The crypto market crash could accelerate in the coming days as stablecoins continue to exit exchanges and futures open interest drops ahead of the Federal Reserve’s interest rate decision on Wednesday. Bitcoin price remains below $90,000, while the market capitalization of all tokens has fallen to $3.04 trillion.

Crypto Market Crash to Happen as Stablecoin Outflows From Exchanges Rise

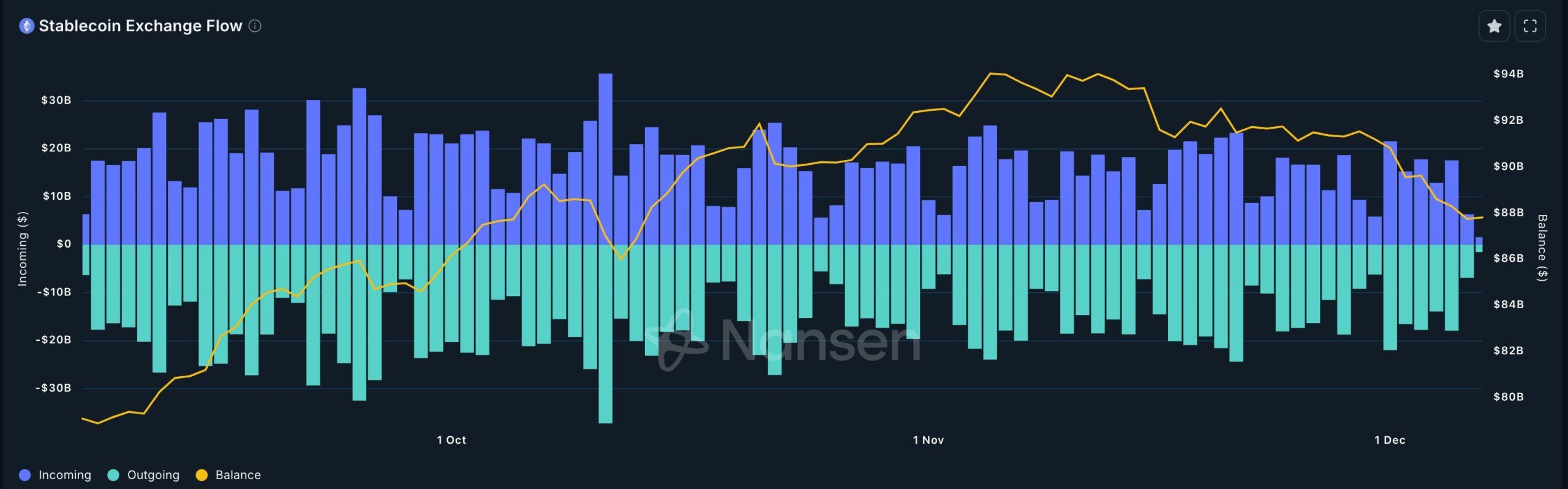

One of the main reasons for the ongoing crypto crash is that investors have been withdrawing stablecoins from exchanges, a sign of increased capitulation.

Data compiled by Nansen shows that the stablecoin exchange flow has been in a strong downward trend in the past few weeks. The flows peaked at $94 billion on November 5 and are now at $87 billion, the lowest level since October 14 this year.

Stablecoins are among the most essential parts of the crypto industry, as they bridge on-chain and off-chain systems. As a result, in most cases, crypto prices rise when more stablecoins move to exchanges and then drop when they move back. The ongoing stablecoin trend is a sign of investor capitulation.

Falling Futures Open Interest Confirms Capitulation Among Bulls

Meanwhile, the ongoing crypto market crash has coincided with investor deleveraging. A good example of this is the continuing decline in futures open interest and the flattening of funding rates across most tokens.

Data compiled by CoinGlass shows that the futures open interest has tumbled to $127 billion from the year-to-date high of $225 billion. It has dropped to the lowest level since June 20th this year.

Crypto traders have embraced leverage over the past few months as the popularity of top perpetual futures exchanges like Aster and Hyperliquid has soared.

Some of these exchanges allow people to open trades with leverage up to 1,000x. While these trades can be highly profitable, traders can lose a fortune when trades go south, as happened on October 10, when leveraged bets worth over $20 billion were wiped out.

