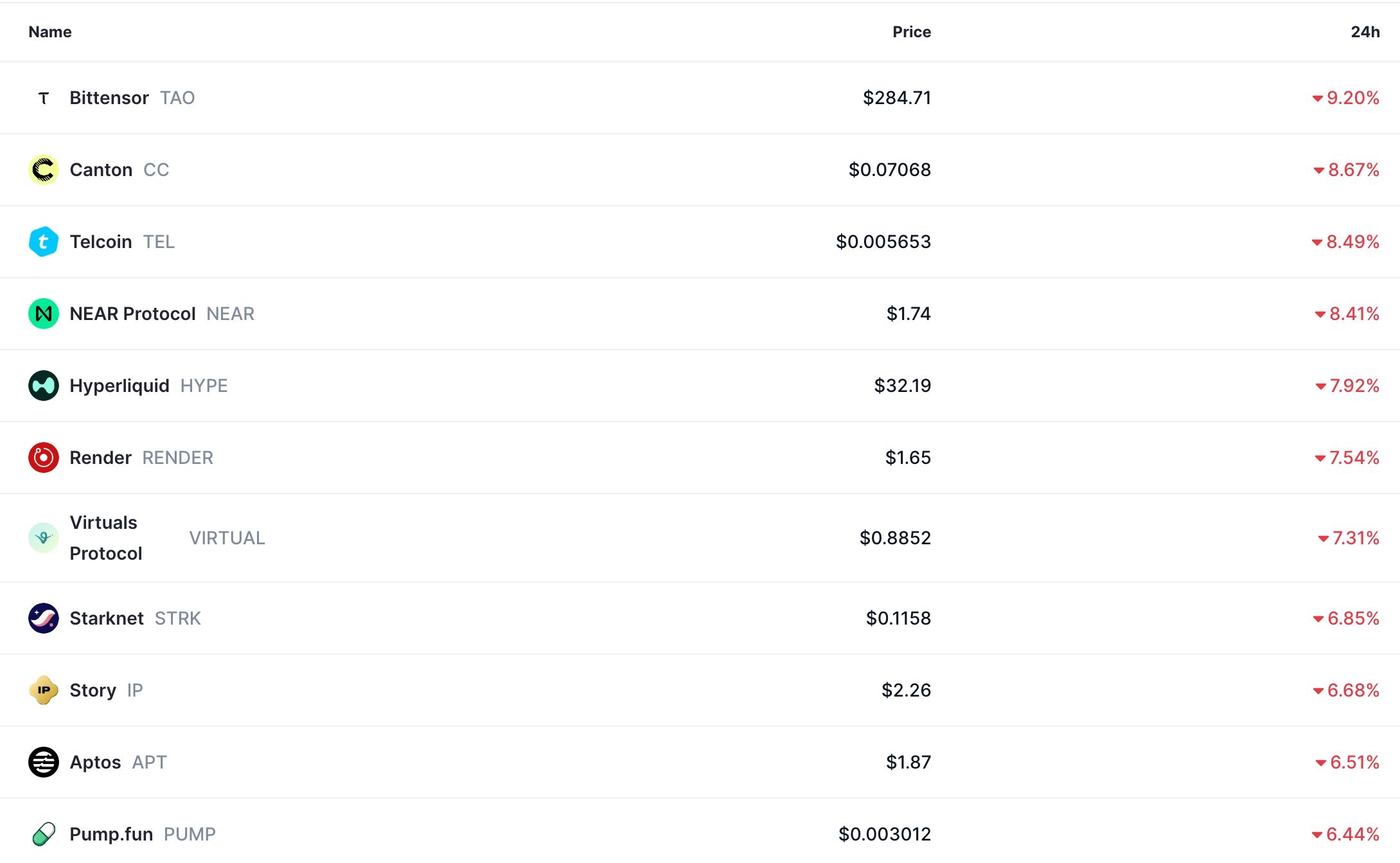

A crypto crash affecting Bitcoin and altcoins is underway today, Dec. 5. Bitcoin’s price has dropped by over 2% in the last 24 hours, while the market capitalization of all coins has fallen by 2.46% to $3.1 trillion. Some of the top laggards were tokens like Bittensor, Canton, Telcoin, Near Protocol, and Hyperliuid.

Why the Crypto Crash is Happening Today

The ongoing crypto market crash is happening as investors book profits after the recent rally that pushed Bitcoin and other altcoins higher. Bitcoin rose to $93,000, up from its low last month of $80,000.

The rally followed Vanguard, the second-largest asset manager in the United States, announcing it would start offering crypto ETFs, in a significant shift. Charles Schwab also announced that it would begin offering crypto trading services in January next year.

The crypto market rally also followed Paul Atkins, the head of the Securities and Exchange Commission (SEC), announcing in January that he would grant an innovation exemption to the crypto industry.

READ MORE: Chainlink Price Prediction as ETF Inflows Rise, Exchange Reserves Plunge

At the same time, there are signs that Donald Trump will replace Jerome Powell with Kevin Hassett, a White House official who shares Trump’s views on interest rates. Ethereum also launched the Fusaka upgrade this week.

Therefore, the crypto crash is happening as investors sell the news and wait for the next key catalyst. In a statement to BanklessTimes, Alexis Sirkia, the head of the Yellow Network, said:

“The crypto market has had to digest several important catalysts this week, including the Vanguard news. This pullback is, therefore, a pause as investors wait for the next big thing. We believe that this is not the end of the comeback.”

The crypto crash is also happening amid low open interest in the futures market and a Fear and Greed Index in the red. Futures open interest dropped by 2.30% to $131 million.

ETF inflows are mixed, with Bitcoin shedding over $142 million in assets this week and Ethereum recording just $9.3 million in inflows.

Is this the Start of a New Crypto Bear Market?

There are signs that this is not the start of a crypto bear market, as key catalysts remain. One of them is that some of the biggest crypto buyers are continuing with the process. BitMine’s Tom Lee and Strategy’s Michael Saylor have continued to accumulate Ethereum and Bitcoin.

At the same time, the Federal Reserve will meet next week and possibly cut interest rates as most analysts expect, with odds of a cut rising to 90% on Polymarket. The crypto market usually does well when the Fed is cutting rates, as it did during the pandemic. Also, there are reports that the bank may start quantitative easing (QE) next year.

Therefore, there is a likelihood of a Santa Claus rally in the crypto market once this selling pressure ends.

READ MORE: AERO Crypto Price Prediction as Aerodrome Revenue Dips