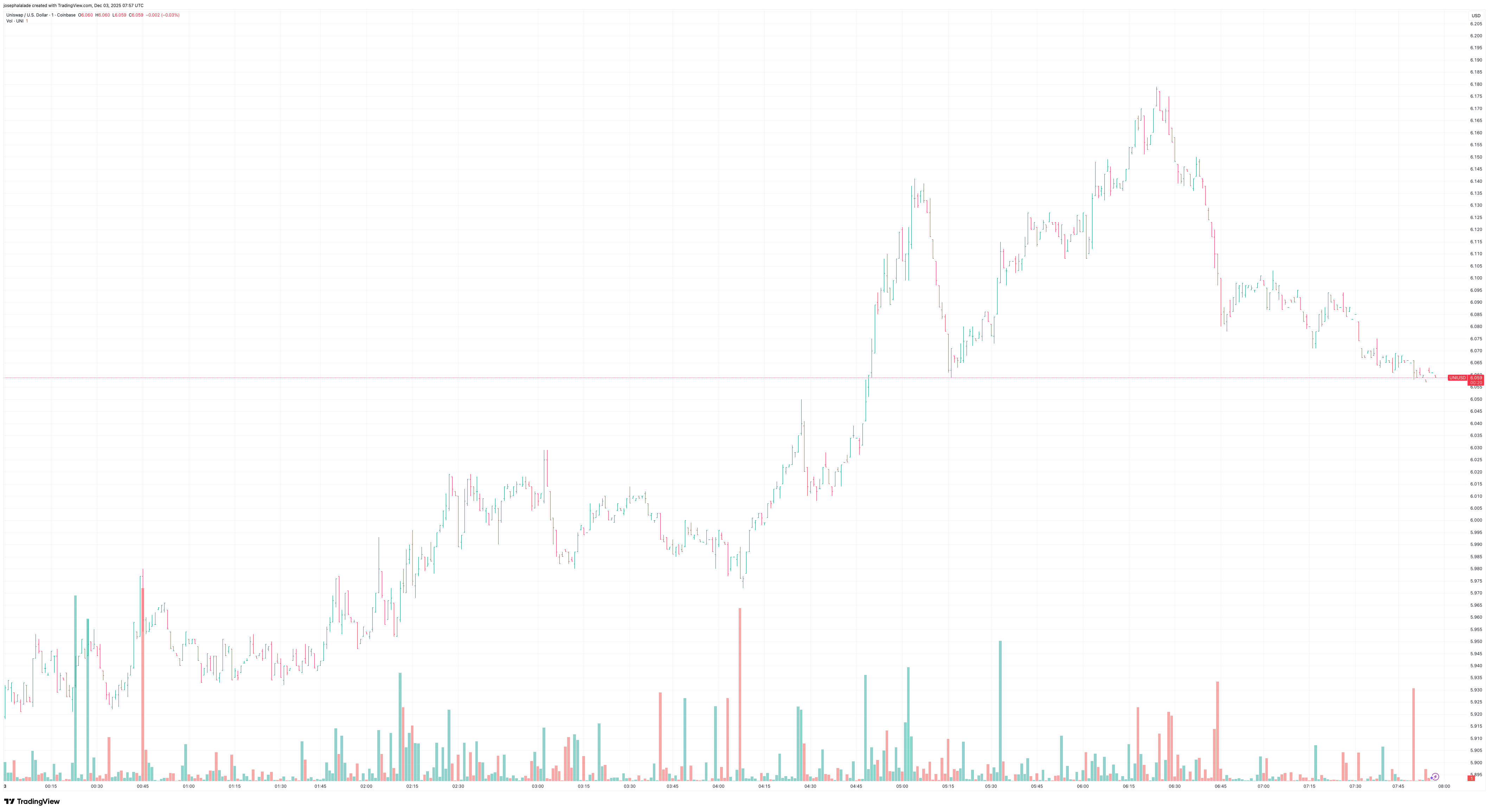

Uniswap price has rebounded to around $6.14 after jumping more than 11% in the past 24 hours, recovering from multi-week lows and testing a crucial trend inflection zone. Traders are watching closely as whale accumulation and shifting supply mechanics inject new momentum into the Uniswap token despite a broader bearish MA structure.

Whales bought 0.8 million UNI, roughly $4.98 million, over 48 hours leading into December 2. This accumulation coincided with a Wyckoff-style volume exhaustion pattern, indicating that selling pressure may be fading.

Large players typically accumulate during late-stage downtrends, and previous spikes in whale demand have preceded sharp recoveries, including UNI’s roughly 80% rally in Q3 2025. If the top 100 holders, now sitting on 8.98 million UNI, continue adding, it would reinforce the bullish base forming beneath the Uniswap coin.

READ MORE: Chainlink Price Nears Breakout Zone After GLNK ETF Surge

Supply dynamics are tightening as well. The November 11 “UNIfication” proposal activated protocol fees, directing 0.05% of swap fees to UNI burns. A retroactive 100 million-token burn, about 12.6% of the circulating supply, was also approved.

If volumes remain high, analysts expect fee-driven burns to remove around $38 million in tokens per month. Traders are closely watching the implementation timing; any delay could soften near-term sentiment around Uniswap’s price.

Ecosystem activity is also accelerating. Uniswap v4 hooks surpassed $10 billion in cumulative volume, with Kyber’s FairFlow, Sorella’s Angstrom, and Aegis leading usage.

Uniswap Price Technical Outlook

UNI trades near $6.14, supported by a 30% rise in volume to $383 million and a market cap of $3.87 billion. Despite the bounce, the trend remains tilted bearish on higher timeframes.

TradingView’s 1-day technical indicators reveal 12 sell signals compared to 4 buy signals, with 11 of the sells derived from moving averages. UNI is trading below the 30-day, 50-day, and 100-day EMAs, all of which provide significant resistance.

The oscillators present a more balanced view: the RSI is around 46 (neutral), momentum has turned slightly positive, yet MACD is still in a sell position, indicating limited trend strength.

The next critical test lies in the $6.50–$6.75 resistance zone, where several EMAs intersect. A daily close above this range could pave the way toward $7.20.

If UNI fails to maintain above $6, it may drop to $5.60 and possibly retest $5.20. For confirmation, both increased volume and a clear break above the 30-day EMA are necessary; invalidation happens if Uniswap price dips back below $5.60.

READ MORE: Crypto Market Rally Today: Is This the Start of a Bull Run?