READ MORE: Chainlink Price Prediction as ETF Inflows Rise, Exchange Reserves Plunge

Federal Reserve Interest Rate Decision is the Next Catalyst

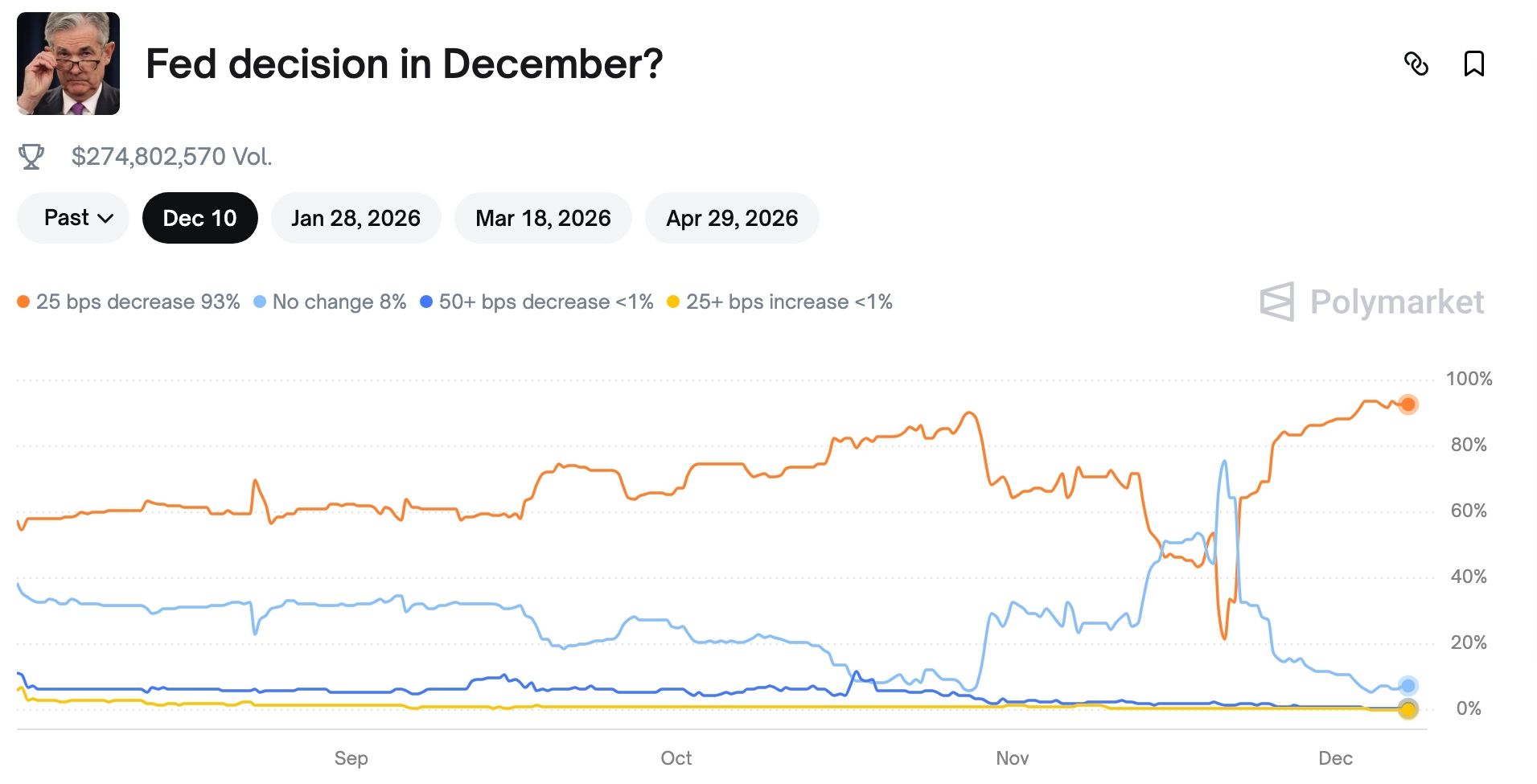

Looking ahead, the next main catalyst for the crypto market will be the Federal Reserve’s interest rate decision on Wednesday this week.

Economists polled by Reuters expect the bank to cut interest rates by 0.25%. Indeed, Polymarket odds of a rate cut have jumped to 93%, the highest level in weeks.

Bitcoin and other crypto prices tend to rise when the bank cuts interest rates, as this makes the cost of capital more affordable. At the same time, the bank has already ended its quantitative tightening policy, and Trump has hinted that Kevin Hassett will replace Jerome Powell as Fed Chair.

There will be additional key catalysts for crypto prices, including the upcoming Midnight mainnet launch and token unlocks.

READ MORE: SoFi Stock is Crashing Today: Time to Panic Sell or Buy the Dip?