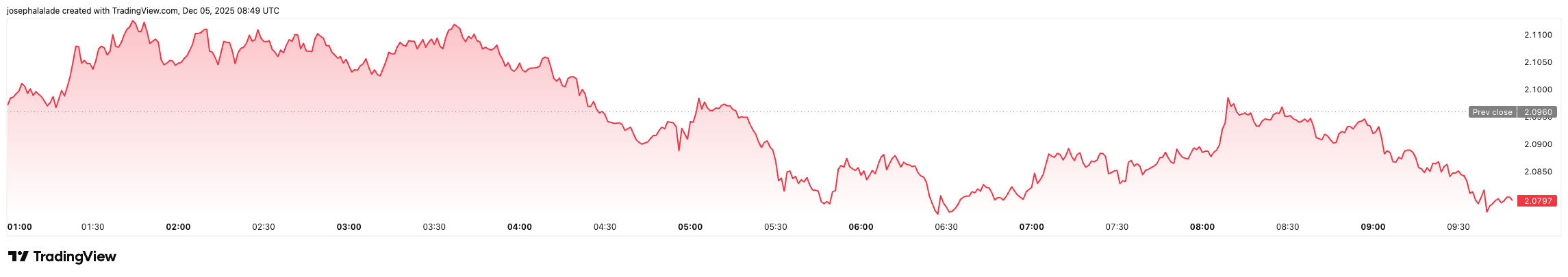

XRP price fell another 4% to around $2.08 amid market-wide risk-off sentiment. The token is now down 31% over the past two months, performing far worse than Bitcoin (BTC) or the broader market, but new data from Santiment suggests crowd fear may be nearing levels that triggered previous rebounds.

Social data shows XRP sentiment has flipped to its most bearish since October. Santiment notes the last time panic reached this zone, on November 21, the token rallied 22% in three days before profit-taking ended the move. That contrast, extreme fear followed by a sharp rebound, is now back on the chart.

Santiment’s visual shows repeated cycles of sentiment flipping between “Greed Zone” and “Fear Zone.” Recent circles sit firmly in fear territory.

The pattern matters because historically, greed-driven spikes have stalled, while panic has preceded short-lived rebounds. The data suggests traders are again positioned on the defensive, even as capital quietly enters through ETFs.

XRP Price Analysis: Key Levels to Watch in the Near Term

XRP is trading near $2.08, with a declining 24-hour change and soft volume of around $3.25B. The chart shows the price moving down the Bollinger band, testing the lower band near $2.02, a short-term support level. A move below this band risks opening further downside, while the upper Bollinger level around $2.25 forms resistance.

Momentum indicators lean cautiously. The MACD histogram remains below zero, and the signal line shows no strong reversal yet. Stochastic RSI is flat near oversold territory, hinting at exhausted sellers, but without a confirmed trigger.

The 20-period EMA sits above the price at roughly $2.13, acting as a nearby ceiling. A breakout above this level would be the first sign that sentiment is shifting.

Traders are watching two nearby levels. A recovery above the $2.13–$2.25 area would be the first sign of strength and could push XRP back toward the mid-Bollinger range, easing some of the fear on the chart.

On the other hand, a move below $2.02 would confirm weakness and signal a continuation of the downtrend.

Meanwhile, spot XRP ETFs continued to attract flows, with $50.27 million on December 3 and another $12.84 million on December 4. The combined net assets now sit near $881 million as per Sosovalue, but XRP price action has diverged sharply from inflows, suggesting capital is entering while sellers still dominate.

READ MORE: Polygon Price Sinks as Transactions and Active Addresses Surge